Table of Contents

Overview

Launched in 2021, SurgeTrader is one of the hottest new prop trading firms. They’re quickly making a name for themselves thanks to a one-step evaluation process, lightning-quick funding, simple trading rules, and great trader support.

Pros

- One-stage evaluation: Literally cuts your evaluation time in half when compared to FTMO and most other prop firms.

- No minimum trading days: Hit your profit target and you move on to become a funded trader, even if you do it in a single day.

- No time limits: Take your time to hit profit targets without worrying about a deadline.

- Simple trading rules: There’s only one main “hard” rule: Stay above a 4% daily loss limit and a 5% max trailing drawdown.

- Tons of tradable assets: SurgeTrader allows you to trade crypto, forex, oil, metals, indices, and a number of the “most popular” stocks.

- Accepts all trading strategies: As long as you abide by the rules, you’re free to trade however you’d like.

- Trade real capital: SurgeTrader gives its funded traders real capital, unlike other prop firms that keep traders forever in demo mode.

- Excellent education resources: SurgeTrader’s blog, Discord channel, and trading resources offer a wealth of information that can benefit new traders and old hands alike.

Cons

- Tight trading parameters: The trading rules may be simple, but they’re also pretty tight. A 5% overall trailing drawdown doesn’t leave much margin for error.

- Withdrawals can limit your max drawdown: With SurgeTrader, you can’t withdraw 100% of your profits unless you want to close your account. To keep your account open, you have to leave a certain amount to protect you against a max drawdown breach.

- Limited leverage: SurgeTrader allows a maximum leverage of 10:1 on forex, metals, oils and indices; 5:1 on shares; and 2:1 on crypto.

- One hidden rule: If you trade equities, you can’t have an open position going into an earnings announcement. Violate this rule and you’ll lose your account.

Promotions

Who should sign up with SurgeTrader?

If you want your capital fast but don’t want to give up 50% of your profits like you would with the 5%ers or other instant-funding prop firms, SurgeTrader could be a great solution. With only a one-phase evaluation and no minimum trading days, you could be funded in a hurry and still cash out 75% of your profits.

SurgeTrader is also a good choice for those who have trading strategies that might not be permitted at other prop firms or for whom other firms’ rules feel too restrictive. SurgeTrader has very few trading restrictions and some very simple rules. A lot of prop firms advertise lax rules, but SurgeTrader actually delivers.

SurgeTrader is also great for crypto traders, with more crypto options than any other prop firm I’ve traded with or reviewed.

Who should NOT sign up with SurgeTrader?

If you’re a high-risk trader, SurgeTrader might not be your best bet. Their tight drawdowns don’t leave you much margin for error.

Equity traders also might stay away from SurgeTrader if they like to trade around news releases. Hidden in the SurgeTrader FAQs is a rule about staying flat around earning releases. If you don’t, you won’t just lose the trade, you’ll lose your account.

All things considered . . .

SurgeTrader is a great choice for crypto and forex traders who can excel at risk management. If you do, and can stay away from the 5% drawdown, you’ll be rewarded with real capital, real fast. If you’re a safe trader, sign up with SurgeTrader and you could be funded within the week, maybe even sooner.

SurgeTrader Basics

SurgeTrader origin story

SurgeTrader was launched in September of 2021 by venture capitalist Jana Seaman after a fateful business dinner with a forex broker and institutional trader. The idea for SurgeTrader was born in order to fund traders who have great talent and strategies but lack sufficient capital.

Seaman is a well-known entrepreneur and philanthropist. Her venture-capital firm Valo Holdings provides the capital for SurgeTrader, runs Solas Wealth, a wealth-management company, and is also behind Seaman’s life-coaching business.

How does SurgeTrader work?

SurgeTrader is like most prop trading firms, with two notable exceptions: they only require you to pass one evaluation in order to receive a funded account and they have no minimum trading days.

That means you can sign up with SurgeTrader, hit your profit target in one day, and if you didn’t breach any of the trading rules, SurgeTrader will give you up to $1 million in capital in record time.

Once you become a funded trader, SurgeTrader will give you the amount of capital you initially signed up for. Unlike with a lot of prop trading firms, this will be real money and you will actually be in the market. You will keep 75% of your profits, or 90% if you purchased an add-on when you first signed up, and SurgeTrader will cover any losses. If you violate any of the trading rules, you will lose your funded trader account and have to start over at the evaluation.

