Table of Contents

Overview

Fidelcrest has had a really rough year so far, and seems to have more or less shut down operations. I can’t get a hold of customer support, and there have been an outrageous number of reports of missed payouts. Stay away from Fidelcrest at this time and use my favorite prop firms for 2024 to find an alternative.

I’ve kept the rest of the review as is, with the hopes that we’ll get some sort of explanation from Fidelcrest and operations will one day return to normal. (Not holding my breath, though.)

Pros

- Highest profit splits in the industry — Fidelcrest pays out 80–90% of profits to funded traders. It doesn’t get any better than that.

- Rapid funding — Fidelcrest has no minimum trading days for either stage of its evaluation. It is actually possible to pass both phases in one day.

- Earn money during evaluation — If you pass the second stage of your evaluation, you will receive a bonus payout, up to $30,000.

- Best prop trading firm for crypto — Fidelcrest offers more options for trading crypto than any other prop firm.

- Ton of tradable assets — Trade crypto, stocks, commodities, metals, and forex.

- Infinite account options — Regardless of your experience level, risk tolerance, or pocketbook, you can find the perfect account for you.

- Million dollar account size — Confident traders can sign up for a Pro Account with a $1 million initial account balance. No scaling. Pay the initial fee, pass the two evaluation phases, and you’ll be trading $1 million.

- Frequent promotions

Cons

- Tough Verification Stage — Phase 2 of the evaluation has tighter trading parameters than the Trading Challenge. For most accounts, the max loss limit is half of what it was during the first phase.

- Strict max loss calculation — Fidelcrest calculates your max loss based on your highest account balance, not on your initial balance. That means you could theoretically make a profit on your account, but fail the evaluation.

- Too many options — Between the 14 different account sizes, plus choices regarding when to take your free account, choosing which account you want with which options can feel a little overwhelming.

- A number of recent payout issues — Fidelcrest seems to have given up on payouts and customer service despite many years of operation. I’ve reached out to them and hope to get some sort of response soon. As is, I don’t trust Fidelcrest to make any payouts.

Who should sign up with Fidelcrest?

No one at this time. Despite many years of operation, Fidelcrest seems to have quit this business more or less. They are no longer active on social media, they don’t have a welcoming page for new traders, and they are not replying to customer service complaints.

Additionally, prior to this hiatus, or whatever it is, there were numerous complaints of missed payouts.

Until we get some sort of explanation for what is going on, do not sign up with Fidelcrest.

Who should NOT sign up with Fidelcrest?

You know your trading style. If you are dependent on a few make-or-break trades to hit your profit targets, you might pass the Trading Challenge, but you might have trouble with the Verification Stage. Due to tighter trading parameters, the Verification Stage rewards cautious traders who can book consistent profits.

If your style is not compatible with the 5–10% max loss parameters in the Verification Stage or you’re not confident in your risk management skills, you should find a firm with looser trading guidelines. In other words, if you take excessive risks with your capital, Fidelcrest probably won’t give you any of theirs.

All things considered . . .

Look elsewhere. My best prop firms list still has some good options that can be trusted.

Fidelcrest Basics

Fidelcrest origin story

Fidelcrest was formed in 2018 by a group of experienced traders who wanted to provide capital to retail traders who had talent but needed further funding.

Fidelcrest the proprietary trading company was established at the same time as Fidelcrest Proprietary Trading Company. That sounds redundant, but Fidelcrest Proprietary Trading Company (capital letters) has the actual capital (hence the capitals?) and issues the real money to traders once they pass the evaluation and become funded. The lowercase Fidelcrest proprietary trading firm handles the Trading Challenge and the Verification stages of the evaluation process.

How does Fidelcrest work?

Fidelcrest works exactly like other prop firms. For a fee, you can audition to receive a Fidelcrest funded account that could give you as much as $1 million of Fidelcrest capital for you to trade. Whatever profits you make you will split with Fidelcrest, keeping either 80% or 90% for yourself. If you lose money, Fidelcrest will pay off your tab, but probably won’t keep you around.

To get started, pick an account size, pay the one-time fee, and you’ll begin the Trading Challenge. If you meet your trading objectives, you’ll advance to the Verification Stage. If you pass the Verification Stage, you’ll receive a bonus for your efforts and become a Fidelcrest Funded Trader.

As a Fidelcrest Funded Trader, you’ll receive the amount of capital that you selected when you chose an account size (or double if you took advantage of the promotion). Make some successful trades and you’ll receive your first profit split. Continue to have success and eventually you’ll be placing a downpayment on a yacht.

How much does Fidelcrest cost?

Fidelcrest only charges a one-time set-up fee, so you never have to worry about recurring charges.

