It used to be that if you were using your phone for trading, it was only to call your overpaid broker, but nowadays your phone has become an incredible trading tool.

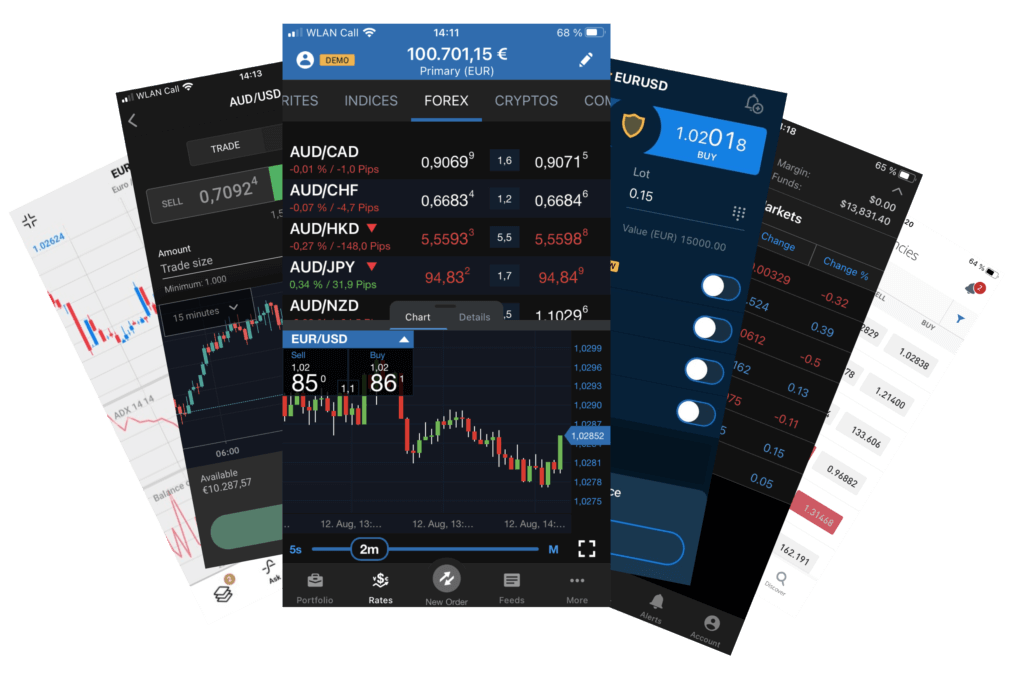

Forex brokers have developed trading apps that have charting capabilities, analytics, economic calendars, trading tutorials, and the ability to execute your own trades within nanoseconds of pushing an icon on your screen.

It’s an amazing luxury that allows you to get out of a stuffy office and make fully informed trades from anywhere you’d like. Some forex trading apps are better than others, however, so read on and choose wisely before you start trading forex from your beach blanket.

Table of Contents

Review Summary

Here’s a quick summary with some of my favorite features from my selection of the six best forex trading apps. Read additional pros & cons below.

| Best Overall Trading App (US & Worldwide) | Best Trading App for Pros (US & Worldwide) | Best Forex Trading App for Beginners (non-US) | Best Overall Forex Broker | |

| Broker | OANDA | FOREX.com | AvaTradeGo | IG |

| Highlights | Incredibly functional but simple Great charting options Easily customizable charts, calendars & themes Simple trade screen with multiple trade options Highly regulated/Very trustworthy broker | Best charting tools Simple trade screen Excellent integration of market analysis and economic calendar Includes SMART signals, an algorithm to generate trade ideas | Simplest, cleanest trade screen Integrated educational videos AvaProtect allows you to trade on the go without incurring any losses Great, highly responsive customer service | My favorite overall broker – trustworthy, fast, cheap Access to IG customer sentiment data Excellent news feed Good charting capability |

| Accepts US Clients | Yes | Yes | No | Yes |

| Start Trading | OANDA | FOREX.com | AvaTrade | IG |

| Best Overall Trading App (US & Worldwide) | |

| Broker | OANDA |

| Highlights | Incredibly functional but simple Great charting options Easily customizable charts, calendars & themes Simple trade screen with multiple trade options Highly regulated/Very trustworthy broker |