SurgeTrader’s website trumpets the two simple “hard rules” that you must abide by, but there are actually three. Violate any one of them, and you will fail your evaluation or lose your funded account. Here’s the rules: Don’t lose enough that you violate either the 4% daily loss limit or the 5% overall max trailing drawdown. The third rule only applies to those trading shares: you must be flat going into an earnings release.

There are also some “soft” rules. If you violate these rules you don’t lose your account, but the trade that’s in violation will be immediately closed. You have to close all positions going into the weekend, use a stop loss on every trade, and you can only trade a specified number of lots.

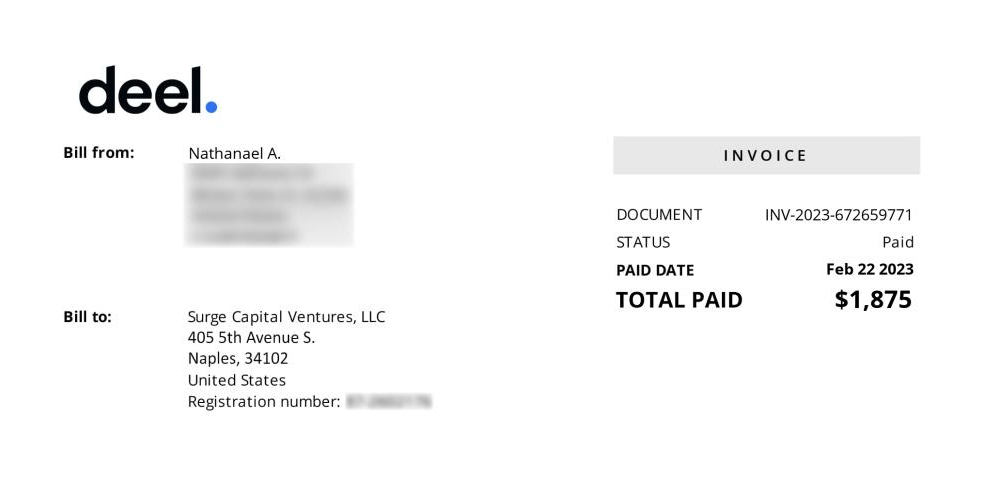

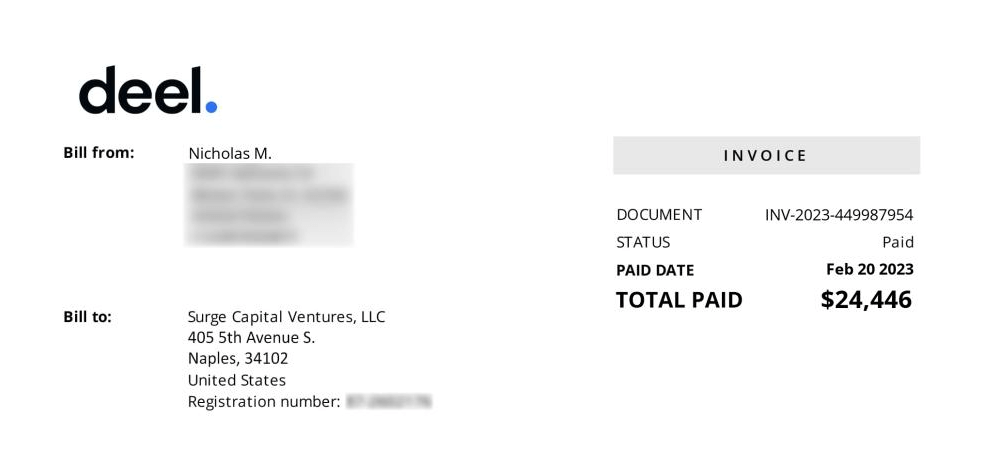

SurgeTrader payout proof

A lot of traders have posted screenshots of their incoming payments from SurgeTrader as proof of payout. You can find many of these on SurgeTrader’s Discord, but here’s a few recent screenshots of Deel invoices:

How much does SurgeTrader cost?