Normal Account

| Account Size | One-time Fee |

| $10,000 | €99 |

| $25,000 | €249 |

| $50,000 | €449 |

| $150,000 | €649 |

| $250,000 | €999 |

| $500,000 | €1,799 |

| $1,000,000 | €2,899 |

Aggressive Account

| Account Size | One-time Fee |

| $10,000 | €149 |

| $25,000 | €349 |

| $50,000 | €549 |

| $150,000 | €999 |

| $250,000 | €1,599 |

| $500,000 | €2,899 |

My Assessment

For my Fidelcrest review, I assessed the firm based on the following criteria. Fidelcrest’s perfect scores in the Profit Split, Affordability, and Tradable Assets categories gave them an 9.0 overall ranking, which is good enough to place them amongst my Top 8 Prop Trading Firms for 2024.

Profit splits – 10/10

Fidelcrest offers the best profit splits in the business. For Aggressive Accounts, Fidelcrest will pay out 90% of your profits. Normal Accounts still get a whopping 80%. Considering that Fidelcrest is handing out real capital, that’s really impressive.

Add in the fact that Fidelcrest makes a bonus payout for passing the Verification Stage (40–50%), and they deserve a 10-plus.

Scaling opportunities – 8/10

Fidelcrest is pretty conservative when it comes to scaling — you have to trade for twelve months before you have the opportunity to double your account size.

That’s not great, but one of the reasons they don’t focus on scaling is that Fidelcrest is one of the only reputable prop trading firm that will offer $1 million accounts right off the bat. So why even worry about scaling? You don’t need a good scaling plan if you can sign up for a $1 million account right now.

Also, although it is not technically scaling, with the current promotion, you can opt to get double your account size once you get funded. So if you pass both evaluation stages, your second account gives you double your initial account balance.

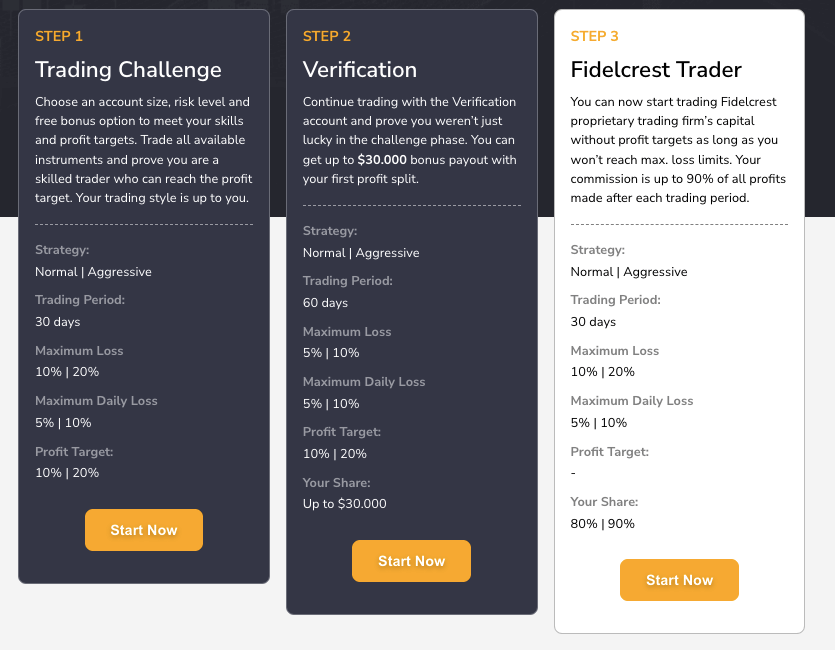

Trade parameters/profit targets – 7/10

This is the number one complaint against Fidelcrest. The initial Trading Challenge Stage is pretty standard and a good percentage of traders pass, but Fidelcrest makes the Verification Stage much more difficult by cutting the max loss in half. If you have a Normal Account, that means the max loss is just 5%. For an Agressive Account, it’s cut down to 10%. Your profit target, however, remains the same.

I think a big part of the problem isn’t the numbers. After all, there are prop trading firms (looking at you Lux Trading) with even tighter loss limits. The trouble is that a lot of traders don’t read the trading parameters and just assume that the loss limits are the same in both stages. That’s a reasonable assumption, but it’s an assumption nonetheless.

These clueless traders are shocked to find out they failed when their account falls below 5%. Know your trading parameters and trade accordingly.

The other thing that Fidelcrest does differently that rubs some traders the wrong way is that they calculate the max loss based on the high water mark of your account. If you make some good trades and find yourself up 7%, but then lose 5% over the next few days, you failed the challenge even if your account is up 2% overall.

Again, if you understand the rules, you can trade accordingly, or choose a prop firm with an easier evaluation. Don’t be one of those traders writing outraged posts on TrustPilot about how you don’t understand how you failed when the rules are written plain as day on Fidelcrest’s website.

Profit targets are reasonable. For smaller account sizes, the minimum profit target is just 5% for Normal Accounts. Larger account sizes have a 10% profit target, and aggressive accounts come with a 20% profit target.

