Table of Contents

Overview

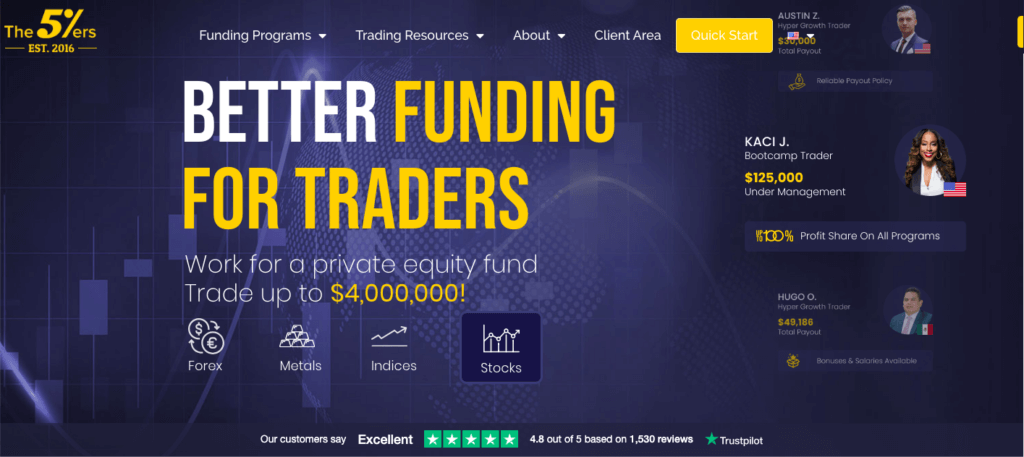

The 5%ers are a very popular, reputable proprietary trading firm famous for providing quick funding, rapid account scaling, great trader support and education. After what happened to MFF, don’t mess around sign up with the 5%ers, one of the few prop firms that I still trust.

Pros

- Best prop firm business model: The 5%ers does things by the book, unlike many other prop firms these days.

- Funded traders trade real capital from the 5%ers private equity fund.

- As a non-US based prop firm, there’s no fear that the 5%ers is not subject to US regulation and will not be shut down by the CFTC.

- Consistently profitable traders can scale up their payout percentage all the way up to 100%

- Offers accounts suitable for any level of trading experience from beginner to those ready for near-instant funding.

- With most accounts, you can double your account size every time you hit your profit targets, which is the best scaling plan in the business.

- Hyper Growth plan allows you to get paid out for profits made during the evaluation stage.

- The 5%ers offers very trader-friendly trading parameters. For example, most accounts don’t have a daily maximum loss.

- Very relaxed trading rules. Hold positions overnight, over the weekend, trade news, trade any style. EAs are allowed. Swing traders and scalpers are welcome. If you can make money as a trader, the 5%ers want you to start trading with them.

- One of the best trader support teams in the business offers access to daily trading rooms, webinars, educational videos and much more. The 5%ers even offer free courses in the psychology of trading and free one-on-one performance coaching.

- Profit payouts are easy. Unlike with other prop firms, you don’t have to jump through hoops to get what’s yours. Request a payout at any time, for any amount, and you’ll have it in a flash.

Cons

- Payouts can scale up to 100%, but start out around 75% for funded traders. That’s good by not great.

- Compared to other prop firms, the 5%ers offers relatively low leverage. Low risk accounts offer 1:10 and Aggressive Accounts offer a maximum of 30:1. No doubt this is due to the fact that the 5%ers use real capital.

- In addition to forex, only offers metals and indices. No shares, crypto, or futures.

Current promotion

- The 5%ers is generously offering my readers 5% off if you follow this link.

Program highlights

- Three different account types: Hyper Growth, High Stakes, and Bootcamp

- Bootcamp: Partial payment at sign up; pay the rest when/if funded

- Reach up to 100% profit splits

- Hyper Growth: One-step evaluation with 10% profit targets

- High Stakes: Full refund of signup fee once funded

- Scale up to $4 million

Who should sign up with the 5%ers?

