Table of Contents

Overview

Topstep is the premier funded trading program for futures traders. They fund thousands of traders a month thanks to their great profit splits, trading options, educational resources and special offer of 70% off.

Topstep is my favorite prop firm for trading futures, and my best overall prop firm for 2024.

Pros

- A current 70% off promotion makes Topstep an absolutely incredible bargain. Prices now start at just $49/month. Topstep fees go away once you become a funded trader.

- Payouts are outstanding. Depending on which account you choose, you can keep 100% of either your first $5,000 in profits or 100% of your first $10,000 in profits. After that, you still keep a whopping 90%.

- One-step evaluation. Topstep significantly streamlined their evaluation process this past year. You can conceivably get funded in just two days.

- Only one rule. Topstep has only one hard rule — the max overall drawdown. You simply have to keep your account above the minimum balance. No hidden rules.

- Respected prop firm with ten years in the business and millions of dollars of trader withdrawals.

- Passing the Trading Combine isn’t easy, but it is definitely achievable. Topstep funds thousands of traders a month.

- Topstep knows the futures market inside and out. Topstep traders trade an average of more than 5,000 contracts per day.

- No timetable/deadline to meet your profit targets.

- Incredible amount of training and educational resources available, including the newly launched TopStepTV, which is broadcast every trading day and includes a wealth of trade ideas, information and real time reactions to the market.

Cons

- It is easy to get confused about the differences between the Express Funded Account and the Live Funded Account. Luckily, Topstep has a world class customer support team to help clear things up.

- For funded accounts, you must have five (not necessarily consecutive) “winning days” (in which you profited more than $200) before you can request a withdrawal of your profits.

- When you become a funded trader, you are no longer responsible for Topstep’s monthly fee, but if you choose a “Live Funded Account” you have to pay exchange data fees via a monthly subscription.

Program highlights

- Keep 100% of the first $10K in profits; 90% after that

- Complete evaluation steps in as few as 2 trading days

- Unlimited time to meet your profit target

- For $50K evaluation: 6% profit target, $2,000 trailing max drawdown, $1,000 daily loss limit

- Monthly costs start at $49 with promo code below

Current promotion

Who should sign up with Topstep?

If you’re a futures trader who just needs access to capital to maximize your profits, Topstep offers funded futures accounts with up to $150,000 worth of buying power for a currently discounted monthly fee.

New futures traders in particular can benefit from Topstep’s trading tools, performance coaches, a very active trading community, and a vast array of educational materials.

If you want to sign up with the best funded trader program for trading futures, sign up with Topstep. No one does futures better.

Who should NOT sign up with Topstep?

If futures trading is not your forte, you should find a prop firm that offers direct access to the forex market. Other prop firms offer a lot more options, including stocks, crypto, and other assets.

If you prefer one-time fees rather than making a monthly payment to your prop firm, you should also look elsewhere. Topstep allows you as much time as you need to pass their evaluation, but you’ll make a monthly payment until you’ve become a funded trader. If you do that within a few months, you’ve made a great deal.

Since Topstep is based in the US, it legally cannot do business with citizens of countries that are being sanctioned by the US Department of the Treasury through their Office of Foreign Assets Control (OFAC). If you are a citizen of one of the countries on OFAC’s surprisingly long list, you’ll have to find a prop firm not based in the US.

All things considered . . .

Topstep is one of the best funded trading programs in the world. They allow trading on more than 35 different futures contracts, have great educational resources, fantastic profit splits, and a low, currently discounted monthly rate.

Topstep Basics

Topstep origin story

Topstep has been in the prop trading game for more than ten years, which is an eternity in this business. You don’t stay in the prop trading business for so long without earning traders’ trust.

Topstep was founded by Michael Patak, trader who lost a small fortune in the futures market and decided to create a business that would allow other futures traders a chance to trade significant capital without risking their life savings like he did.

Fast forward ten years, and Topstep has educated and funded thousands of traders from all over the world.

How does Topstep Futures work?

Topstep Futures awards funded accounts just like most prop firms, although the extra account options after you pass the Trading Combine can make things a little confusing.

In order to get started with Topstep, you have to select one of three account sizes based on how much buying power you want and how much you’re willing to spend in monthly fees.