| Accepts US Clients | Yes |

| Start Trading | OANDA |

| Best Trading App for Pros (US & Worldwide) | |

| Broker | FOREX.com |

| Highlights | Best charting tools Simple trade screen Excellent integration of market analysis and economic calendar Includes SMART signals, an algorithm to generate trade ideas |

| Accepts US Clients | Yes |

| Start Trading | FOREX.com |

| Best Forex Trading App for Beginners (non-US) | |

| Broker | AvaTradeGo |

| Highlights | Simplest, cleanest trade screen Integrated educational videos AvaProtect allows you to trade on the go without incurring any losses Great, highly responsive customer service |

| Accepts US Clients | No |

| Start Trading | AvaTrade |

| Best Overall Forex Broker | |

| Broker | IG |

| Highlights | My favorite overall broker – trustworthy, fast, cheap Access to IG customer sentiment data Excellent news feed Good charting capability |

| Accepts US Clients | Yes |

| Start Trading | IG |

My Top Pick: OANDA – 9.4/10 (Best Overall Forex Trading App)

OANDA has put together a nearly perfect forex trading app. It is simple and easy to navigate but packs in a treasure trove of information and charting options. The combination of simplicity and functionality makes OANDA my choice for best overall forex trading app.

Pros

The competition for the best trading app is pretty steep these days, and other brokers (see below) are making constant improvements. To date, however, I don’t think anyone has matched OANDA’s mobile platform, which is also known as fxTrade.

Probably my favorite thing about the OANDA app is how much information it can fit in one screen without things getting overly busy. The home screen is a split screen with quotes of your favorite currency pairs on the top and a chart from a pair you select below. You can move the chart down to show up to ten different price quotes. It really feels like you have an entire Bloomberg terminal from the old trading desk days right in the palm of your hand.

The home screen isn’t just informational, it’s also highly functional. Tap an icon on the bottom and you can make a trade, check your open positions, catch up on your news feeds, or check rates in other markets. You can also very easily manipulate the chart to show long-term or short-term price trends.

OANDA’s mobile app is also easily customized. A pen icon at the top allows you to reorder or add any new currency pairs to your home screen. You can also very easily set alerts from the economic calendar to keep you up to date on any economic data releases that may be relevant. OANDA has also partnered with StockTwits to provide another news and information source, and this, too, you can personalize by choosing news streams based on what you plan on trading.

If you enlarge the chart on the bottom of the homescreen, you’ll see some real magic. The charting options are impressive for any trading platform, let alone one that fits in your pocket. There’s a number of indicators and overlays, and 11 drawing options, including everything from ARC to TZone. If you would prefer to chart Open High Low Close (OHLC) rather than a simple candle, OANDA even gives you 19 color options.

Even if you currently don’t use complicated charting options, it is beyond impressive that they’re available and give you infinite possibilities to grow and evolve as a trader.

And, of course, I wouldn’t have chosen OANDA as my favorite app if it didn’t make the actual process of executing a trade insanely easy. From the trade screen you can place a market order or entry order and set up take profits or stop losses as you make the trade. Sell and buy prices are both very visible, with the spread you’ll be paying clearly disclosed. You can also enter a trailing stop or lower bound either by PIPS or by price.

Finally, as I talk about in the methodology section below, although I am focusing most of my attention on the mobile trading apps, you still have to be certain that you are dealing with a forex broker you trust. OANDA is as trustworthy as you’ll find, as it is registered with both the NFA and CFTC in the US as well as the FCA in the UK, the JFSA in Japan, and several others.

Cons

You probably shouldn’t consider an additional level of app security a “con,” but depending on your market, your app may direct you to the OANDA website in order to sign in. You can still do this on your phone, of course, but it’s an extra half step that I found a bit cumbersome. That said, when it comes to cybersecurity, you can never be too careful these days, especially when there’s money involved.

As I mentioned above, the trade screen is extremely easy to use, with one small nit, and I mean small. For whatever reason, the trade submit button is a little on the small side. Full disclosure, I do occasionally wear reading glasses, so maybe it’s just me.

I’m also a little curious where OANDA takes this app. OANDA is under significant pressure due to the advances of other mobile trading platforms. I am a little worried that they’ll make too many changes in an attempt to keep up. To me, this app—as is—is nearly perfect.

Overall

OANDA’s mobile trading app manages to pack more information, charting options, and trading options into a simple package on your phone than any of its peers. To start trading forex over your phone using the most comprehensive, easy-to-use app in the market, open an account with OANDA.

