Forex.com ranks among the best foreign exchange brokers in the world thanks to their trading platforms, execution speed, overall safety, and excellent trading tools. With nearly half a million traders worldwide, forex.com is favored by forex traders with any level of experience.

Table of Contents

Forex.com review summary

Forex.com achieved an excellent 9.3/10 after I judged them according to 11 key criteria. My full review with a more extensive breakdown is below, but here are the highlights:

Pros

- Highest ranking in my survey of regulated forex brokers according to performance in 11 critical factors

- Complex trading tools packaged in easy-to-use trading platforms

- Largest selection of forex trading opportunities, with 80+ available currency pairs

- Great educational resources, including in-platform tutorials

- Extremely safe and reliable; in compliance with financial regulators in the US and many other jurisdictions

- Part of the publicly traded StoneX Group Inc., which means great transparency

- Excellent trading tools, including proprietary algorithms to identify trading opportunities

- Flexible fee structure that lets you minimize your trading costs

Cons

- Customer service department that is sometimes overwhelmed

- Difficulty with KYC (Know Your Client) protocols can—on rare occasion—make opening and closing accounts difficult

All things considered…

As the name implies, forex.com is the standard bearer in the forex trading industry. There’s none better. From their highly functional but easy-to-use trading platforms to their wide range of invaluable trading tools and innovative algorithms, forex.com is committed to giving their traders everything they need to achieve long term success. Sign up with forex.com here to join my choice for the best regulated forex broker in the industry.

My forex.com experience/detailed review

I’ve spent a lot of time trading with forex.com and with a lot of other forex brokers as well. In order to most objectively rate each broker, I rank them on a scale of 1–10 in each of the following 11 critical categories. Here is how forex.com fared.

Trading platforms (10/10)

Forex.com has been a trading platform innovator since they were founded more than 20 years ago. All three of their platforms are highly customizable, full of resources, and extremely easy to navigate. I suggest you sign up for a demo account and give the platforms a spin. I think you’ll be as impressed as I was.

Mobile trading app

Since I’ve been testing so many forex brokers that I have nearly a dozen mobile trading apps downloaded on my phone. If I’m out of the house and want to quickly check what’s going on in the forex market and maybe check on some trading opportunities, I always choose the forex.com app. It’s the simplest, quickest, and most informative.

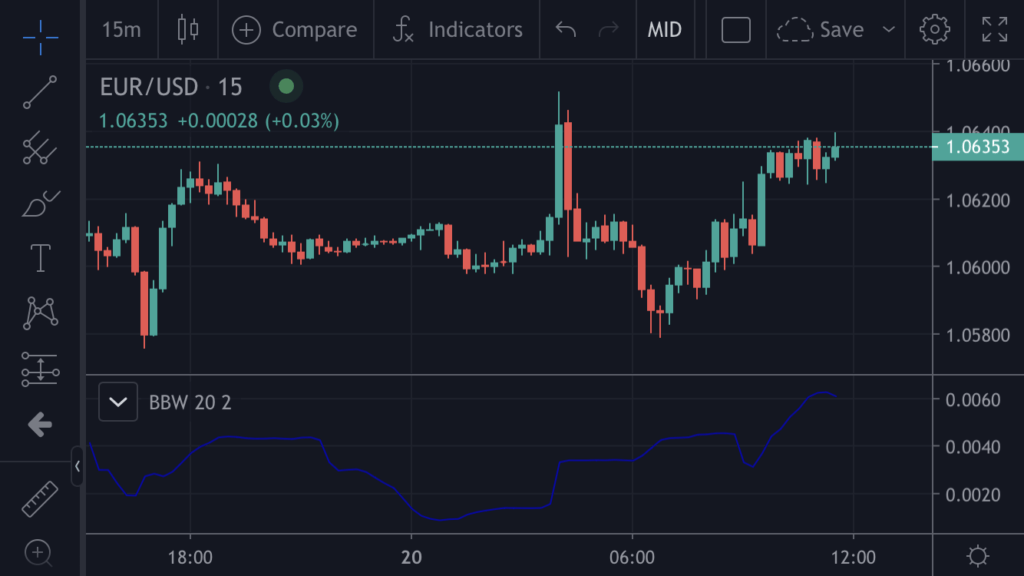

Forex.com also has the best charting capabilities of any mobile trading app. If you are a trader who relies heavily on technical analysis (like most forex traders) you probably don’t feel like you can trade on the go simply because you won’t have your full tool belt. With the forex.com mobile app, you will. I counted 88 indicators and didn’t find a single charting tool missing. All the other great forex.com trading tools are here as well—the economic calendar, SMART algorithm (more on that later), and plenty of news and analysis. It’s a pretty incredible piece of programming.