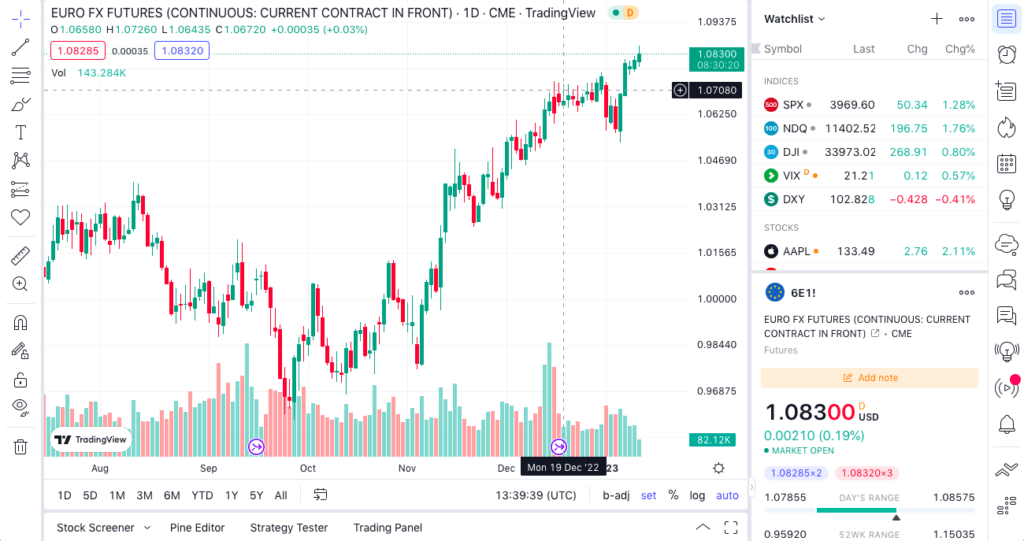

After you’ve registered, you will integrate your Topstep account with one of their available trading platforms, such as TradingView, pictured below. Then you’ll begin the Trading Combine in order to prove to Topstep that you can make consistent profits without taking on too much risk. You have as much time as you need to hit your profit target, but you have to trade for at least two days.

The current profit target is 6% of the buying power you selected. That means for a $50,000 account you need to make $3,000, which is definitely doable. Of course, you’re also confined by trading parameters designed to limit risk. You are only allowed to have five open contracts at a time, and your trailing max drawdown is set at $2,000. These limits are, of course, higher with higher account sizes.

For the longest time, Topstep required you to pass two steps to get funded, but they have significantly streamlined things. Now, if you hit your target in Step 1 you become a funded trader immediately. The only speedbump is that there is a consistency target — you can’t have accumulated more than 50% of your profits in one day. So you can’t move on after just one great day. You need to spread out your profits over two or more days to get funded.

Once you’ve become a funded trader, you have two choices. You can opt for an Express Funded Account or a Live Funded Account. An Express Funded Account is with simulated funds like in the Trading Combine. A Live Funded Account is the real deal – real capital on the real exchange. The downside of the Live account is that you have to pay monthly data subscription fees to the exchange on which you’ll be trading. An Express account has a one-time activation fee ($149) and that’s it.

Funded traders still have to keep within the trading guidelines set for the Trading Combine to maintain their funded account, but as you accumulate profits you can trade more and more contracts.

How much does Topstep cost?

Topstep charges monthly fees for as long as you are competing in the Trading Combine, but those go away after you’ve graduated to a funded level account.

Those who opt for a Live Funded Account become responsible for professional data subscription fees, however, which vary in cost depending on your platform and the exchange, but will be somewhere between $100–$150 per month. Traders who opt for an Express account pay $149 set up fee, but do not pay anything beyond that.

Trading Combine fees:

| Account Size (Buying Power) | Monthly Fee* | Monthly Fee* with Current Discount |

| $50,000 | $165 | $49 |

| $100,000 | $325 | $99 |

| $150,000 | $375 | $149 |

| Account Size (Buying Power) | $50,000 |

| Monthly Fee* | $165 |

| Monthly Fee* with Current Discount | $49 |

| Account Size (Buying Power) | $100,000 |

| Monthly Fee* | $325 |

| Monthly Fee* with Current Discount | $99 |

| Account Size (Buying Power) | $150,000 |

| Monthly Fee* | $375 |

| Monthly Fee* with Current Discount | $149 |

My Assessment/Methodology

I assess prop trading firms based on the following criteria. Topstep ranks very highly in all seven categories and was a clear winner in best funded trading account for futures. To see how Topstep compares to other leading prop trading firms, read my Best Prop Firms of 2024 article.