My Runner Up: FOREX.com – 9.2/10 (Best Trading App for Pros)

FOREX.com offers a mobile trading app that packs as much punch as OANDA’s but lacks some of the appeal. The charting options are incredible, and the functionality is outstanding. If the app was a little more visually appealing, it could easily take my top spot.

Pros

I’ll start with the charting options because FOREX.com’s charting tools are even better than OANDA’s, which are impressive in their own right. If you’re holding your phone vertically, the chart doesn’t seem all that impressive, but rotate your phone to the side, and an enormous array of options appears.

From a pull down menu on the top of the chart, you can choose from 88 indicators. Eighty-eight! Bollinger Bands, Keltner Channels, and just about any other indicator you can imagine are all right there. There’s also a very simple comparison tool that allows you to add other assets or currency pairs to your chart.

Before I lose any of you who aren’t that interested in charting, I have to mention the drawing tools, which are also myriad. From simple trend lines to four different kinds of pitchfork to Gann Squares, this app has everything.

I also love the simplicity of FOREX.com’s economic calendar. Upcoming events are separated into three categories depending on their market impact. The categories are color coded so you can immediately see what important events are imminent. You can also customize the calendar by country, category, and expected volatility. Tap the event and you’ll get a description of the event and why it’s important, plus consensus estimates and previous data. It’s the perfect tool for planning out your trading day or, for traders like myself who sometimes hold positions over the long term, your trading week or month.

FOREX.com also offers a ton of market analysis that is easily accessible through their app. The Market Commentary section takes you to insights on current market conditions by FOREX.com’s analysts, plus you have access to Trading Central and all of its technical insights and analyst views. I personally love the “Market Buzz” section that registers what currencies are receiving the most news coverage—it’s a great place to hunt for news events among exotic currency pairs that otherwise might not be on your radar.

The FOREX.com app also does a pretty good job of integrating SMART Signals, FOREX.com’s proprietary trading algorithm. SMART Signals uses historical price data to identify trading opportunities in real time and also tells you how successful traders have been when using each signal. If you want to make a trade, the algorithm tells you the optimal trade to make, you just have to push a button.

I also like the simple trade screen, which also has a hedging option in addition to the standard take profit and stop loss toggles. If you want to close or edit a trade, it is as simple as swiping the trade one way or the other. From open to close, FOREX.com makes the whole trading process incredibly easy.

Cons

As much as I love their app, FOREX.com does have some customer service issues. FOREX.com is regulated by the NFA and CFTC as well as at least six more jurisdictions. It is as safe a broker as you can find. That’s great, of course, but being subject to so much regulation does have a downside.

All regulated brokers abide by KYC (Know Your Client) protocols, which is a part of a global effort to curb money laundering, but some seem to implement them better than others. If, for whatever reason, your initial paperwork to open a FOREX.com account is deemed lacking, it can be very frustrating trying to get through to their customer service team to correct whatever it is that needs correcting. The same thing can happen when you need to make withdrawals.

I never had any trouble, but I’ve heard some rough stories, so make sure you have all your paperwork in order before you open your account.

Overall

I love the FOREX.com trading app for its functionality and incredible charting capabilities, and the sheer amount of information they present. Only some customer service concerns keep them from my top spot. To make the most informed trades on the go, sign up with FOREX.com and start trading.

#3 AvaTrade – 9.0/10 (Best Forex Trading App for Beginners, non-US)