Really the only thing that bothers me a bit is that when I have the chart expanded to full screen, I am unable to trade directly from that screen. You have to minimize the chart by turning your phone vertically in order to make a trade.

Web platform

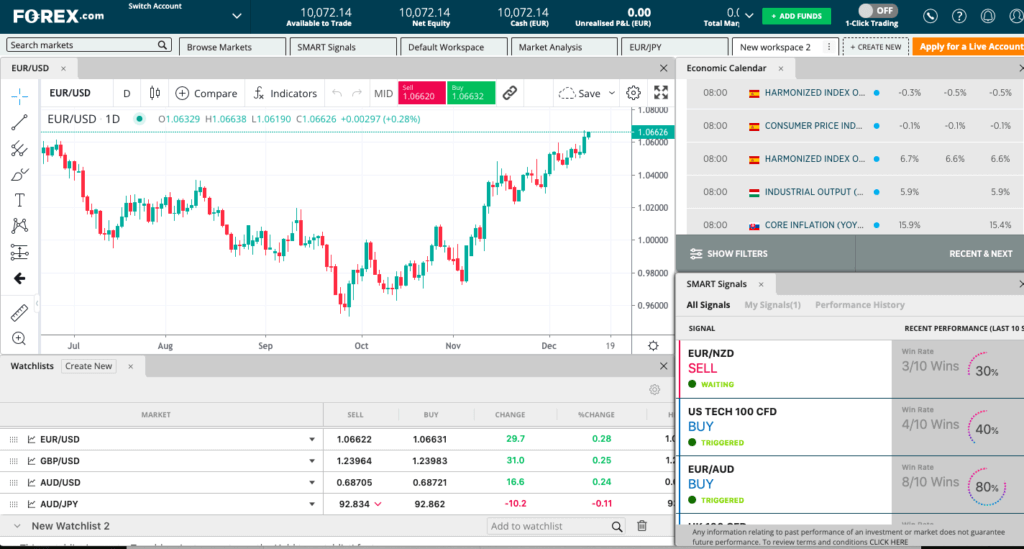

Other than a few purely aesthetic issues, the forex.com web platform is also near perfection. Alerts pop up regarding upcoming news releases or signals from their SMART algorithm so I never miss out on trading opportunities.

This is a big deal to me, since one of the things I struggle with as a forex trader is the thought that I’m missing out on opportunities. The forex market is so large and dynamic that it is impossible to stay abreast of everything. The forex.com web platform with its integrated economic calendar and alerts always makes me feel like I’m in the know and ready to trade.