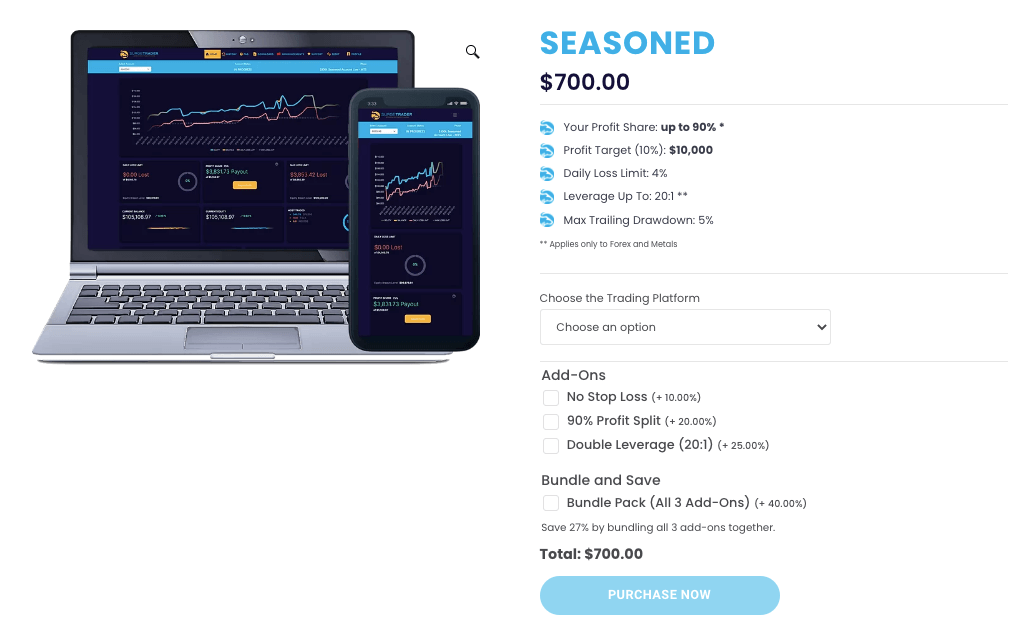

Unlike some other prop firms that offer more accounts than anyone could possibly need (looking at you My Forex Funds), SurgeTrader just has six account options. They do, however, offer some add-ons that can complicate pricing (see below).

| Account Size | Sign-up Fee |

| $25,000 | $250 |

| $50,000 | $400 |

| $100,000 | $700 |

| $250,000 | $1,800 |

| $500,000 | $3,500 |

| $1 million | $6,500 |

For an additional fee of 20% beyond the regular price, you can boost profit sharing to 90%, for an extra 25% you can double your leverage on most assets, and for another 10% you can eliminate mandatory stop losses. Or, if you want to bundle all three add-ons, you can add 40% to the prices.

My Assessment of SurgeTrader

My prop firm reviews are based on a pretty simple evaluation. I rate each prop firm according to seven critical factors and then average out the score. SurgeTrader scored well enough to make my Best Prop Trading Firms for 2023.

Profit splits: 8/10

SurgeTrader advertises “up to 90% profit splits,” but the “up to” is doing a lot of work in that claim. The only way you can actually get 90% profit splits is if you upgrade your account when you first sign up. That upgrade will cost you, of course—20% beyond regular prices.

Despite that, I still rate them 8/10 because the default rate of 75% is actually pretty good when you consider their evaluation is just one stage. Proprietary trading firms that offer instant funding never pay out more than 50%, and firms with typical two-stage evaluations pay out around 80%. Looking at it that way, I think 75% seems generous. SurgeTrader is taking on more risk by allowing such a simple evaluation, so they deserve more of the rewards.

Scaling opportunities: 6/10

SurgeTrader’s scaling plan makes scaling pretty difficult for profitable traders. Here’s how it works: Once you pass your audition, you can accept your funded account in the amount you signed up for or go through the audition again to try to get to the next level. All the same rules apply as the first time you auditioned, so if you hit your drawdown and violate the trading rules, you’re not a funded trader and have to start all over again.

That means that if you pay for a $25,000 audition and pass, you would have to pass the audition five more times consecutively in order to scale that up to a $1 million account. In some sense that’s fair, after all you only paid for a $25K account, but other proprietary trading firms would allow you to begin trading with your $25K account, take out your percentage of profits and scale you up if you kept hitting your targets.

Trade parameters/profit targets: 7/10

I like SurgeTrader’s trading rules for one reason: simplicity. A lot of prop firms make their rules intentionally complicated in order to trip up traders and close their accounts. Surge Trader doesn’t do that at all. For all accounts, the rules are the same: Don’t violate the daily loss limit or the max trailing drawdown.

Unfortunately, the daily loss limit and max trailing drawdown leave very little margin for error. The daily loss limit is set at 4% and the max trailing drawdown is currently at 5%. That’s about as stingy as it gets in the prop trading industry.