Profit splits – 10/10

Topstep is as generous as it gets when it comes to profit splitting. After you become a funded trader, you keep your first $10,000 in profits and 90% after that. No one in the industry is as generous.

Scaling opportunities – 6/10

The Topstep scaling plan is a little different than what you’d find at typical prop trading firms like FTMO. Most firms increase your trading capital by a certain percentage after you’ve met profit targets, but Topstep scales your account by increasing your buying power based on your account balance.

Bottom line, you still get increased buying power if you are a profitable trader, but with Topstep, that increased buying power comes as a result of further leveraging the profits you keep in your account, not because Topstep is increasing your funding.

Trade parameters/profit targets – 8/10

The sheer number of traders that pass the Trading Combine each year is evidence that Topstep sets achievable trading parameters and profit targets.

Profit targets are set at 6% of the buying power of the trading combine account you choose. So if you sign up for the $50,000 account, you have to profit $3,000 before you can move on to a funded account. Most other prop firms have a 10% profit goal, and many of them will put you on a clock. With Topstep, you just have to hit your 6% mark, and you have as much time as you need to get there.

Continuing to use the $50K account as an example, the trailing max drawdown is $2,000, which is a little tight, but pretty reasonable. Of course the loss limits and max drawdowns are substantially higher if you select the accounts with more buying power.

Affordability/value – 10/10

I awarded Topstep a perfect score based on their current 70% off promotion. With the promo, you can start the Trading Combine with $50,000 of buying power for just $49/month. When you consider all the resources available to you once you join Topstep, that’s a really great value. If the promo goes away, I’ll update their score.

Educational resources – 10/10

This is where Topstep really excels. Their educational resources are widely regarded in the futures industry, and a key reason why they get good reviews even from those who didn’t pass the Trading Combine. Whether you succeed or fail, you will come out of your Topstep experience as a better trader.

Topstep offers training through multiple platforms, so there’s a program designed for you no matter what your preferred method of learning. Topstep offers a digital trading trainer, affectionately known as “Coach T,” group training sessions, dozens of instructional videos, a frequent podcast, an active trading community, blog posts, live market prep sessions and written instructions.

Their latest educational resource, TopstepTV is probably their best. Every trading day, you can join senior Topstep traders while they assess the market in real time, offer trading ideas, tips, and a little entertainment as well. It is as close as remote prop traders can come to actually being on a trading floor. It’s brilliant. Even if you don’t decide to trade with Topstep, check out TopstepTV. I guarantee you’ll learn something.

If none of that puts you over the top, you can also (for a fee) get one-on-one instruction from one of their incredibly knowledgeable trading coaches.

Tradable assets – 10/10

For the purposes of this review, I’m judging Topstep based on the variety of futures contracts they offer. No funded futures trading account offers more CME contracts. You can currently trade 37 different futures contracts in categories such as oil and gas, metals, agriculture, interest rates, foreign exchange, and equities.

Trustworthiness – 10/10

Topstep has funded traders for more than 10 years and you can find numerous proofs of profit online. This is no fly-by-night prop shop. Topstep is funding more than 10,000 accounts a month thanks to their current promotion. They are as legitimate as it gets.

My overall rating – 9.1/10

Topstep earned a lot of perfect scores, which isn’t a surprise considering their longevity and reputation in the industry. There’s no such thing as a perfect prop shop, and I wish they’d offer better scaling opportunities, but if you want to trade futures, you won’t find a better prop trading firm, especially at these prices.

What Others Are Saying

TrustPilot

Topstep has an “Excellent” rating at TrustPilot with an average review score of 4.5 stars. What jumps out at me about Topstep’s rating is that they have well over two thousand reviews, which speaks both to their popularity and to the accuracy of their reviews. A lot of prop firms have only a hundred or so TrustPilot reviews, meaning the scores are much easier to manipulate. Topstep has enough trader reviews that we can be confident their “Excellent” rating is legit.