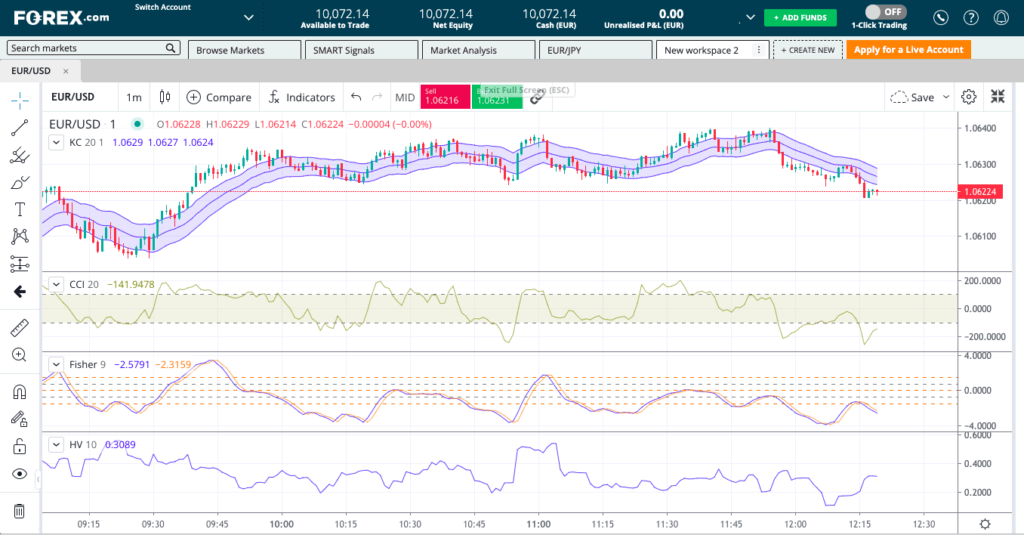

I also love the ability to customize your workspace. Below I’ve added a screenshot of a workspace I created with some of my essentials—calendar, chart, SMART signals, and my watchlist. It is so easy to manipulate to create exactly what you need. Once I’ve focused on one opportunity, I exit the SMART signals and calendar, expand the chart, and easily execute my trade.

Desktop trading platform

Forex.com also offers an “advanced trading platform” that is only available in certain markets and can only be downloaded if you have a computer operating Windows, not a Mac or Chromebook. I’m not sure to what end, but it seems as though forex.com is either phasing out the desktop platform all together or would simply prefer clients to use the web platform.

Whatever the motivation, a version for the Mac OS seems unlikely, since the forex.com website instructs Mac users to download third-party software called Parallels in order to run their Windows-based trading platform on your Mac.

If you do go to all that trouble, you’re rewarded with a very advanced trading platform for hardcore technical analysts. Charting isn’t quite as straightforward, but there’s more than double the indicators, and an automated trading tab that accesses a number of automated strategies.

Beginning traders will be more than content with the web platform, but it is nice to know that as you grow as a trader, forex.com has the advanced trading platform for true professionals.

MT4

Truthfully, I don’t use MT4, so this part of the review is always based on secondhand information from trader friends and associates. From what I hear, forex.com’s software integrates very well with MT4 and provides a seamless trading experience, complete with all the trading tools forex.com offers.

Trading costs (10/10)

In general, trading fees at forex.com are comparable to if not better than any of the other large forex brokers. If you’re like most traders and trading commission free, you’ll be very happy with forex.com’s spreads. Of course, spreads are constantly changing, but if you take the average spreads, forex.com is typically a pip or two better than the competition.

Forex.com also earns high marks for pricing due to their various options. Those who routinely trade during times of high volatility can choose a commission-based fee structure. Traders who qualify for the active trader program based on their trade volume qualify for rebates, and true high rollers can open an STP Pro account and save upwards of 60%.

Trade execution (10/10)

I use this category to judge both the trader’s experience pulling the trigger on a trade and the broker’s ability to complete a trade without significant slippage.

Let’s look at the broker’s side of the trade first. Thanks to their almost unparalleled transparency, we know forex.com’s execution speed down to the millisecond. Their average execution speed is 0.04 seconds, and more than 99% of their trades are executed within a second. That’s obviously fast, but what does it mean to you, the trader? It means that forex.com executed 100% of their limit trades at or better than the specified price. The data is just from one month—November 2022—but that’s still remarkable.

