Table of Contents

Overview

As of August 31, 2023 regulators in the US and Canada have temporarily frozen My Forex Funds bank accounts.

The Commodity Futures Trading Commission (CFTC) has charged My Forex Funds with defrauding their clients using a variety of methods, including manipulating prices, failing clients under false pretenses, and more.

I’m leaving this review up in case MFF comes back, but it seems unlikely unless they make a drastic change in their business model or register as a broker/dealer. The most recent court opinion was not great news for either MFF or US-based prop firms. I’ll update this page as more information becomes available.

Prior to the shutdown, MFF was one of the world’s leading prop firms. Since its inception in July 2020, My Forex Funds had signed up thousands of traders and paid out millions of dollars in profit splits.

Pros – What I liked about MFF before they shut down

- Accounts for every skill level — MFF had accounts tailored for beginners, intermediate, and professional traders.

- Earn during evaluation — Earn 2% of your profits after passing phase 1, 4% after passing phase 2, plus a 112% refund of your signup fees with you first payout

- Affordable pricing — Evaluation accounts with MFF were up to 25% cheaper than FTMO for the same level of capital.

- Free retakes — Traders who don’t violate the trading rules but also don’t reach their profit target get two free extension or unlimited free retakes.

- Great profit splits — Profit splits for Evaluation accounts start at 75% and go all the way up to 85% or even 90% for VIP traders. That’s about as good as it gets.

- Low profit targets — For Evaluation accounts, it’s 8% split to pass the first stage and then just 5% to move on to a funded account.

- Popularity — MFF claimed more than 40,000 traders in 120 countries since its inception.

- Active trading community — MFF’s Discord channel with more than 175,000 members is an invaluable tool for beginning traders.

Cons

- The cons list got a lot longer after reading the CFTC’s allegations. MFF responded that a lot of the CFTC’s charges came from conversations taken out of context and a misunderstanding of the prop firm industry. This may be true, but it seems clear that MFF was definitely using the demo trading environment to their advantage, often at traders’ expense.

- “Slip them to hell” — This is the quote from the CFTC’s complaint that will live on forever. A MFF employee reportedly used those words to tell one of their software contractors to increase slippage against a profitable trader.

- Slow customer service — MFF has acknowledged the need to hire more trader support agents, and although I’ve seen a marked improvement of late, they can still be slow to respond.

- Equity-based drawdown — Drawdown is based on your equity not your account balance, which trips a lot of traders up.

- Account choices — MFF has so many account options, it can be difficult to discern which rules apply to which accounts.

Who should sign up with My Forex Funds?

No one can sign up for MFF at the moment as they’ve been shut down, but again, I’m keeping this up in case they come back.

If you want to join probably the fastest growing prop firm in the world, sign up with MFF and take advantage of a growing, dynamic trading community. MFF’s meteoric rise from a prop firm offering one funding option on an amateurish website to a company with 40,000 traders in less than two years is incredible, and they continue to grow and innovate.

Bargain hunters will also delight in MFF’s great prices. A $50K Evaluation account is still just $299 (see all prices below). By way of comparison, FTMO’s $50K account is €345. That’s a significant discount if you choose MFF.

If you don’t care for the evaluation process or demo trading, MFF also offers an instantly funded account. The instantly funded accounts aren’t quite as competitively priced, especially when compared with the 5%ers, but they are still a good deal. Traders have access to forex, CFDs, and metals.

Who should NOT sign up with My Forex Funds?

If you like holding positions overnight, you might be put off by the 5% drawdown limit, which is based on your equity at 5 p.m. EST rather than your account balance. That means if you have a winning trade running but it pulls back more than 5%, you’ll have violated the maximum drawdown and will lose your account. At that point it doesn’t matter if your account is profitable overall, you’re still out of luck.