Traders had nothing but good things to say about the Topstep educational programs, with a lot of compliments along the lines of “I’m a 10x better trader thanks to Topstep!” The customer service staff is also universally praised.

Google Business

Google has Topstep rated a 3.9 out of 5, with 64 reviews. Most five-star reviews credited the Topstep trading environment and community with helping them learn trading discipline and connecting with other traders.

Critics expressed frustration with their trading platforms. Topstep offers more trading platform options than any other prop firm I cover, so there are lots of alternatives should you not like your trading platform.

Topstep must have disabled the rating function on their Facebook page, so there’s no trader feedback to be found, but their page does have more than 34,000 likes, for whatever that’s worth.

It is worth noting that there are several Topstep community groups, one of which has over 10,000 members exchanging general trading tips and tricks for passing the Trading Combine. This type of online support community is a huge advantage and not something you will find with the smaller prop shops.

You can also find Topstep apparel on their Facebook page, which is a first for me. I know funded traders become loyal to their prop firms, but to be so loyal that you’d wear a beanie with their logo is a whole different level of devotion.

Overall

You’re never going to find a funded trading program with perfect reviews. There will always be some traders who don’t make it to the funded trader stage and a handful of them always blame the firm. That said, Topstep’s reviews are generally very good. Those who have made it to the funded trader program are effusive in their praise and extremely loyal to Topstep.

Frequently Asked Questions

Is Topstep legit?

Topstep is as legitimate as it gets. They’ve been in the prop trading business for a decade. They have thousands of funded traders and they’ve paid out millions in profits.

Topstep is based in Chicago, just a few stops on the L away from the Chicago Board of Trade and a stroll across the river from the Chicago Mercantile Exchange. They’ve become a fixture in the Chicago futures trading community.

Does Topstep offer discounts or promo codes?

Topstep does offer great promotions from time to time, but none better than the 70% off you can claim now by following this link.

Can anyone join Topstep?

Topstep is based in Chicago, so they are subject to the rules of the US Department of Treasury. That means they cannot conduct business with citizens of countries that face US economic sanctions. The Office of Financial Assets Control maintains the list of prohibited countries. Anyone else over the age of 18 is welcome to join.

What is the Topstep Trading Combine?

The Topstep Trading Combine is the one-step evaluation process that you must pass to get your trading account funded. After you select an account size, you will trade with a simulated account in order to test both your trading skills and risk management capabilities. The Trading Combine takes a minimum of eight days to complete, but often can take quite a bit longer depending on how quickly you meet profit requirements.

The Trading Combine exists because Topstep wants to make sure you are a successful, serious trader before they entrust you with real capital.

How do you pass the Trading Combine?

The Trading Combine has gone from a two-step evaluation to a one-step evaluation, much to traders’ delight. You only have to meet your 6% profit target once, although there is a small catch. You won’t pass your Combine unless you spread those profits out over two days or more. You can’t just have one great day trading and move on. You have to show a level of consistency in your trading to become funded.

Since Topstep gives you unlimited time to hit your profit target, passing the Trading Combine is more of a test of your ability to follow rules and manage risk than a test of your trading skills.

The only rule you have to watch out for is your max drawdown. A violation will either cost you your account or force you to hit the reset button.

Here’s how the max drawdown works. Using the $50,000 account as an example, your trailing max drawdown is $2,000. Topstep advises that you think of the max drawdown as a minimum account balance. That means you start with a minimum account balance of $48,000. For the sake of the Trading Combine, the trailing max drawdown is calculated at the end of the trading day, meaning you can dip below $48,000 so long as you finish the trading day above.

The trailing max drawdown is a moving target, however. If you make a profit during your first day of $1,000, you start the second day with $51,000 in your account. Your trailing max drawdown of $2,000 means your new minimum account balance is $49,000, and it will stay there even if you lose money on subsequent trading days.

If you continue to profit, however, your minimum account balance will not rise above your opening balance of $50,000. So if you make $3,000 in profits, your balance is $53,000 and your minimum account balance stays at $50,000. You’ve basically raised your trailing max drawdown to $3,000.