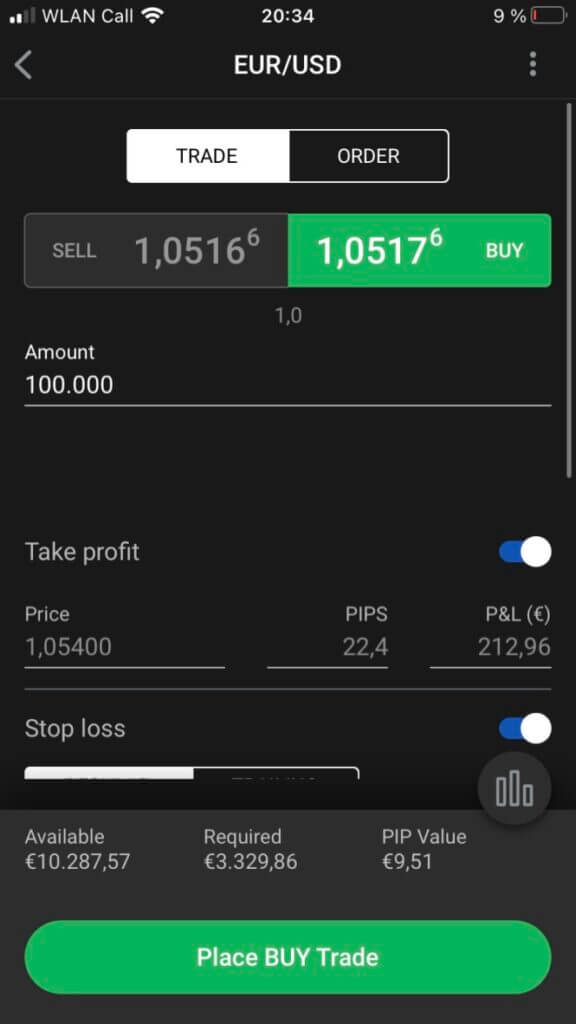

From the trader’s side, forex.com makes it incredibly easy to pull the trigger. If you want, you can easily opt in to one-click trading, which I don’t recommend until you’re extremely comfortable with the platform but can save you precious pips in volatile markets.

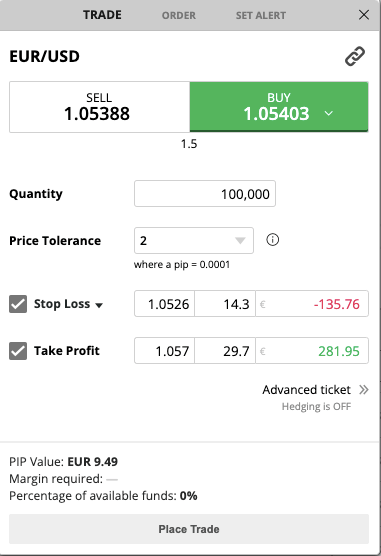

The trade screens themselves are also easy to use and make it extremely easy to set your limit orders as quickly as possible.

Here are some screenshots from the trade screens of forex.com’s platforms:

Regulation and reputation (10/10)

Forex.com is part of GAIN Capital Holdings, which itself is a part of the StoneX Group. Through GAIN capital holdings, GAIN Capital UK, and other subsidiaries, forex.com is regulated in at least six different jurisdictions, including the Monetary Authority of Singapore (MAS), the CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association (NFA) in the US, and many other agencies worldwide.

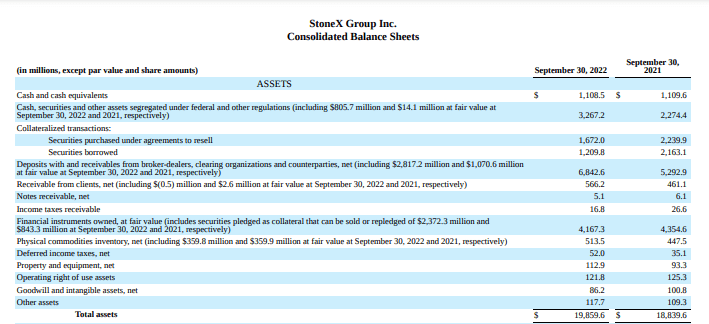

Add to all that the fact that StoneX, the parent company of forex.com, is publicly traded on the NASDAQ, and you have one of the safest, most transparent brokers in the world. It is no wonder that more than a million traders worldwide trust forex.com with their money.

Safety and security (9/10)

For forex brokers, safety can be measured by their balance sheet and the number of regulators they are subject to. You know your money is safe because forex.com has billions in assets and is required to keep customer accounts separate from company assets.

That’s great peace of mind, but what about your data, including personal and banking information? Again, the fact that forex.com complies to so many different regulators is an advantage. Forex.com has to comply with very strict data protection laws all over the world.

In fact, one small data breach affecting some Japanese customers more than three years ago is the only thing I can find.

Tradable assets (10/10)

At my last count, Forex.com offered 84 currency pairs (listed below under Leverage), which should be more than enough to satisfy even those traders who trade the most obscure exotics. That’s also more than most of forex.com’s US competitors, such as Oanda, who only offers 68. US traders can also access the precious metals market and, through a partnership with FuturesOnline, futures and options as well.