If you love the prop firm concept but are worried about recent prop failures, don’t hesitate to sign up with the 5%ers. They have a unique business structure that allows funded traders to trade real capital for their private equity firm. Beyond that, they’ve been the business forever and have a stellar reputation.

The 5%ers also has different programs for different trader experience levels, so whether you’re a novice or a pro, you’ll find the perfect account.

If you need funding immediately, the Hyper Growth program is one-step program with no minimum days or minimum number of trades. Bootcamp is a great place for beginning traders to learn the ropes, and High Stakes is typical two-step evaluation program.

If you want to become a funded trader with a firm that’s trustworthy and won’t change the rules on you at the last minute or try to erect barriers between you and your profits, you can trust the 5%ers.

Who should NOT sign up with the 5%ers?

The 5%ers only trades forex, metals and indices, so, obviously, if you want to trade other financial instruments, you need to look elsewhere. They expanded their tradable assets in the past year, and could very well continue to do so.

The 5%ers also typically doesn’t offer very high margin, but their High Stakes program does offer 1:100.

If you prefer trading with demo accounts and not real capital once you are funded, you should also look at other funded trader programs.

All things considered . . .

The 5%ers deservedly own the best reputation amongst prop firms that offer quick funding. They are reliable and supportive and they practically throw capital at profitable traders. Jumpstart your funded trading journey by signing up with a great prop firm.

The 5%ers Basics

The 5%ers origin story

The 5%ers opened for business in 2016. The firm was founded by two professional forex traders who found themselves groveling for trading capital despite successful strategies. They turned their frustrations into a business that would give talented traders worldwide the opportunity to trade with sufficient capital.

How does the 5%ers work?

As you sign up with the 5%ers, you have to choose between the Hyper Growth, High Stakes, and Bootcamp accounts. Once you pass the evaluation phase(s), you are given real capital. You’ll then receive the lion’s share of any profits you make, and the 5%ers will be responsible for any losses.

Here’s a quick breakdown of the different accounts:

Bootcamp

Bootcamp is the 5%ers three-step evaluation program for beginning prop traders.

One of the reasons it is so great for new traders is that you only have to put down a certain percentage of the price when you start. For example, for a $100K account, you only have to put down $95. If you fail the evaluation, that is all you’ll pay. If you succeed, you pay the other $205. That’s a great way to get your feet wet without too much at stake.

A $100K Bootcamp account actually starts you off with $25K for the first phase of your evaluation. You have to hit a modest 6% profit target with a 5% max loss for all phases. Once you hit your target, you’re bumped up to $50K for phase 2, $75K for phase 3, and you get $100K in real capital to trade.

Once you are funded, the scaling is incredible. Every time you hit your profit target, your account grows by 25% — all the way up to a maximum of $4 million. If you make it beyond $2.5 million, the 5%ers will reward you for your outstanding trading with 100% profit splits.

High Stakes Challenge

The 5%ers High Stakes Challenge is a more typical two-step evaluation program. The obtainable profit targets start at just 8% for phase 1 and drop to only 5% for phase 2. The max loss is set at industry-standard 10%, and the max daily loss is 5%.

You have unlimited time to hit your profit targets, but you do have to have a minimum of three profitable days to pass your evaluation. Once you pass the first step of the evaluation, you’re eligible for a little bonus – $95 for a $100K account. Once you pass the second step, you get a refund of your evaluation fee.

The High Stakes program offers 1:100 leverage, and also features a great scaling plan. Hit that 10% profit target with three or more profitable trading days, and you’ll grow your account by 25%. Scale up to the $350K mark and you’ll be getting 100% of your profits, plus a $4,000/month salary. You won’t find better than that.

Hyper Growth

The Hyper Growth program is the 5%ers quickest path to funding. You can pass the one-step evaluation by hitting a 10% profit target. The stop out level (max loss) is set at 6% and there’s a 3% “daily pause” — if you lose 3% in a day, you don’t lose the account, it is just frozen for the rest of the trading day.