SurgeTrader can justify the tight parameters because they have only one evaluation stage. Yes, you’ll have to walk a more narrow tightrope with SurgeTrader, but you’ll have only half the distance to cross.

The 10% profit target is pretty close to industry standard. Some prop firms now require only an 8% profit but typically give you a limited time in order to hit your goal.

In many places on their website, SurgeTrader talks about their “two straightforward rules” that you have to be aware of, but there’s actually a third. The only other rule that constitutes a “hard breach,” meaning you’d lose your account if you break it, applies only to equity traders.

Traders cannot have an equity position going into an earnings release. It’s a pretty simple rule to keep on top of and only applies to certain traders, but I don’t like the fact that it’s hidden in SurgeTrader’s FAQ. As always, make sure you read all the fine print when signing up with a prop firm.

Affordability/value: 9/10

SurgeTrader is definitely on the expensive side, but still represents a good value when you consider how much less time you’ll spend being evaluated.

FTMO, the standard bearer, charges less than SurgeTrader, but requires you to pass two stages before you’re eligible for a funded trading account. With SurgeTrader, you’ll pay more, but depending on how you value your time, you’ll probably end up ahead.

Educational resources: 10/10

It is clear that SurgeTrader has dedicated significant resources to trader education, which is always a good sign of a prop trading company that is actually rooting for its traders’ success.

With downloadable e-books, such as “25 Rules for Becoming a Disciplined Trader” and “The 10 Commandments of Risk Management” you can get a great education just off their website. They also offer cheat sheets for different charting techniques, checklists to keep you organized, and monthly market outlooks. Even if you don’t ultimately sign up with SurgeTrader, going through their trading resources page will be well worth your time.

Beyond all that, SurgeTrader has also developed educational partnerships that focus on the forex market. Traders who sign up with SurgeTrader right now receive a 30-day free membership to BKForex, which offers live trading guidance, trade ideas, webinars, coaching, and much more.

Tradable assets: 10/10

SurgeTrader gives its traders access to more trading instruments than any other prop firm I’ve reviewed. What exactly you can trade varies on whether you use the MT4 or MT5 platform, but either way, you’ll have plenty of options.

I used MT5 and was overwhelmed with the choices. I could trade more than 600 stocks, oil, metals, 46 currency pairs, 17 indices (CFDs), and an insanely long list of cryptocurrencies. For crypto traders or traders who like to trade a little bit of everything, in my experience SurgeTrader has the most markets.

Trustworthiness: 8/10

SurgeTrader is still a pretty new proprietary trading firm, which normally gives me pause. Plenty of new prop firms stumble or fail in their first few years. I have a lot more confidence in SurgeTrader because of Jana Seaman, who founded Surge Capital Ventures LLC.

Seaman is a well-known leader in the Naples business community, an active philanthropist, and the very public face of SurgeTrader. I don’t believe she would risk her stellar reputation on a prop firm unless she knew she had the capital and staff in place to make it a success.

My overall rating: 8.3/10

I wish SurgeTrader would loosen their trading parameters a bit, but if you want a trustworthy prop firm, quick capital, the most tradable assets in the business, and great educational resources, start your prop trading career with SurgeTrader.

What Others Are Saying

TrustPilot

SurgeTrader has an “excellent” rating at TrustPilot. Of the 200+ reviews, nearly 80% have awarded SurgeTrader a full five stars. Most of these very satisfied traders were thrilled at the speed with which they were funded. Other five-star reviews listed great customer service and an easy payout process.

On the negative side, some traders expressed frustration with Eightcap, through which SurgeTrader runs its MT4 and MT5 trading platforms. Others complained about the tight trading parameters. Overall, however, traders reported very good experiences with SurgeTrader.

Google Business

I went through more than 100 SurgeTrader reviews on Google Business and could find only two that were negative. Overall SurgeTrader has a 4.9, which is as high as I’ve seen for a prop firm. Somehow they even have better reviews than their neighbor, Sails Restaurant (4.7), which serves some of the best seafood in all of Florida in my humble opinion.

As far as SurgeTrader goes, traders cite the simple trading rules and great customer service as the chief reasons for their overwhelmingly positive reviews. More than one trader called SurgeTrader the best prop firm they ever traded with.

It’s clear that SurgeTrader has a lot of support in the prop trading community and beyond.

SurgeTrader Frequently Asked Questions

Is SurgeTrader Legit?