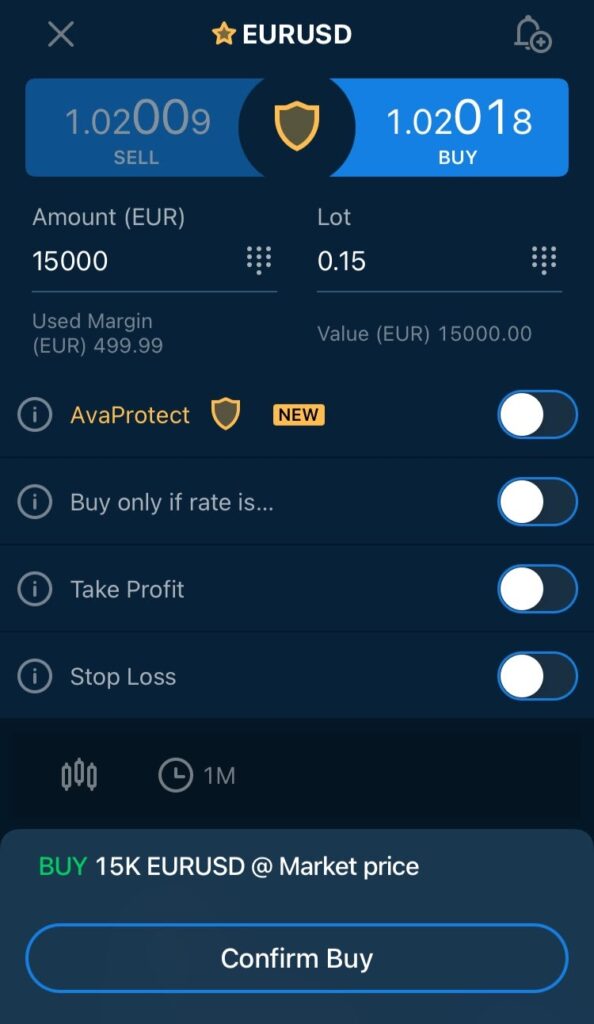

AvaTrade’s app is by far the best designed, cleanest looking forex trading app I have used. AvaTradeGo lacks the sophisticated charting tools of its competitors but is the best in terms of ease of use by a wide margin.

Pros

If you are new to trading forex and don’t plan to use a lot of charting tools, AvaTradeGo is a fantastic option. The simplicity with which you can execute a trade is unmatched. I know some traders who actually use charting tools from other brokers but still make their actual trades with AvaGo because it is so simple and functional.

Another reason why AvaTradeGo is a great forex trading app for beginners is that AvaTrade’s educational videos are fully integrated into the app. You can watch tutorials on how to use the app and how to use AvaProtect (more on that in a minute), as well as some basic intro-to-investing videos all while still in the app.

AvaProtect is another invaluable tool for first-time forex traders. AvaProtect is basically an insurance policy that will reimburse you for any losses your trade incurs. Like with insurance, you have to pay a small fee, but you’re guaranteed not to lose money.

To protect your trade, you just have to tap the shield icon and select for how long you want the trade protected. The app will tell you how much the protection will cost (often $10 or less) and you’ll be completely protected against losses. I love this feature when I’m trading on the go and know that I won’t be able to focus entirely on my portfolio.

I also love AvaTrade’s customer service. I had a minor issue when I first downloaded the app (entirely my fault) and hit the chat button. Initially I was connected to a bot, but when I elected to chat with a real person, I was connected immediately and the issue was resolved within seconds. That speed of service can be a lifesaver if you need help with a trade during times of heavy volatility.

A final reason to love AvaTradeGo is the broker behind the app. AvaTrade has an outstanding reputation amongst traders. They’ve been a pioneer in the online broker space and are constantly making improvements and offering new products to stay at the top of their game.

Cons

Sadly, AvaTrade is not regulated in the US and therefore does not accept US traders. I really hope that recent rumors of a US expansion turn out to be true—American traders would be thrilled to have AvaTrade as an option. In the meantime, traders in 150 other countries can open accounts and trade forex using a really outstanding app.

If you rely heavily on charting tools, you won’t be satisfied with AvaTrade’s mobile platform. Their forex app simply doesn’t have the charting options that OANDA and FOREX.com offer. I haven’t heard for certain, but I’d imagine that AvaTrade is working to improve their charting functionality, but until then, any hardcore technical analysts should look elsewhere.

AvaTrade has the reputation of being a little more expensive than other brokers. They’ve made an effort to cut costs and have largely succeeded, but if you trade exotic pairs, keep an eye on their spreads.

Overall

If you don’t rely too much on charting, AvaTradeGo is an incredible trading app. New forex traders in particular will love the simplicity, educational resources, and risk mitigation tools. If you’re not based in the US, sign up with AvaTrade to start using the cleanest, simplest forex trading app on the market.

#4 IG – 8.9/10 (Best overall broker)

IG’s trading app is absolutely stuffed with data, information, and charting options, but I’m not a huge fan of the app’s layout. IG is my overall favorite forex broker, and there’s a lot to love about their app—I just wish things were presented a little better.

Pros

IG is a powerhouse of a broker. It is probably the safest, most regulated broker in the world. I ranked them as my pick for best forex broker for a lot of good reasons. They keep trading costs down, invest in education and trader support, and are beyond reproach as far as reputation goes. They also offer more than 80 currency pairs, including some exotics you won’t find with other brokers.