Affordability/value – 10/10

Fidelcrest is very affordable, especially on the smallest and the largest capital accounts. When compared to FTMO, the standard bearer, Fidelcrest is the cheaper option on all but the mid-sized $50K and $100K accounts.

If you are looking for the absolute most capital for your buck, Fidelcrest is far cheaper than FTMO. FTMO offers $200K accounts for €1080, while Fidelcrest charges just €999 for $250K. That’s 25% more capital for less money.

Beyond that there’s literally no comparison because FTMO doesn’t offer any larger accounts, while Fidelcrest offers accounts up to $1 million.

Educational resources – 8/10

Fidelcrest has done a lot in the last few years to address shortcomings in their education department. They still do more for funded traders than for those who are in the evaluation stages, but that’s to be expected.

Funded traders have access to experienced one-on-one performance coaches, which is really great if you get that far. Not all prop firms offer that level of individual attention.

For those still in the evaluation phase, Fidelcrest has essentially outsourced any educational program to NeuroStreet, a highly regarded trader education company. Traders who sign up with Fidelcrest get 30 free days of access to NeuroStreet’s video classes and live trading sessions. After the 30 days are up you can continue on with NeuroStreet for a deeply discounted rate.

NeuroStreet is a great resource, especially for the greenest of traders who need guidance on basics, such as how to use trading platforms, etc. Just make sure to take advantage of the offer by clearing some time within the 30-day free window.

Beyond that, Fidelstreet leans pretty heavily on its customer support team to help instruct any novice traders.

What you won’t find at Fidelcrest, which you can get at other prop firms, are weekly podcasts, webinars, or YouTube series. Of course you can find those elsewhere, but if you want a prop firm that delivers that type of content, look elsewhere.

Tradable assets – 10/10

Fidelcrest really stands out over the typical prop trading firm that only offers forex trading. In contrast, Fidelcrest offers more than 175 tradable assets, including more crypto pairs than any other prop trading firm that I know of. With Fidelcrest, you can trade forex, cryptocurrency, indices, gold and silver, commodities, and shares.

Trustworthiness – 1/10

With four years in the industry and over 6,000 traders worldwide, I thought Fidelcrest was here to stay. Something went wrong, however, and you can find a number of complaints about accounts cancelled without good reason, payouts that were never made and customer service issues that were never resolved. Unless we get a reasonable explanation, their trustworthiness will remain at 1/10.

My overall rating – 7/10

I liked a lot of things about Fidelcrest, but their recent treatment of traders and unresponsiveness has knocked their trustworthiness down to a 1, which obviously torpedoed their overall score.

What Others are Saying

TrustPilot

Fidelcrest has an overall rating of 4.2/5 on TrustPilot, more than good enough to get TrustPilot’s “Great” label.

If you sort reviews by the most recent ones, however, you will get a different story. According to reviewers, Fidelcrest has closed a number of accounts without adequate justification and denied or simply ignored numerous payout requests.

YouTube

YouTube is an increasingly good source for prop trading firm reviews — if you can endure some painfully slow talkers who talk over blinking views of their monitors. Of course it is impossible to come up with any sort of consensus from YouTube, but the reviewers seem to be as equally split as the TrustPilot crowd.

The detractors hate the changing trading parameters, of course. More enthusiastic reviewers loved the direction that Fidelcrest has taken lately. The current promotions and expanding account options up to a $1 million account are extremely popular.

Overall

Fidelcrest reviews are a little more varied than those of other firms. Some traders absolutely love them, some very clearly don’t. Those in the latter camp hate the strict trading rules imposed in the Verification Stage, and that seems to be the bulk of their gripes.

Fidelcrest’s backers love the customer support team, promotions, profit splits, access to different financial markets, and massive account sizes.

Frequently Asked Questions

Is Fidelcrest legit?

At one time they were, but things seem to have taken a turn for the worse. They’ve been in business for five years, which is nothing to sneeze at in the prop trading industry, and have over 6,000 active traders by their own account.

Despite that, they’ve had numerous complaints lodged against them in the last few months and simply seemed to have given up.

Does Fidelcrest offer discounts or promo codes?

Yes, some of the best promotions in the business. Right now traders get free unlimited retries, if they can’t meet profit targets but still have a positive balance and no account violations. When you sign up, you can decide to get a second chance if you fail, or bet on yourself and get double your account size should you succeed.

Whichever promotion you choose, you’ll be the recipient of a really great deal.

Can anyone join Fidelcrest? Can Americans join Fidelcrest?

Yes. Fidelcrest is open to traders from all over the world, including the US. Fidelcrest offers their website in seven different languages.

What is the Fidelcrest Trading Challenge?