Yes, SurgeTrader is a legit prop trading firm with substantial proof of profit payouts and a good overall reputation in the prop trading community. They’ve only been in business for two years, but they use an ASIC regulated broker and give real capital to traders who pass their trading audition.

People often question the legitimacy of prop trading companies because they sound too good to be true. Yes, there are companies out there that will give you their money to trade and then let you keep most of the profits. The catch? There’s three: you have to trade by their rules, you have to complete a trader evaluation first, and you have to pay a fee to take that evaluation.

Does SurgeTrader offer discounts or promo codes?

Yes, click here to access SurgeTrader’s 10% off coupon with the code EM10OFFSTX.

To check how this compares to other firms promos, visit my prop trader promo page.

What trading platforms can you use with SurgeTrader?

SurgeTrader offers MT4 and MT5 through Eightcap.

Can anyone join SurgeTrader?

SurgeTrader is open to anyone over the age 18, regardless of nationality.

Can Americans join SurgeTrader?

Yes, SurgeTrader is based in Florida and is open to Americans.

How do you pass the SurgeTrader Audition?

The SurgeTrader audition is a one-step evaluation designed to test your trading strategy and skills. You simply have to hit a 10% profit target without any time constraints or minimum trading days. You can pass the audition in one day or 100.

Of course, there are rules you have to abide by, or you will fail the audition. In general, SurgeTrader rules are much simpler than those of most other prop firms. The SurgeTrader rules are categorized as “hard” or “soft” rules.

Violate any of the three hard rules and you fail the audition. Here are the rules:

- Stay above the 4% daily loss limit. If your account dips 4% below your balance at the beginning of the trading day, your account is violated.

- Stay above the 5% overall max trailing drawdown. A 5% “trailing drawdown” means you can’t fall 5% below the highwater mark of your account. For example, if you have a $100,000 account, and trade it up to $104,000 (a 4% profit), your trailing drawdown is set at 5% of $104,000, which is $5,200. That sets your minimum account balance at $98,800. Fall below that mark, even though it’s less than a 2% loss on your opening balance, and you’ve failed the audition. The trailing drawdown is removed for traders that have a 5% profit or more. In those cases, your minimum account balance is simply your opening balance.

- Equity traders don’t trade around earnings releases. Anyone trading single-share equity CFDs must close their positions by 3:50 p.m. EST before aftermarket earnings releases, or the day before premarket earnings releases.

There are also three soft trading rules that you have to be aware of, even if breaching them won’t fail your audition. Stop losses are required for every trade (unless you pay extra to trade without them), you have to be flat over weekends, and your number of open lots can’t exceed 1/1000th the size of your account.

Violate any of these rules and the offending trade will be canceled. If you really can’t be bothered with stop losses, you can rid yourself of the requirement by paying an additional fee (10%) when you pay for the audition.

If you follow those rules and hit your 10% profit target, you’ll become a funded trader. SurgeTrader is known for their speed, and some traders have received their funded accounts within a few hours of passing the audition.

What can I trade with SurgeTrader?

SurgeTrader offers access to a staggering variety of assets, although exactly what assets you can trade depends on whether you sign up with MT4 or MT5. To give you an idea of how many assets you can trade, I counted what is offered with MT5—646 stocks, oil, gold, silver, platinum, 17 indices, 46 currency pairs, and 377 crypto options.

What types of accounts does SurgeTrader offer?

SurgeTrader offers six different accounts, these accounts vary only in size and price—all trading rules, available assets, profit splits, etc., are the same. Accounts start at $25,000 and go all the way up to $1 million.

Is SurgeTrader regulated?

Like most prop trading firms, SurgeTrader is not regulated because they aren’t broker/dealers and distribute only their own capital to traders.

Does SurgeTrader offer second chances?

If you violate one of the three rules that results in a hard breach of your account, you do not get a do-over, although SurgeTrader does offer a 20% discount for retries.

Soft breaches, such as forgetting to use a stop loss, results in your trade being closed, but your account is still open.

How do I get in contact with SurgeTrader?

SurgeTrader can be reached via their Discord channel, email: info@surgetrader.com, website chat , or by calling 1-866-998-0883 or 239-944-5317.

You can also reach them by mail:

405 5th Ave South

Naples, FL

34102

My SurgeTrader Review Summarized in Exactly Fifty Words

SurgeTrader has a really great reputation due to amazing trader support and educational resources, incredibly fast funding thanks to their one-step evaluation, and their wealth of tradable assets. If you can abide by tight trading parameters, start your trading career with SurgeTrader and you could be funded within the week.