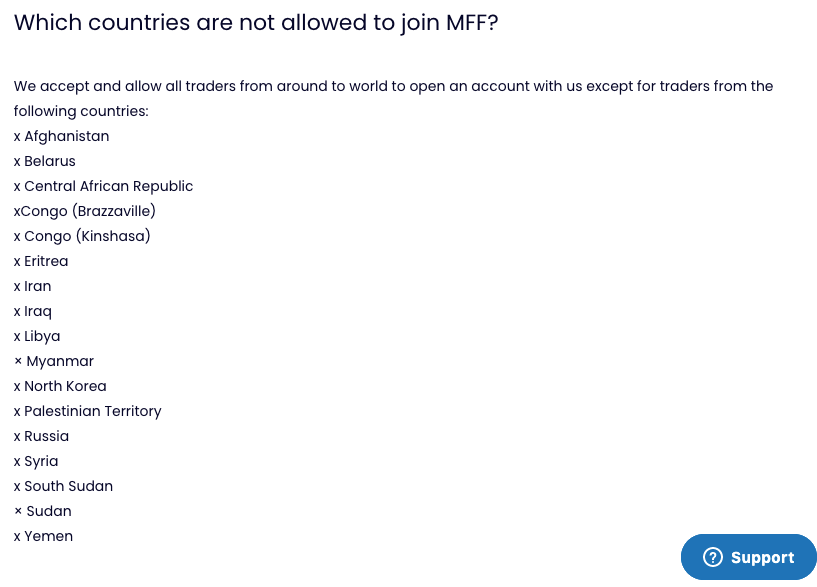

Residents of certain OFAC sanctioned countries are no longer permitted to join MFF. This includes those residing in Iran, Iraq, Libya, Russia, Syria, Myanmar, Sudan and a few other countries.

All things considered . . .

It was easy to get excited about MFF — they had great price points, account options to accommodate traders of any skill level, and an immense trading community. It is still unclear why the CFTC targeted them over any other prop firm, but perhaps it was because they had become so popular.

MFF Basics

My Forex Funds origin story

MFF was founded in Toronto in June of 2020 and started their Evaluation account in March 2021. They signed up more than 4,000 traders in their first few months. Fast forward to 2023, and they are, by some metrics, the second most popular prop firm in the world (behind FTMO).

Murtuza Kazmi is the founder and the wizard behind MFF’s curtain. He was a part-time trader and a very early investor in crypto currencies. The capital he now uses to fund forex traders comes from his substantial crypto gains. After his early success, he had some ups and downs as a trader and thought his capital could be put to better use by better traders. He began offering forex traders funding through MFF to find those traders and piggyback on those that were successful.

How does My Forex Funds work?

MFF works like all prop trading firms that offer funded accounts. They offer forex traders funding in exchange for an up-front fee and a percentage of any profits the trader generates. The trader just has to demonstrate excellent risk management by adhering to all MFF’s trading rules, and MFF will continue to fund them.

With MFF, you can become a funded trader via three different account types. You can sign up for a Rapid account, and slowly learn the ropes and eventually receive funding. You can choose an Evaluation account and pass two evaluation stages to receive funding. Or, finally, an Accelerated account offers instant capital.

The Rapid accounts are for inexperienced traders and are designed to familiarize them with the trading platform, while teaching risk management. If you demonstrate with a Rapid account that you’ve mastered risk management and have the tools to be a successful trader, you will graduate to a live account. Once you’ve been given a live account, with real capital, you’ll receive 50% of the profits the first month. Your profit split will grow by 15% for every month that you’re profitable and stay within the guidelines, up to the maximum split of 80%.

Evaluation accounts start you out trading in demo mode. If you meet modest profit targets of 8% in the first stage, and 5% in the second, and stay within the trading rules, you are rewarded with a live account. You need to trade a minimum of five days in each stage in order to advance.

Most traders join MFF with Evaluation accounts, and many traders fail thanks to MFF’s infamous daily maximum drawdown. If your account drops 5% or more in one day, you’ve violated the drawdown and lose your account. A 5% daily drawdown isn’t outrageous, but MFF calculates their drawdown on equity balance rather than your account balance. I explain the distinction elsewhere in my review. Make sure you understand it before signing up with MFF.

If you do pass both stages of evaluation, you’ll finally be trading real money. Initially you’ll receive 75% of the profits, but if you continue to trade without breaking the rules, you’ll be bumped up to a maximum of 85%.