The strength of the IG app is probably its charting capabilities. Once you’ve tapped on a forex pair and scrolled down to “Chart,” you can tap the chart to access a wide array of options. I counted more than 30 indicators, a lot of drawing options, and the ability to integrate economic events into the chart itself. There is more than enough here to satisfy most technical traders.

The trade screen is also packed with options, particularly if you hit the tiny gear icon next to the asset you’d like to trade. This allows you to turn on “Advanced Options,” which lets you choose if you want to accept partial fill amongst other options.

The trade screen is also the most functional screen on the app as the buy and sell tabs are large, with the spread prominently displayed.

There’s also quite a bit of information available about each currency pair, including news provided by Thomson Reuters, and upcoming economic events, plus client sentiment, which I have found most useful. Client sentiment details what percentage of IG clients expect the price to rise, how many IG clients have open positions, and breaks down trading activity by time frame. Considering that IG has more than 300,000 clients worldwide, their client sentiment data can be useful in judging overall market sentiment.

You can also use the client sentiment data to help with trade ideas, as IG displays “other positions taken by clients trading this market.” This shows four other positions taken by clients trading your selected currency pair and what percentage of those positions are long or short. If you have a strong feeling about a certain currency pair but want to limit your exposure a bit, you can see what other traders are doing.

Cons

Overall, the app just isn’t particularly easy on the eyes at first glance. Under settings you can switch themes, and once I went with the black background there was a definite improvement, but the app just seems too busy. That might not seem important, but if you don’t like looking at your app, you might be resting your eyes more than looking for trade opportunities.

The charts suffer from a similar problem. As much as I love the impressive amount of options, I found them difficult to manipulate. Maybe I’m all thumbs when it comes to these things, but more than once, I found myself in no man’s land, somehow looking at a blank chart from three years in the future.

IG is among the best brokers in the world when it comes to trader education, but unfortunately very little of their educational resources are available in this app. Instead, you can find it all on a second app called “IG Academy.” IG Academy is great, but I’d prefer if they could have integrated those resources into the trading app as well.

Overall

IG’s reputation as a world class broker, its dedication to trader support and education, and its low trading costs make up for an app that is really good but not quite great. Sign up with IG if you want the best overall broker and don’t mind an app that’s incredibly informative but not as user friendly as some of its peers.

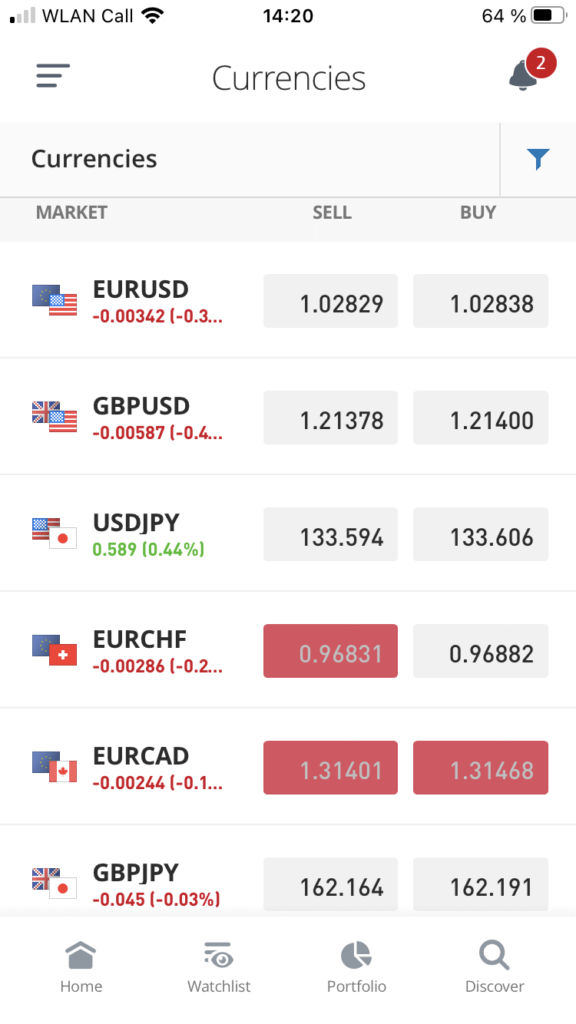

#5 eToro – 8.7/10

eToro allows forex trading through CFDs in much of the world, but in the US, their platform is limited to stocks, ETFs, and cryptocurrency. eToro is extraordinarily popular worldwide, particularly for their groundbreaking copy trading.