If you are a trader from outside the US, forex.com offers CFDs covering the aforementioned currency pairs plus indices, shares, crypto, and commodities. That pretty much covers any market you’d want to participate in. I should note, as I always do, that CFDs are, of course, highly leveraged instruments, and carry significant risk. Don’t start trading CFDs until you truly understand how they work.

Leverage (9/10)

Like all regulated brokers in the US, forex.com offers a maximum leverage of 50:1, but they only allow it on six of their 84 pairs. Other brokers offer the maximum leverage on more pairs, so if you’re into high-risk, lay-it-all-on-the-line trading, you should go elsewhere. Of course if you want to be a long-term profitable trader you would recognize that maximizing your leverage is also a really good way to maximize your risk.

Forex brokers determine how much leverage to allow based on regulations plus the inherent risk and volatility of the specific currency pair. In general, I think forex.com’s leverage is more than reasonable. Please see the list below.

Forex.com expresses available leverage in terms of the minimum margin requirement (MMR), which is sort of the inverse way of representing leverage. If your available leverage is 50:1, that means the minimum you can have is 2% of your position. To illustrate in the simplest terms, if you had $2, you could take a position worth a maximum of $100, which is 50 times the amount in your account (50:1 leverage), with the $2 of your cash being the 2% MMR.

| PAIR | MMR | PAIR | MMR | PAIR | MMR |

| AUD/CAD | 3% | AUD/CHF | 3% | AUD/CNH | 5% |

| AUD/JPY | 3% | AUD/NOK | 7% | AUD/NZD | 3% |

| AUD/PLN | 5% | AUD/SGD | 5% | AUD/USD | 3% |

| CAD/CHF | 3% | CAD/JPY | 2% | CAD/NOK | 7% |

| CAD/PLN | 5% | CHF/HUF | 5% | CHF/JPY | 3% |

| CHF/NOK | 7% | CHF/PLN | 5% | CNH/JPY | 5% |

| EUR/AUD | 3% | EUR/CAD | 2% | EUR/CHF | 3% |

| EUR/CNH | 5% | EUR/CZK | 10% | EUR/DKK | 2% |

| EUR/GBP | 3% | EUR/HKD | 15% | EUR/HUF | 5% |

| EUR/JPY | 2% | EUR/MXN | 10% | EUR/NOK | 7% |

| EUR/NZD | 3% | EUR/PLN | 5% | EUR/RUB | 20% |

| EUR/SEK | 3% | EUR/SGD | 5% | EUR/TRY | 12% |

| EUR/USD | 2% | EUR/ZAR | 7% | GBP/AUD | 3% |

| GBP/CAD | 3% | GBP/CHF | 3% | GBP/DKK | 5% |

| GBP/HKD | 15% | GBP/JPY | 3% | GBP/MXN | 10% |

| GBP/NOK | 7% | GBP/NZD | 3% | GBP/PLN | 5% |

| GBP/SEK | 5% | GBP/SGD | 5% | GBP/USD | 3% |

| GBP/ZAR | 7% | HKD/JPY | 15% | NOK/DKK | 7% |

| NOK/JPY | 7% | NOK/SEK | 7% | NZD/CAD | 3% |

| NZD/CHF | 3% | NZD/JPY | 3% | NZD/USD | 3% |

| SGD/HKD | 15% | SGD/JPY | 5% | TRY/JPY | 12% |

| USD/CAD | 2% | USD/CHF | 3% | USD/CNH | 5% |

| USD/CZK | 10% | USD/DKK | 2% | USD/HKD | 15% |

| USD/HUF | 5% | USD/ILS | 20% | USD/JPY | 2% |

| USD/MXN | 10% | USD/NOK | 7% | USD/PLN | 5% |

| USD/RUB | 20% | USD/SEK | 3% | USD/SGD | 5% |

| USD/THB | 20% | USD/TRY | 12% | USD/ZAR | 7% |

| ZAR/JPY | 7% | XAG/USD | 100% | XAU/USD | 100% |

| PAIR | MMR | PAIR | MMR |

| AUD/CAD | 3% | AUD/CHF | 3% |

| AUD/JPY | 3% | AUD/NOK | 7% |

| AUD/PLN | 5% | AUD/SGD | 5% |

| CAD/CHF | 3% | CAD/JPY | 2% |

| CAD/PLN | 5% | CHF/HUF | 5% |

| CHF/NOK | 7% | CHF/PLN | 5% |

| EUR/AUD | 3% | EUR/CAD | 2% |

| EUR/CNH | 5% | EUR/CZK | 10% |

| EUR/GBP | 3% | EUR/HKD | 15% |

| EUR/JPY | 2% | EUR/MXN | 10% |

| EUR/NZD | 3% | EUR/PLN | 5% |

| EUR/SEK | 3% | EUR/SGD | 5% |