The Accelerated accounts are pretty straight forward. Sign up and you’ll receive instant funding. There’s no daily drawdown, just an overall drawdown, set at a maximum of 5% for Conventional Accelerated accounts and 10% for Emphatic Accelerated accounts. If your equity or account balance dips below either 5% or 10%, you lose your account.

Accelerated accounts can be scaled all the way up to a maximum of $2 million. Profit splits are an even 50/50, paid out weekly.

How much does My Forex Funds cost?

MFF charges one-time fees, which are refundable for Rapid and Evaluation accounts if you meet trading requirements and graduate from your demo account to a live account. The two Accelerated accounts offer instant funding for a nonrefundable fee.

Rapid Account

| Account Size | Refundable One-time Fee |

| $10,000 | $99 |

| $20,000 | $189 |

| $50,000 | $399 |

| $100,000 | $749 |

Evaluation Account

| Account Size | Refundable One-time Fee |

| $10,000 | $84 |

| $20,000 | $139 |

| $50,000 | $299 |

| $100,000 | $499 |

| $200,000 | $979 |

Accelerated Account – Conventional

| Account Size | Refundable One-time Fee |

| $2,000 | $99 |

| $5,000 | $245 |

| $10,000 | $485 |

| $20,000 | $970 |

| $50,000 | $2,450 |

Accelerated Account – Emphatic

| Account Size | Refundable One-time Fee |

| $2,000 | $198 |

| $5,000 | $490 |

| $10,000 | $970 |

| $20,000 | $1,940 |

| $50,000 | $4,900 |

My Assessment

I assess all prop trading companies according to the following seven criteria. For my overall rating, I weigh each factor equally, but to you personally some factors may be more important than others. For example, if you are obtaining forex capital from a prop trading firm for the first time, you should place a higher value on a prop firm’s educational resources than I do.

Profit split – 9/10

MFF’s profit splits are in line with the most generous firms in the industry. MFF pays out 75%–90% on Evaluation accounts once you have become a funded trader. Instantly funded accounts pay out at a 50/50 profit split, which is industry standard.

Scaling opportunities – 9/10

MFF does offer excellent scaling opportunities with their Accelerated account. For the Conventional Accelerated account, they will either double or give you 1.5x your account size every time you hit your 10% profit target, up to $2 million. For the Emphatic Accelerated account, the scaling is the same once you hit 20% profit targets.

Scaling for the Evaluation account isn’t quite as appealing. They say they will fund you “to the moon,” but you have to generate 10% profits or more over four months in order to request an additional 30% of trading capital. The moon is a great objective, but in 30% increments every four months, it will take you a while to get there.

Trade parameters/profit targets – 8/10

MFF has some trade parameters that are fairly unusual in the industry, particularly with their Rapid account, which is aimed toward beginning traders. The Rapid account requires traders to make a trade on three trading days per week. Most prop firms have minimum trading days, but this is the first time I’ve seen a weekly minimum.

They also have a “consistency rule” on the Rapid accounts, which is quite complicated. Here’s MFF’s explanation:

“A safe way to increase or decrease your risk parameters is to keep within +/- 200% of your average or deviation by a factor of 2. Two main KPI we use here are trades and lot size. Each week, we will take an average of mentioned KPIs and place a ceiling (avg x 2) and floor (avg/2) for the trades. Any trades outside these parameters will raise a flag on an account and be a possible violation.”

Again, supposedly the Rapid accounts are for those who are first-time users of forex trading accounts. Seems like a lot to process for a rookie. This rule can be circumvented if you request an “NCA,” which is a non-consistency account.

The rules for the Evaluation accounts are much more straightforward. MFF’s profit targets are lower than the average prop trading firm, and quite obtainable. You have to hit an 8% profit target to pass the first stage, and only a 5% profit target to pass the second, with a five trading day minimum.

The 12% overall drawdown is very reasonable, and one of the most lenient in the industry. However, the daily drawdown of 5% is what eliminates most traders.

A 5% daily drawdown isn’t uncommon in the industry, but MFF calculates it a little differently. They use your equity or your current balance, whichever is higher, when measuring drawdown. Your benchmark is set at 5 p.m. EST, so if you have an open position at the time, you have to factor the value of that position into the calculation to get your equity.