Pros

You can’t talk about eToro without talking about their innovations in the world of copy trading. In fact, eToro has a trademark on the word “CopyTrader.” Over the years, they have built a sizable community, and with a few clicks, you can set up your account to automatically copy the trades made by the trader of your choosing.

That’s pretty revolutionary, and if you are looking to be a more passive trader, or if you’re just learning, this is a great way to ease your way into the market. You can find a successful forex trader who shares your general strategy, set up the CopyTrader, and your account will trade along with them. Eventually, you can take over the reins yourself, or if you’re making money, continue to mimic the trades of the more experienced trader.

The community aspect of eToro is evident throughout the app. Even your newsfeed is populated by twitter-like posts from other traders. I’ve found it useful for generating trading ideas, although there are a number of more self-promotional posts from traders hoping you will begin to copy them.

Like a lot of apps designed more for European traders, eToro gives you access to the forex market through CFDs. Unlike most of these other apps, eToro makes this exceedingly transparent with a prominent reminder to review the trade parameters. They are also very forthcoming when it comes to fees—overnight fees are listed directly under the Open Trade icon. I really appreciate this level of honesty and transparency. It’s well beyond industry standard.

There are a number of little things that make eToro one of the more visually pleasing trading apps I’ve tested. Forex screens, for example, have little flags representing the currencies you’re trading. Not super useful, but a nice touch.

Cons

Even if you are in regions in which you can trade forex through eToro, the main focus is definitely on other assets. The “Discover” screen has a number of featured assets, but I’ve never seen any currency pairs. In fact, if you scroll through the categories, “Currencies” is the last icon.

That certainly doesn’t mean that you can’t trade forex CFDs, as eToro offers trading in more than 50 pairs by my count, but if you are entirely focused on forex, you should find an app with a similar focus.

For experienced forex traders, eToro’s charting options also leave a lot to be desired. FOREX.com’s charts really put eToro’s to shame. Five chart types and five studies, including Bollinger Bands, are all that eToro makes available on the app. If you need more than that, you should look at another broker.

I also don’t like that when you are on the Discover screen or when you are looking at charts for other currency pairs, your equity balance is not visible. That means you can’t monitor your profits on your active trades while seeking out new trades. You have to toggle back to any of the other screens in order to see your balance.

One difficulty of reviewing trading apps is that when there is a glitch, it is impossible to tell if it’s your hardware, your network, or some type of bug in the app. It did seem to me, however, that eToro occasionally lagged—more than the other apps on this list.

Overall

eToro is unquestionably the world leader when it comes to copy trading, which is a great way to learn and profit at the same time. Forex trading doesn’t seem to be a huge priority for eToro, however, so if you’re interested in forex above all else, you should probably choose one of the options listed above.

#6 Capital.com – 8.5/10

Capital.com is an extremely popular broker for traders outside of the US. Their trading app is clean and fairly easy to use, but some customer service issues limit their overall appeal.

Pros

Capital.com does not offer brokerage services to US traders, but they certainly are popular in the rest of the world. The capital.com trading app is available in 31 languages and they have around 500,000 global traders.

I’ll throw another big number at you—5,100. That’s how many markets you can trade via Capital.com’s app. Immediately when you open the app you can see just how many assets they have available across the top of your screen. If you’re more of a jack-of-all-trades type of trader, you won’t find more tradable assets anywhere else.

The app itself is highly regarded in the trading community, boasting a 4.7/5 rating in both the Google Play store and the Apple App Store. That makes it the highest ranking forex trading app in a number of countries. I’m always a little suspicious of these types of ratings, but in this case, more than 40,000 traders have weighed in and given Capital.com a resounding vote of approval.

Capital.com offers a number of charting options, including an impressive number of indicators. As far as charting capabilities, they are probably only bested by FOREX.com, which is the gold standard of app charting. Capital.com makes it very simple to add both drawings and indicators to their chart.

I also like the fact that you can enable one-tap trading or go through a second confirm button. I definitely like that extra half a second to make sure I want to make a trade, but for a lot of traders, one tap is all they need.