| EUR/USD | 2% | EUR/ZAR | 7% |

| GBP/CAD | 3% | GBP/CHF | 3% |

| GBP/HKD | 15% | GBP/JPY | 3% |

| GBP/NOK | 7% | GBP/NZD | 3% |

| GBP/SEK | 5% | GBP/SGD | 5% |

| GBP/ZAR | 7% | HKD/JPY | 15% |

| NOK/JPY | 7% | NOK/SEK | 7% |

| NZD/CHF | 3% | NZD/JPY | 3% |

| SGD/HKD | 15% | SGD/JPY | 5% |

| USD/CAD | 2% | USD/CHF | 3% |

| USD/CZK | 10% | USD/DKK | 2% |

| USD/HUF | 5% | USD/ILS | 20% |

| USD/MXN | 10% | USD/NOK | 7% |

| USD/RUB | 20% | USD/SEK | 3% |

| USD/THB | 20% | USD/TRY | 12% |

| ZAR/JPY | 7% | XAG/USD | 100% |

| AUD/CNH | 5% | AUD/NZD | 3% |

| AUD/USD | 3% | CAD/NOK | 7% |

| CHF/JPY | 3% | CNH/JPY | 5% |

| EUR/CHF | 3% | EUR/DKK | 2% |

| EUR/HUF | 5% | EUR/NOK | 7% |

| EUR/RUB | 20% | EUR/TRY | 12% |

| GBP/AUD | 3% | GBP/DKK | 5% |

| GBP/MXN | 10% | GBP/PLN | 5% |

| GBP/USD | 3% | NOK/DKK | 7% |

| NZD/CAD | 3% | NZD/USD | 3% |

| TRY/JPY | 12% | USD/CNH | 5% |

| USD/HKD | 15% | USD/JPY | 2% |

| USD/PLN | 5% | USD/SGD | 5% |

| USD/ZAR | 7% | XAU/USD | 100% |

Trading resources (11/10)

This is where forex.com really outshines the competition. If I could, I would give them an 11/10. I suppose this is my review, so why not? They deserve it. No forex brokers give you better access to more resources and information than forex.com.

I’ll start with their charting capabilities, which are second to none. On the surface, all brokers seem to offer the same charting tools, but no one includes more drawing tools or technical indicators than forex.com. Technical analysts are lacking for nothing. You could trade for years before you made use of every overlay and indicator.

I’m also a big fan of the SMART signals, a proprietary algorithm that uses historic data to identify trading opportunities. Once an opportunity has been identified, you can also see what percentage of traders have profited from the signal in the past. I’ve personally done very well with SMART signals, and love when I get an alert.

Forex.com even offers a better economic calendar than other brokers. News events are color coded depending on what sort of market impact they’re predicted to have, which makes it exceptionally easy to filter what news might have an effect on your trades, and what news represents good trading opportunities.

Finally, forex.com offers their own news and analysis, but also incorporates all the news and information from Trading Central. If you can’t stay abreast of the market with a forex.com account, you might be in the wrong business.

Education (10/10)

Forex.com has put a lot of thought into how to welcome beginning traders to the initially confusing world of forex trading. For instance, the first time you use their web trading platform, you’re greeted by a very quick tutorial that shows you how to use and customize the platform.

That type of education on the fly can be found throughout forex.com’s platforms and website. If you click the question mark at the top of the platform, a menu appears with explanations on over a dozen features, which can be accessed without leaving your workspace.

Outside of the platforms, anyone can (and should if they’re new to forex) go through forex.com academy, a series of 12 courses that cover the basics of trading starting with fundamental analysis through advanced strategies and advanced risk management. Each course is broken down into lessons, which you can read through at your own pace.