That means if you hold a successful trade overnight, your equity will be higher than your balance. If the trade pulls back the next day, you could find yourself in violation, even if your account balance never dipped 5%.

The bottom line is that you should either close all positions before 5 p.m. EST, so that you’ve realized all profits or losses and don’t have to do any equity calculations, or keep a close eye on your equity balance. The Accelerated accounts don’t have a daily drawdown.

MFF doesn’t allow EAs, unless they are trade copiers that copy your own trades from a different account. You can hold trades over weekends and trade news.

Affordability/value – 10/10

If you are just looking at how much you’re paying for your forex trading capital, MFF might be the best bargain in the business. For example, when you compare MFF with FTMO, MFF is quite a bit cheaper. If you choose a large trading account, you might save 25% or more going with MFF over FTMO. These fees are also fully refundable, once you graduate to a funded account.

That’s a great bargain, although the calculation gets a little more complicated when you consider what you’re getting for your dollar. FTMO, for example, offers substantially more educational resources. Whether that’s worth a 25% higher price tag is up to you. If you just look at the bottom line, however, MFF is very affordable.

Educational resources/trader support – 7/10

At one time, MFF was planning to launch a forex academy, but that seems to have been shelved. I hope that it is still in the works. For the time being, they are fairly active in offering tips on social media, and they have a blog that is regularly updated with trading tips. There’s also some good introductory level posts about the forex market.

Beyond that, MFF’s chief educational resource is other MFF traders. Their Discord community is enormous and active. For the most part it is a very supportive community, and you can learn a lot just following the general chat or trade ideas thread.

Trader support has been an occasional issue for MFF, something that even the founder, Murtuza Kazmi, has had to address publicly. This is a common problem for rapidly growing prop firms, for the simple reason that prop firms are complicated. You can’t hire temp workers to answer complicated questions from traders. It takes a tremendous amount of training to get customer service reps up to speed.

MFF has made a lot of improvements in this area and now employs more than 300 staffers, many of them in trader support.

Tradable assets – 9/10

MFF offers its traders access to a number of financial instruments, although it varies depending on the account you choose. Of course all traders can access the forex market, on most accounts you can also trade some commodities and metals, as well as CFDs. MFF also allows crypto trading on weekdays.

MFF does make one caveat that worries me a bit—they state very clearly that they may restrict certain markets due to any number of factors. Certainly this won’t affect the most popular trading instruments, but if you trade a niche asset, it would be devastating to wake up and find that you can no longer execute your strategy.

Trustworthiness – 8/10

In the past, MFF worried me simply because their growth didn’t seem sustainable. They didn’t seem to have the resources to accommodate so many traders and this showed in a number of customer service issues, which I saw as red flags. I’m very pleased to have been proven wrong thus far. Most of My Forex Funds growing pains seem behind them and their popularity only continues to grow.

I’m still a little worried that they are flying a little too close to the sun, but that probably says more about my risk tolerance than it says about MFF who have always proven themselves up to the task.

UPDATE: I guess I was right to be “A little bit worried.” I had no idea the CFTC would get involved.

My overall rating – 8.6/10

My Forex Funds was once among my favorite 10 prop firms, but they obviously didn’t make my Best Prop Firms of 2024 list.

What Others Are Saying

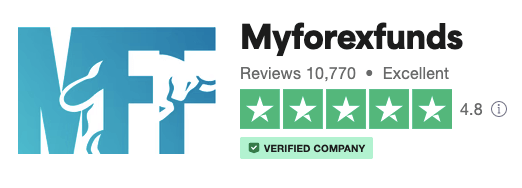

TrustPilot

The TrustPilot reviews are overwhelmingly positive. MFF has a 4.8 score, more than enough to be labeled “excellent.” They also have more than 10,000 reviews, which is a ton for a company that’s been around for only a few years. They actually have more reviews than FTMO, and FTMO has been around forever. A whopping 92% of those reviews give My Forex Funds a full five stars. That’s a pretty good percentage of satisfied customers!