Finally, Capital.com has some of the tightest spreads I’ve seen amongst regulated brokers. Especially if you only trade major currency pairs, you’ll be very pleased with your trading costs.

Cons

As probably can be expected with a broker this size, Capital.com suffers from some issues with customer service. And as is the case with other highly regulated brokers, these issues can extend to customer deposits and withdrawals.

The vast majority of traders don’t have any issues whatsoever, but if you get caught in the KYC vortex due to some problem processing your paperwork, it can be incredibly frustrating to get to the bottom of the issue. Again, this is just the result of a broker trying to abide by regulations, but other brokers have the same rules and they seem to handle any issues much faster than Capital.com. In some instances, traders have had to resort to online review sites in order to get an adequate response.

Capital.com has packed a ton of capabilities into their trading app, but I wasn’t overly impressed with the layout and functionality. It can be easy to get “lost,” so to speak. For example, if you select and start to manipulate a chart in landscape mode, there’s no clear way to get back to the trade screen. You have to turn your phone or mobile device vertical in order to get back to trading options. Not the end of the world, I know, but a little annoying.

Another nit—with most forex trading apps, when you press the buy button, you have the immediate option of adding a stop loss or take profit order. With Capital.com, you have to select your trade after you’ve made it and only then can you add a stop loss or take profit.

Overall

For the hundreds of thousands of traders that use Capital.com without any issues, they have a world-class broker with a great app and low trading costs. For those that find themselves with withdrawal issues, Capital.com can become a nightmare. To play the odds that you’ll be among the vast majority of forex traders with an outstanding experience, click here.

How to Start Trading Forex

I’ve written a more comprehensive step-by-step guide here, but here is a quick summary of how to get started in the forex market:

Step 1: Learn the foreign exchange market

This really should go without saying, but there are a surprising number of people who don’t fully understand the market before diving in. Even if you are copying someone else’s trades or relying on expert advice, master the forex market before you begin. There’s a tremendous amount of resources at your disposal on the internet. Don’t lose money out of ignorance, know what you’re getting into.

Step 2: Choose a forex broker

I’ve written extensively about choosing a broker in a separate article that I encourage you to read, and you can also continue reading my Methodology section below. Don’t take this step likely. It is imperative that you find a broker you trust and are comfortable with.

To that end, if I had to narrow down this section to one piece of advice, it would be this: open a demo account! Almost all brokers offer demo accounts. Take advantage of the opportunity and use your demo period to test trade strategies, use different trading platforms—particularly the mobile trading platforms—and contact customer service to test response times and accuracy. Make sure you are signing up with the right broker before you begin.

Step 3: Open and fund an account

Once you’ve found the trading platform you’re comfortable with, opening an account is usually pretty simple. Most brokers allow you to open up an account directly through the app, but sometimes you’ll have to sign up through the website before you start using the trading app.

Occasionally you may have to take extra measures to verify your address and identity, but often you can open an account and start forex trading within minutes.

Can I Trade Forex on My Phone?

Yes, as soon as your account is open, you can begin mobile forex trading. The best mobile forex trading apps (like those listed above) give you all the same charting and analytic resources that you’d find on any desktop forex trading platform.

It’s really incredible when you consider the massive amount of hardware that was once required to provide data and analysis for professional forex traders. Now that’s all in the palm of your hand.

Is Forex Trading Risky?

Yes, it is. There’s no way to sugarcoat it. Forex markets move impossibly fast, and there are so many factors—political, economic, social, psychological—that affect price movements that it can be impossible to keep up, even for experienced traders.

The risks are significantly compounded whenever leverage is involved. Leverage maximizes your buying power but also maximizes your losses when the market moves against you. This is particularly true if you plan on trading CFDs. A sizable majority of retail investor accounts lose money when trading CFDs.

Before you start trading forex, be absolutely certain you understand the market and understand the instrument you’re using. Never put yourself in a position where you’re trading more than you can afford to lose.

Methodology: How I Chose the Best Forex Trading Apps

Most of the work in choosing the best forex trading platform is, quite simply, testing as many forex trading apps as you can find. However, great trading apps are worthless if they’re not connected to great forex brokers that can fulfill your orders in an affordable, timely fashion. To determine my final rankings, I gave each broker numeric scores based on seven essential factors. I started by assessing its mobile trading platforms and weighted that factor the most but also included the other factors listed below.