The Fidelcrest Trading Challenge is the first step in the two-part evaluation process that you must pass to become a funded trader. It is very similar to the challenges offered by other prop firms.

To pass, you have to meet profit objectives while staying above both daily and overall max loss restrictions. If you violate your max loss, you’ve failed the challenge and have to try again, either with your second account, if you took advantage of the promotion, or by purchasing a new challenge account.

If you pass the Trading Challenge phase of your evaluation, you move on to the verification phase, which, say it with me, has tighter trading parameters.

How do you pass the Fidelcrest Trading Challenge?

Passing the Fidelcrest Trading Challenge sounds pretty easy, but easier said than done, of course. It is just as much a test of your risk management skills as it is your trading skills.

Trading objectives and parameters vary based on which account you sign up for, but let’s take the $50,000 Normal Account as an example. In order to pass the Fidelcrest Trading Challenge, you have to make 5% profit without violating the 10% overall maximum loss rule or the 5% daily maximum loss rule.

Fidelcrest calculates their max loss figures based on the highest equity level your account has reached, which is not typical of most prop firms. So, you can never dip 10% below the high watermark of your account, nor can you lose 5% off your high in a single day. If you do, your account is closed.

Typically you have a set trading period in which to accomplish your profit goal. For the Normal 50K account, you have to grow your account by 5% within 30 calendar days, and you need to make trades on 10 of those days.

However, if you take advantage of the Fast Track option with an Aggressive Account, the minimum trading days requirement is removed, meaning the minute your account passes your profit threshold, you’ve passed and moved on to the Verification Stage.

What can I trade with Fidelcrest?

Fidelcrest doesn’t just cater to forex traders like the rest of the prop trading universe. They offer more than 175 tradable assets in the following financial markets: forex, cryptocurrency, indices, gold and silver, commodities, and shares.

What trading platform does Fidelcrest use?

Fidelcrest just uses MT4 at this time, although there’s talk of adding more platforms in the future.

What types of accounts does Fidelcrest offer?

Fidelcrest has accounts with initial capital ranging from $10,000 all the way up to $1 million. You can also choose between Normal and Aggressive accounts on almost every account size. Few prop firms offer as many account options as Fidelcrest.

Does Fidelcrest offer swap-free accounts?

Yes. When Fidelcrest debuted its new Trading Solution for the Evaluation stage, it added new swap-free accounts. Contact customer service for more details.

Is Fidelcrest regulated?

No, Fidelcrest is not regulated. Like all prop firms, Fidelcrest skirts regulation because they are not technically broker/dealers. When Fidelcrest funds traders, it uses its own capital and therefore isn’t subject to regulation.

If I violate the trading objectives do I get a second chance?

Fidelcrest offers a bonus option of a free do-over should you fail the first time around. If you don’t select that option or if you fail twice, you have to start over again.

How do I get in contact with Fidelcrest?

Fidelcrest can be reached via chat at their website, which is available 24 hours a day during the work week and somewhat less consistently on Saturday and Sunday. They can also be reached via email at support@fidelcrest.com. They are based in Nicosia, Cyprus.

My Fidelcrest Review Summarized in Exactly Forty Words

Fidelcrest was known for its massive account sizes, quick funding, number of tradable assets, including crypto, and great profit splits. That reputation has taken a serious hit of late as they’ve missed payouts, closed accounts, and left traders dangling.

Further Reading

More full prop trading firm reviews: FTMO, Lux Trading, Topstep Futures, Blufx, The 5%ers.

Best of’s: Best Prop Firms of 2024, Best Prop Firms for Stocks, Best Prop Firms for Beginners

Thanks alot management of fidelcrest for be so clear about ur trading rules but I want to inquire whether that rules in evaluation still continue after passing the process? And secondly for how long does it take for u to withdraw the profits after being funded. Thanks

Hello, just to be clear, I’m a trader who reviews prop firms, I’m not Fidelcrest. Please find the answers to your questions at their website. There are definitely still rules once you become a funded trader, although usually they are not as strict as they were during the evaluation process. The trading rules depend on which account you open. The timing of the payouts also depends on which account you open, so again, check their website. Thanks for reaching out, and good luck!

Do they still give the option to get a free re-try or double the amount to this day?

Hi Elijah, they actually changed the promotion. You no longer have a choice, but they are offering unlimited free retries for accounts that have no trading violations and a positive balance. So if you can’t hit your profit target in 30 days, you can try again, if your account is in good standing and not in the red. I am updating this page with the new details now.

Just as an update – not sure if it changed recently or not but the Verification second stage now has the exact same trading parameters as the Challenge Phase 1 stage. Losses on both stages are now 5% Daily loss / 10% max loss..

Thanks Mark, I appreciate the updates! That was a recent change. I’ll add the new info to the review.

Further to my previous update for your info, the company also no longer offer the “40-50% Verification stage payout. One step forward, one and a half back…

Indeed.