If you prefer to learn via video, there are also 15 tutorials that cover some trading basics within the context of how to use the trading platforms.

Sign-up and withdrawal process (6/10)

Unfortunately, this is one of the few places that forex.com struggles. For probably 95% (or more) traders, this won’t be an issue at all. You’ll sign up for a trading account, upload the identity verification documents, and soon be trading.

The trouble is, for those unlucky souls who have some sort of issue with their paperwork, it can be incredibly frustrating to get the sign-up process back on track. This is an issue with all regulated forex brokers, but forex.com seems to do a worse job than some of its competitors.

As frustrating as sign-up issues can be, withdrawal issues are even worse, particularly if you really need your money. Again, the vast majority of traders will never have an issue, but those that do might be in for a long delay until customer service can fix the issue.

These issues are a result of complicated KYC protocols that require brokers to look out for potential money laundering. All regulated forex brokers are subject to these protocols, but some execute them better than others. Hopefully forex.com can improve this area of their business.

Customer service (7/10)

When not dealing with KYC protocols, forex.com’s customer service department is quite good. Unlike with other brokers, forex.com’s chat support doesn’t filter you through a bunch of answer-spewing bots before connecting you to a real person. I’ve never waited more than two minutes to connect to someone, and have found the service reps to be very knowledgeable and courteous.

Based solely on my own personal interactions, I’d rate them substantially higher, but there is significant improvement to be made in how they handle customers who run into KYC problems.

Overall rating

Some poor ratings surrounding the customer service department and their struggles with KYC protocols prevented forex.com from posting a near perfect score. If your identity verification documents are in good order and you don’t run into any issues, you will have an outstanding forex trading experience if you sign up with forex.com.

Forex.com FAQs

Who can use Forex.com?

Forex.com is available nearly worldwide, as traders from more than 140 different countries, including the US, countries of the European Economic Area, are eligible for accounts. Due to economic sanctions invoked by the US Office of Foreign Assets Control (OFAC), forex.com is prohibited from offering accounts to countries subject to economic sanctions by the US. Traders in certain OFAC sanctioned countries are unfortunately out of luck.

What types of accounts does forex.com offer?

Account types vary by region, but US traders can choose between four types of personal accounts, plus corporate accounts if you’re trading on behalf of a company and want to authorize multiple traders on the same account.

The main difference in personal accounts is pricing. Here’s a breakdown of the four account varieties:

Standard trading account

The standard account is the most popular account type at forex.com. You get all the advantages of a forex.com account with a commission-free pricing model, meaning you’re only paying the spread.

Active trader account

An active trader account is basically the standard account or the MT4 account with some really nice extra frills. It’s a frequent flier program, more or less. To qualify for an active account, all you have to do is sign up for a standard account, but open it with more than $10,000 or trade more than $50 million of volume in one calendar month. Do that, and you’ll automatically be upgraded.

The benefits of the active trader account include a rebate on trading costs, which can save you between 5%–15% depending on how much you trade. You also get a reimbursement of any wire transfer fees, plus the assistance of a Market Strategist who is there at your beckon call.

Commission account

A commission account is for those that would rather pay a flat commission rate plus a much smaller spread instead of opting for a spread-only account. All other account benefits are the same.

In the commission account, Forex.com currently charges $5 per 100K units traded, plus a very minimal spread, as low as .2 on major currency pairs, although it varies.

Most traders choose the spread-only pricing model, but commission accounts might save money for traders who trade during times of high volatility. High volatility means high spreads, so $5 plus a minimal base spread might be the cheaper option in these circumstances. If you like to trade around the release of significant news, for example, you should consider the commission plan.

MT4 account

An MT4 account is essentially the standard account but for diehard MT4 fans who want to stick to that platform. As I mentioned above, forex.com does a great job integrating its best features with the MT4 platform, so this is a good option for some traders. Traders who choose an MT4 account are also eligible to get the active trader upgrade, which means rebates on some trading costs.

STP Pro account (aka Direct Market Access Account)

STP Pro accounts are designed for very experienced traders with deep pockets. Forex.com suggests at least a $25,000 balance and a minimum trade size of 100,000 units. For those that can meet that criteria, the STP Pro account offers considerable savings in terms of trading costs.