A number of the recent complaints surrounding My Forex Funds come from Vietnam. Many traders there had their accounts suspended due to copy trading violations, to which they claim innocence. I’m in no position to judge, however I know other prop firms have also claimed to have found widespread copy trading violations from Vietnamese accounts.

Social media

It’s always hard to determine the credibility of reviewers on social media. Social media seems to bring out the extremes—love it or hate, so long as you express it. Nowhere is this more true than on MFF’s Instagram account. Every MFF post has comments ranging from unbridled adulation to bitter resentment.

Examples from a recent post range from: “Wonderful!” and “Changed my life!” to traders asking about lagging payments, complaining about failed evaluations, or trying to get a response out of customer service.

Checking out a prop firm’s social media can be a scarring but illuminating exercise. Although you can disregard a lot of the comments, it is always informative to see how the prop firm responds. Reading the comments on MFF’s posts leaves you thinking that they might be a little overwhelmed at the moment.

Overall

Judging from recent comments and reviews, My Forex Funds seems to be doing quite a bit better than they were when I initially reviewed them. Customer service seems, for the most part, to have caught up and most traders seem quite pleased with their overall experience.

Frequently Asked Questions

Is My Forex Funds legit?

According to the CFTC, My Forex Funds has been defrauding its clients in a number of ways. They manipulated prices to traders’ detriment, failed traders during the evaluation stage under false pretenses, added deceptive commissions to deplete traders’ equity, and more.

Does My Forex Funds offer discounts or promo codes?

In the past few months, MFF has cut down on the number of discounts they offer. Promo codes are harder to find. In the event of a My Forex Funds promo or coupon, I’ll note it at the top of this post as well as here.

Can anyone join My Forex Funds? Can Americans join My Forex Funds?

No one can join MFF at the moment, as they’ve been shut down by the CFTC.

In the past, Americans could join MFF as can most traders around the globe with the exception of some traders from countries on the OFAC sanctions list.

Here’s the current list of prohibited countries from MFF’s website:

What can I trade with My Forex Funds?

MFF allows trading in Forex, CFDs, indices, and metals. Crypto is allowed on weekdays in some accounts.

What types of accounts does My Forex Funds offer?

MFF offers Rapid, Evaluation, and Accelerated accounts, with four account size options for each.

The Rapid is basically a demo account that slowly gives you access to more capital and an increasingly large profit split if you meet trading requirements. The Evaluation account has a two-stage evaluation process. Once you pass both stages, you’re rewarded with a live account and can keep up to 85% of the profits.

The Accelerated account is instantly funded. No demo, no evaluation, just immediate capital and access to financial markets.

Does My Forex Funds offer swap-free accounts?

Yes, MFF offers swap-free accounts with some additional rules attached. Trades can only be held for a maximum of three days, and cannot be held over the weekend. The swap-free designation only applies to live accounts because, according to MFF, “swap is not truly charged on demo.” Therefore there are no swap-free options for the evaluation stages.

Is My Forex Funds regulated?

No, like almost all prop firms that offer funded accounts, MFF lives in the gray area between being a financial services company and an education company.

UPDATE: That grey area has been largely erased. The CFTC is contending that even trades made in simulated trading environments like what MFF are “real,” which means that MFF should have been a registered broker/dealer. They obviously were not, which was one of the reasons for the shut down. One judge has agreed with the CFTC’s assessment, but we’ll see if this case sparks an industry-wide change.

If I violate the trading objectives do I get a second chance?

With the Evaluation accounts, MFF allows free retakes for traders who didn’t meet the profit objectives, but still ended up with some profits and didn’t violate any trading rules.

They also offer discounted resets for those that did fail due to a trading violation. Prices range from $75.60–$881.10, depending on the size of the account you’re trying to reset.

How do I get in contact with My Forex Funds?

This has been an occassional issue with MFF. They can be reached via email: support@myforexfunds.com. Chat is also available at their website, or they can be reached via Discord. Customers have also had success reaching out via social media on both MFF’s Instagram and Facebook pages.

My Forex Funds Review Summarized in Exactly Forty Words

MFF was once the shiny new prop firm on the hill, but new CFTC allegations make it obvious that all was not as it seemed. My Forex Funds may never reopen, and if the allegations are true, they never should.