The Hyper Growth program features some of the most aggressive scaling in the industry. Every time you hit your profit mark, your account is doubled. Yes, doubled — all the way up to $4 million.

Payouts jump up to 100% once you pass the $1.28 million mark, which happens in just five steps if you open a $40K account.

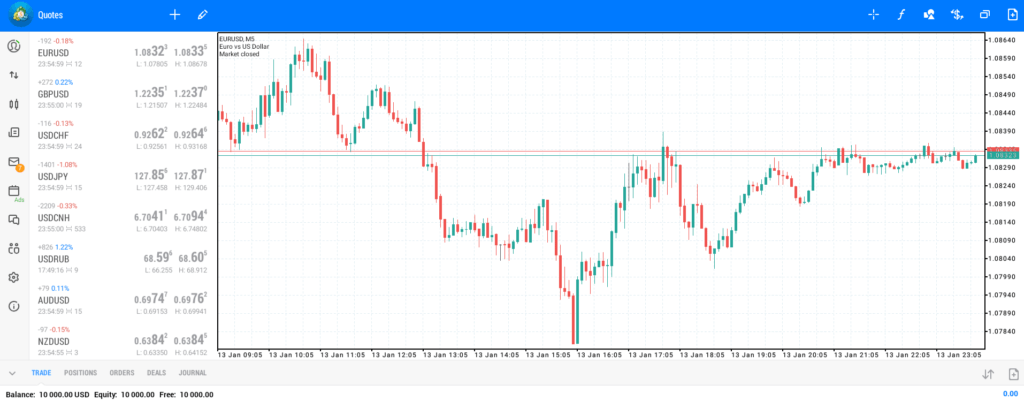

What trading platform does the 5%ers use?

The 5%ers exclusively uses MT5 Hedge from Metaquotes at this time.

How much does the 5%ers cost?

The 5%ers charge a one-time fee, which is refundable with some accounts. For Bootcamp accounts, you are only responsible for a partial payment to start. The balance is not due until you become a funded trader. Use this link for an exclusive 5% discount if you decide to sign up!

Boot Camp

| Account Size | Upfront Cost | Balance payable if/when funded |

| $100,000 | $95 | $205 |

| $250,000 | $225 | $350 |

High Stakes Challenge

| Account Size | Refundable Fee |

| $5,000 | $39 |

| $20,000 | $165 |

| $60,000 | $300 |

| $100,000 | $495 |

| Account Size | One Time Fee |

| $10,000 | $260 |

| $20,000 | $450 |

| $40,000 | $850 |

My Assessment

When rating prop trading companies, I take the following seven factors into account. Every trader has their own specific priorities, but I think these represent, in broad terms, the best way to assess a prop trading company and whether they’re the right choice for you.

To see how the 5%ers compares to other prop firms, visit my Best Prop Firms of 2024 article.

Trustworthiness – 10/10

The 5%ers have been around long enough that they no longer have to prove themselves to anyone. They have instantly funded thousands of traders and paid out substantial profits. They are as legit as it gets and a major player in the growing world of prop trading.

Their unique business structure – funded traders become contractors for their private equity fund – makes them one of the safest prop firms in the world.

Scaling opportunities – 10/10

The 5%ers goal is to get as much money into the hands of deserving traders as they can. If you can prove you have the trading skills to make them money, they will give it to you as quickly as any prop firm out there.

Different accounts offer different scaling opportunities, but they are all great. They Hyper Growth program actually doubles your account size every time you hit your objectives.

Trade parameters/profit targets – 9/10

The 5%ers deserve a lot of credit for the simplicity of their trading objectives. So many prop firms try to confuse traders with difficult drawdown calculations and other confusing parameters. This is the biggest complaint I receive about other prop trading firms. Traders lose their accounts after violating rules they never fully understood because their firm made things intentionally opaque.

Different accounts offer different parameters, but they are all quite trader-friendly. For many accounts there is now maximum daily loss. Instead, there’s a “daily pause,” that shuts you out of the market until the end of the trading day if you’ve had a rough session.