It works like this: traders are given direct access to liquidity providers and can make trades without paying an additional spread to forex.com. Instead, you’ll pay a commission, which varies depending on your monthly trading volume. If you trade less than $100 million per month, you’ll pay an $80 commission per USD million traded. That commission gradually goes down as monthly trade volume goes up, until you reach the traders who are trading $1 billion per month or more. These high-volume traders pay just $30 per USD million. It pays to be rich!

What methods can I use to make deposits?

In the US, Forex accepts deposits through bank transfer (ACH), wire transfer, or debit cards. Outside the US, traders can also fund their accounts with credit cards and e-wallets Neteller and Skrill. Keep in mind that you will have to fill out far less paperwork and have a much smaller chance of complications if you make your withdrawals via the same source as your initial deposit. So always fund your account with a debit card or bank account that you know you will still be using going forward.

What is forex.com’s contact info?

The quickest way to get ahold of customer service is to use the chat function or fill out the help form on their website, but if you’d like to get in touch through one of the old-fashioned ways, you can email them at support@forex.com if you’re based in the US, or support.en@forex.com from any other country.

If you really want to use an old-fashioned method, you can also call 1-877-731-0750 from the US, or +357 220 900 62 for international clients.

And if you want to get really, really old fashioned, you can send forex.com a letter:

GAIN Capital Holdings

30 Independence Blvd.

Suite 300

Warren, NJ 07059

How long do forex.com withdrawals take?

Keep in mind that like all forex brokers, forex.com issues withdrawals via the same method as your deposit. If you made a wire transfer to fund your account, your withdrawal will also be a wire transfer. Currently, forex.com processes debit card withdrawals instantly, although they can take up to 48 hours. Wire transfers are usually processed with two business days for domestic transfers and five business days for international transfers, and bank transfers take up to 48 hours to process.

What is the minimum initial deposit for forex.com?

If you’re just getting started, forex.com has a minimum deposit of 100 units of your base currency. So if you’re in the US, that’s $100, in the UK £100, etc.

Is forex.com safe?

Forex.com is amongst the safest brokers in the world. They operate all over the world and are therefore subject to a number of regulatory bodies, including the CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association (NFA) in the US, as well as the Financial Conduct Authority (FCA) in the UK, the Monetary Authority of Singapore (MAS), and many other agencies worldwide.

In maintaining compliance with these agencies, forex.com must keep client deposits separate from their own assets, and most always keep a certain amount of cash on hand. These measures mean that forex.com will never go the way of FTX, the unregulated crypto broker that went dramatically bankrupt.

Forex.com is also owned by StoneX Group Inc, a publicly traded company, meaning their balance sheet is an open book. With close to $20 billion of assets, you can rest assured that your money will be there when it is time to make a withdrawal.

Is Forex.com good for beginners?

Yes, forex.com is excellent for beginners. They even have a quiz designed to help you determine what type of trader you are and match you with compatible trading strategies. Their educational resources are also excellent, as evidenced by 12 courses that take you from the very basics all the way through advanced charting techniques. Their trading platforms are also very user friendly, starting with the pop-up tutorials that appear the first time you open a platform. If you’re new to trading forex, forex.com is a great place to start.

Why trade with Forex.com?

If you asked forex.com’s million traders why they chose forex.com, I suspect the most common answers would be the excellent trading platforms and account security. You trade with forex.com because you know your money is safe, and you know they provide you with the best trading tools and resources to give you the best chance to succeed as a forex trader.

Risks of forex trading

Choosing a reputable broker can remove some significant risks, but no matter who you trade with, the forex market can be very difficult, especially for newcomers. Do not start trading forex without doing your research, understanding the market, learning how to minimize risk, and honestly assessing how much you can afford to lose. Most retail investor accounts lose money, particularly with CFDs.

Conclusion: Should you trade with Forex.com?

Yes, forex.com is an excellent choice for forex traders of any level of experience. No matter what your trading strategy, forex.com provides the tools and resources necessary to help you succeed. Sign up here to join nearly half a million traders worldwide who trust forex.com to give them the best chance at trading success.