Factor 1: Mobile forex trading platform

This was my obvious focus for this article, so let me break it down further and show you exactly how I graded these apps.

Ease of use

When you’re trading forex, there are times when you need to make a split second decision and immediately execute a trade. You can’t be fumbling around looking for the right icon to push. I want a trading app that makes things as simple as possible once I’ve decided to place a trade.

Functionality

How much can your trading app do? There’s a lot of slick-looking trading apps out there that don’t actually have a whole lot of resources. I don’t need a thousand charting tools at my disposal when I’m mobile trading, but I definitely need some.

Appearance

Appearance may not seem like such an important factor, but if you plan to be doing the bulk of your trading over your phone, you’d like an app that’s (literally) easy on the eyes. An app that is too busy or difficult to read can lead to a sort of fatigue. If your app makes you want to put your phone down after a few moments, you could miss some valuable trading opportunities.

Speed

This can be a function of your Wi-Fi signal or your cell service, but all things equal, how fast does your app function? There’s not a lot of variance in this category, at least among the best forex trading apps, but even a tiny lag can make a big difference in a market as dynamic as the foreign exchange market. I didn’t have my stopwatch out, but I noted any of the apps that seemed to lag a bit behind their competitors.

Customer service response

I don’t want to waste anyone’s time, but for the sake of this article, I did ask customer service a quick sample question on each of the trading apps I tried out. Customer service can be critical if you encounter a trading error, and in some cases you’ll need them to respond immediately.

What surprised me a little was that some brokers that have a reputation for poor customer service were actually more responsive through their apps. I think that’s a pretty strong indication that most brokers are investing heavily in their mobile forex trading apps and really believe mobile trading is the future of trading.

Factor 2: Trading costs

No matter what platform you use, you have to pay attention to how much your broker is charging you per trade. If your trading strategies involve making a lot of transactions to take advantage of small price movements, commissions and spread costs could eat up a lot of your profit. Forex brokers typically just make their money from spreads (the difference between the buy and sell prices) so I judged the brokers based on average spreads on the most popular currency pairs.

Factor 3: Trading execution

In a market that moves as quickly as the forex market, your broker should deliver nearly instantaneous execution. Any lag between when you make your order and when you receive it can cost you money. These costs that are incurred between order and execution, known as slippage, can really affect your profits in volatile markets. I made a number of trades in each trading app and looked out for slippage and slow execution.

Factor 4: Withdrawal process

Since some of my forex app testing took place in demo modes, I wasn’t able to directly test the withdrawal process in every app. Instead, I relied on my network of trader friends, public trader reviews, and other sources to see which brokers made withdrawals the easiest. Withdrawing your own money should be the simplest process in the world, but due to regulations, particularly anti-money laundering laws, some brokers have to go through some further identity verification procedures before you see your funds. In my experience, some brokers are much better at this process than others.

Factor 5: Reputation and regulation

There’s a staggering number of forex brokers operating in the world. Some are subject to very strict regulations, and some, the unregulated brokers, have very little. As a forex trader, you’ll be depositing a large amount of money with your broker, and hopefully withdrawing an even larger amount of money at some point in the future. You have to be absolutely certain you can trust your broker.

Factor 6: Education and resources

You can learn about the foreign exchange market through any number of possible means. There’s YouTube channels, podcasts, webinars, training apps, blog posts, and even good old fashioned books.

So why do you need it from your broker? Convenience, for one. Some brokers even have their educational materials integrated into their apps, which makes staying on top of market trends incredibly easy. But I also believe that how much a broker invests in trader education speaks to how much it values you, the trader. A broker that invests in your education is a broker that wants you to be a successful trader for a long time.

Factor 7: Tradable assets

I didn’t weigh this category too highly for the purpose of this article. Every broker I tested allows you to trade every major currency pair and plenty of currency crossings and exotics. However, it’s always nice to have a lot of options, especially if you like seeking out trading opportunities among really obscure currencies.

Conclusion: Best Forex Trading App

I’m perpetually amazed at how sophisticated and smart but simple to use some of the forex trading apps are today. It’s incredible. With such a powerful portable tool at your disposal, you can trade forex from anywhere your phone gets a signal without missing a beat.

Out of all these, OANDA secured my top spot due to its excellent ease of use, charting options, simple customization, and overall performance. If you want to get started trading with the best mobile forex trading app in the business, start with OANDA.