Affordability/value – 8/10

The 5%ers funded trader program is about middle of the pack in terms of pricing. There are a few cheaper options, but not from prop firms that offer such quick funding with real capital.

If you’re really on a budget and interested in learning prop trading with a low-risk evaluation program, the 5%ers Bootcamp is just $95 to start. Only if you pass are you responsible for the remainder of the fee (see above).

Trader support/educational resources – 10/10

The 5%ers goes to great lengths to make sure you are in the best position to succeed.

That means they’ve made a substantial investment in trader education and trader support. They offer one-on-one performance coaching, trader psychology courses, access to their trading room, and an enormous amount of other educational resources. All free to their traders.

Tradable assets/permitted styles – 9/10

The 5%ers don’t offer as many tradable assets as other prop firms like Lux Trading or FTMO, but they do seem to be adding assets. In the past year, they went from forex only to also offering metals and indices. Forex is still their main specialty as they offer all the major currency pairs plus all major crosses. If you want to trade shares or crypto, you’ll have to find another prop firm.

Where the 5%ers score big points is in the permitted trading styles department. As mentioned above, if you can make money doing it, you can trade in whatever style you please.

Profit splits – 8/10

The 5%ers is famous for offering 100% profit splits. That’s obviously awesome, but the truth is, the 100% split doesn’t happen until you’ve made the 5%ers a lot of money with your trading prowess. It is more of a reward, albeit a great one.

Typically you’ll be making 75% – 85%, which is middle of the pack in terms of prop firms.

My overall rating – 9.1/10

If you want to go the instant funding route, the 5%ers is the best choice. They are clearly committed to their traders’ success and try to make your route to substantial capital and substantial profits as simple as possible.

What Others Are Saying

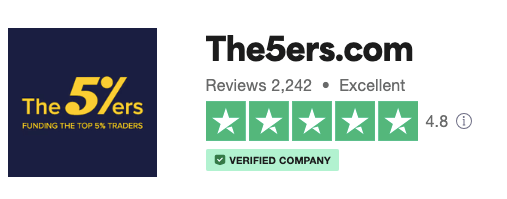

TrustPilot

TrustPilot gives the 5%ers an “excellent” rating. With more than 2,200 reviews, their average rating is an impressive 4.8/5. More than 85% of traders have given them the full five stars.

Reviewers rave about how easy it was to request payouts and how quickly they got them. Others love the scaling plan and just about everyone mentions the phenomenal trader support and online resources.

Older reviews feature complaints that the 4% stop out was too small a margin for error, but the 5%ers changed upped the stop out to 6% for almost all accounts, which lead to a definite uptick in trader satisfaction. All in all, TrustPilot users are very content with their experiences with the 5%ers.

The 5%ers has an average score of 5/5 on Facebook with more than 1,500 reviews. They have a strong facebook presence with daily updates, responses to trader queries, invitations to webinars and more than 47,000 likes and followers.

They also have a very active community of more than 5,000 traders called “The 5%ers Trader Support Group.” It includes both official responses from the company and from experienced traders. They discuss everything from the successful trades they’ve made to recommendations for a good signal provider, as well as trading ideas and a random Star Wars vs Star Trek digression every now and again. Other than the latter, it’s an incredibly useful forum.

Overall

Like with many prop firms, it’s hard to find a centralized source of trader feedback. Reviews of the 5%ers are everywhere, including YouTube, which has many trader success stories, a few traders who detail why they failed, and someone who apparently trades from her houseboat. To each their own.

Wherever you find reviews for the 5%ers, you’ll find contented traders who are happy they entrusted their time and resources to a prop trading firm that aggressively funds and supports them.

Frequently Asked Questions

Are the 5%ers legit?

Yes, they are one of the most trustworthy funded trader program in the world. The 5%ers have been in business since 2016 and have funded and paid out thousands of traders in that time.

Do the 5%ers offer discounts or promo codes?