Beyond that, there are some “soft” rules you have to keep in mind. Violations will give you a pause, meaning you can’t trade for the rest of that trading day. They will not cost you your account, just put you on the sidelines for a bit.

The first of these is the daily drawdown. The daily drawdown is set at 2%. Lose 2% in a given day, and you’ll have to try your luck tomorrow.

You also have to be conscious of when you are allowed to trade certain products because Topstep has certain times that are prohibited for trading. All positions must be closed every day by 3:10pm CST. Sunday through Thursday you can resume trading at 5 p.m. CST. You have to be flat over weekends. There are also certain limits around holiday trading, so you have to be sure to stay on top of the calendar.

Finally, you have to be wary of your maximum position size. For the $50,000 account your maximum position size is five contracts, so you can’t have more than five open positions at any time. For example, you’d hit your limit if you were long three crude oils and short two E-mini S&P.

Follow these rules, hit your 6% target and congratulations, you can join the ranks of Topstep’s funded traders.

What can I trade with Topstep Futures?

The Topstep Futures funded trader program allows you to trade various CME Equity Futures, CME Foreign Exchange Futures, CME Agricultural Futures, such as lean hogs and live cattle, CME NYMEX Futures for crude oil and natural gas, CME CBOT Agricultural Futures, such as corn, wheat, and soybeans, CME CBOT Financial/Interest Rate Futures, and CME COMEX futures for gold, silver, and copper.

What types of accounts does Topstep offer?

Topstep offers three choices when you sign up, based on the amount of buying power you prefer. You can choose accounts with $50K, $100K, or $150K. Obviously the more buying power you want, the more you will have to spend.

Currently the $50K account costs just $49 a month, down from $165 per month, so lock in that price and sign up with them here.

When you graduate to a funded trading account, you can choose between a Express Funded Account, which is still a simulated account but pays out in real money, or a Live Funded Account, which is the real deal.

The benefit of the Express Funded Account is that there’s a $149 activation fee and that’s it—no exchange fees or Topstep fees, plus you get to keep 100% of your first $10,000 in profits.

The Live Funded Account is no longer a simulated trading account. You enter the market with Topstep’s money as a professional trader. The drawback is that you have to join one or more of the futures exchanges, which will mean paying a monthly subscription.

Is Topstep regulated?

No. Like most prop firms, Topstep is not regulated. Since prop firms trade with their own money, do not seek funds to invest on others’ behalves, and don’t act as broker/dealers, they are not subject to US financial regulations. Topstep is also not required to register with the National Futures Association or the Commodity Futures Trading Commission.

If I violate the trading objectives do I get a second chance?

Yes, Topstep does offer a “reset” should you break the trading rules during the Trading Combine. The reset does come at a price, however. Depending on your account size, you’ll have to pay $89 or more to reset at the same level.

How do I get in contact with Topstep?

Topstep is renowned for their customer service and can be reached via email, Discord, and their website has a chat function available during business hours.

My Topstep Review Summarized in Exactly Forty Words

For futures traders who need extra capital to make their financial dreams come true, Topstep is your best bet. The best profit splits. The best trader education. Best customer service. Best futures offerings. And they’re currently offering the best deal.

Further Reading

More full prop trading firm reviews: FTMO, Lux Trading, Fidelcrest, Blufx, The 5%ers.

Best of’s: Best Prop Firms of 2024, Best Prop Firms for Stocks, Best Prop Firms for Beginners, Prop firm promos and discounts.

I am looking into taking the Trading Combine. I have a few questions. I have seen places where you pay out 80%and places where you pay 90% after funding which is it? I have a lifetime Nija trader platform. I will be doing the 150,000 dollars Combine if I decide to do it. Do you have larger plans, if I get started and make consistent profit. I know how to trade, I trade only RTY. I think you could help me have greater discipline and could fund me to be able to reach a monthly goal of minimum of 20k a month. Looking forward to hearing back from you. Thanks Stan

Hi Stan, just wanted to clarify that I’m a trader who writes reviews, so you should send any questions directly to Topstep. I do know that they have increased their payout to 90% now for funded accounts, so I have to update this page. Thanks for bringing that to my attention and good luck with your trading! — Michael