Yes, for a limited time my readers can get 5% off by following this link.

Can anyone join the 5%ers? Can Americans join the 5%ers?

Yes, the 5%ers is open to everyone, Americans included, who are over the age of 18.

What is up with the name? Is it 5ers, 5%ers, or 5 ers?

It is definitely 5%ers, although apparently the % sign doesn’t work in a url, hence their website is the5ers.com. There’s also a lot of reviewers and clients who are simply too lazy to search for the % sign on their keyboards, so a lot of them just write the 5 ers. In a google search it all gets you to the same place, so feel free to ignore that pesky % sign.

What is the 5%ers Bootcamp?

The new 5%ers Bootcamp seems designed to compete with the FTMO Challenge. Bootcamp is also a trading challenge conducted entirely using a demo account, but there are some key differences. The 5%ers trading challenge consists of three phases rather than two and only costs $95 to join.

It’s a low-cost, low-risk evaluation program that could be a great entrance into the world of prop firms for beginner traders.

How do you pass the 5%ers Bootcamp?

To pass the 5%ers Bootcamp, you need to prove your trading abilities by hitting 6% profit targets with increasingly higher amounts of capital.

You can complete a stage as quickly as possible with no minimum days, but you have to complete all three stages within one year. In the first stage of the $100K account you have $25K, which is doubled to $50K for the second stage. The final stage begins with a $75K account. Pass that and your account is funded to the full $100K

The rules are pretty simple. Hit your profit target without letting your account dip 5% below your starting balance. You are allowed to hold your positions overnight and over weekends, and you can also trade news releases.

The one other rule that makes the Bootcamp truly challenging is that a stop-loss is required in all trades and positions. Your stop-losses must be set so that you are not risking more than 1% in any given position.

That would be a difficult task even for professional forex traders, but considering how cheap it is and how much you stand to win (a funded account for $100,000 or $200,000) it definitely seems worth a try.

What can I trade with the 5%ers?

Forex: All major currency pairs and all major crosses. Metals: Gold & SIlver. Indices: NAS100, US30, DAX30, UK100, JPN 225. This list has expanded over the past year, and may continue to do so. I’ll keep this section updated.

What types of accounts do the 5%ers offer?

The 5%ers offers three different types of accounts, designed for any experience level of trader. The Bootcamp is for beginners, while the Hyper Growth account and the High Stakes Challenge are both designed for more experienced traders.

The Bootcamp is a three-stage evaluation program, Hyper Growth is just one stage and the High Stakes is a typical two-stage program.

Does the 5%ers offer swap-free accounts?

No, the 5%ers does not offer swap-free accounts at this time. Should that change, I will update this section.

Is the 5%ers regulated?

No. Like most prop firms, the 5%ers are not forex brokers, and when you become a funded trader you will be trading their private money. That means that they are not subject to any financial regulatory bodies.

If I violate the trading objectives do I get a second chance?

No, the 5%ers do not offer resets at this time.

How do I contact the 5%ers?

To sign up for an account, visit them here. The 5%ers are very responsive to questions posted in their Facebook group page. They also have a chat function on their website, or you can email help@the5ers.com, or phone them at their US number +1(929) 955 5595 or their UK number +44(20) 8068 0793.

My Review of the 5%ers Summarized in Exactly Forty Words

If you are seeking quick funding, the 5%ers are your most trustworthy option. They’re completely dedicated to your success and offer the quickest access to a mountain of capital. Sign up with the 5%ers today and sign up with a great firm.

Further Reading

More full prop trading firm reviews: FTMO, Lux Trading, Topstep Futures, Blufx, Fidelcrest.

Best of’s: Best Prop Firms of 2024, Best Prop Firms for Stocks, Best Prop Firms for Beginners, Best Prop Firms for Forex

The 5ers do not have a stop loss rule on any of their accounts now. It was removed last year.

You’re right, thank you! Although they still require stop losses in their Bootcamp Program, it was removed from all the instant funding accounts.The article has been updated and I appreciate the correction.