Table of Contents

Overview

True Forex Funds is another new prop firm that has very quickly become a favorite among traders for a lot of good reasons. So far, I’ve also been very impressed, although recent issues with MetaQuotes have given me pause.

Pros

- Bi-weekly payouts: True Forex Funds gets your profit splits into your pocket way more quickly than other prop firms I’ve traded with.

- Simple rules: No complicated drawdown calculations. Just keep your account above 90% of your initial balance and 95% of your daily balance and you’re good.

- Tight spreads: I’ve found very little slippage when trading forex with TFF.

- Low profit targets: Evaluation requires only an 8% profit to move to Phase 2, and then a 5% profit to become a funded trader.

- Funding options: Open your account in either dollars, euros, or British pounds.

- Free retries: If you don’t violate the loss limits, but also don’t hit your profit targets, you’re entitled to a free retry.

- 24-hour support: Trader support is available 24 hours a day, Monday through Friday, and is very quick to respond in my experience.

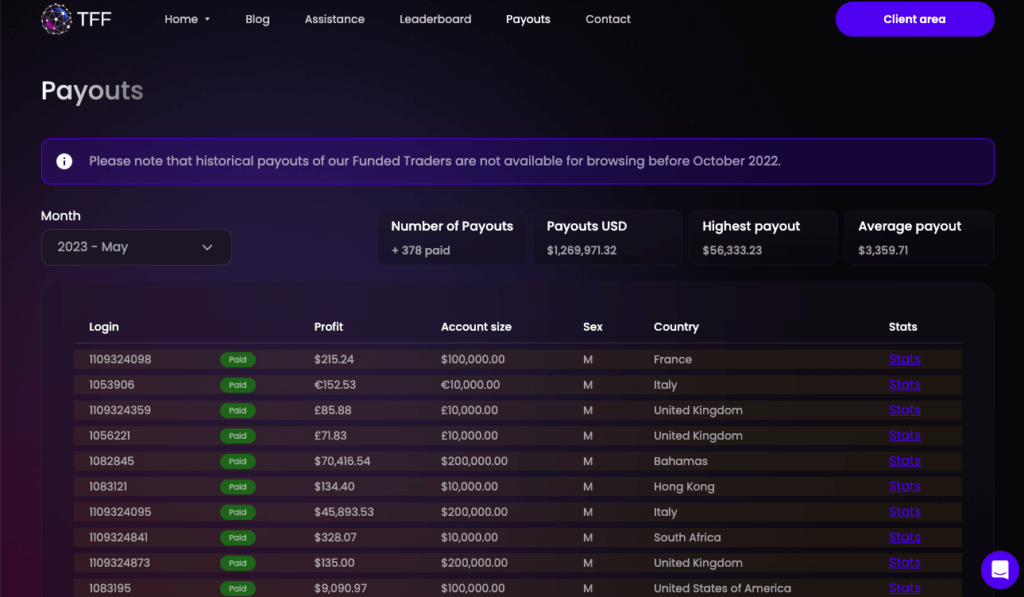

- Transparency: TFF reveals monthly payout statistics.

- News trading allowed: No restrictions on trading around news releases.

- Scaling opportunities: TFF will increase funding to profitable traders by 25% every 90 days up to $2.5 million.

Cons

- Suspension of service: Problems with MetaQuote, the maker of MT4 and MT5, has lead True Forex Funds to temporarily suspend operations in February 2024. They appear to be back to business as usual, however

- Time limits: Other prop firms are removing time limits, but TFF still requires you to hit profit targets within 30 days for Phase 1 and within 90 days for Phase 2.

- 80% profit splits: You can find up to 90% splits elsewhere, although usually with a lot more strings attached.

- New prop firm: TFF has only been around since 2021, making them a relative newcomer, albeit one with tons of verified payouts.

- Two-phase evaluation: TFF still requires you to pass two separate evaluations, although the objectives are quite easy.

Promo codes

- For other prop firm discounts, check out my page: prop firm discounts and promo codes

Steps to earning a funded account with True Forex Funds

True Forex Funds keeps their evaluation process refreshingly simple. There are no complicated drawdown calculations. To pass the two-phase evaluation and keep your account once you are funded, you simply have to maintain a balance above 90% of your initial account size, and 95% of your daily balance.

- Evaluation Phase 1: Hit a profit target of 8% within 30 days, without falling below 90% of your initial account balance or 95% of your balance from the beginning of the day. If you lose more than 5% on any given day or 10% overall, you’ve failed your evaluation.

- Evaluation Phase 2: For phase 2, your profit target falls to just 5% and you have 60 days to get there. The same loss limits apply as in Phase 1.

That’s it! Like I said, it is a really simple process. Once you become a funded trader, you are funded indefinitely, so long as you don’t breach the same 5% daily loss limit or 10% overall loss limit or violate any of the trading rules.

Funded traders who profit more than 8% in a three-month period are eligible to scale up their accounts by 25% until they reach a maximum account size of $400,000.

Other True Forex Funds program highlights

- Only five minimum trading days for Phase 1, and another five for Phase 2

- Available leverage:

- Forex, Metals, Energy and Indices – 1:100

- Cryptocurrencies – 1:5

- Stocks – 1:10

- Tradable assets: 40 currency pairs, 30 stocks, 28 cryptocurrencies, 13 equity indices, metals, energies, and “a variety of CFDs”

- Trading platforms: MT4, MT5 with cTrader coming soon

- Capital: Currently all accounts, including funded accounts, are demo accounts, but TFF has told me they’ll be transitioning funded accounts to real capital in the near future.

- Rollover and weekend trading: Both are permitted.

- Copy trading is permitted so long as it’s done between your own accounts.

- Prohibited trading strategies/actions (violation will result in account suspension):

- Changing your MetaTrader password

- Simultaneously opening opposite positions in separate accounts

- Account management

- Arbitrage bots

- Tick scalping

- Latency arbitrage

- Any EAs, robots, or strategies that “take advantage of MetaTrader’s inefficiencies”

Who should sign up with True Forex Funds?

If you appreciate the simple things in life and like a good bargain, TFF is your prop firm. They have very few trading rules, loss limits that don’t require a masters degree in mathematics to decipher, quick payouts, and obtainable profit targets. They also offer great scaling opportunities, and a lot of available assets for trading. All that for a very affordable, fully refundable sign-up fee.

Who should NOT sign up with True Forex Funds?

If you’re trying to game the system and make money off of the inefficiencies of various trading platforms, TFF will catch on pretty quick. They’re very savvy when it comes to tick scalping, etc.

Traders whose forex trading style involves trading exotic pairs should probably also look elsewhere.

Finally, those traders who are wary of younger prop firms, should seek out a more established firm—TFF has been around for less than two years.

All things considered . . .

If you aren’t biased against new prop firms, TFF is a great option. They offer some of the most trader-friendly terms of any prop firm I cover, and they’re very affordable. Sign up with TFF now to start your career with a prop firm that’s earned an outstanding reputation in a very short time.

True Forex Funds Basics

How does True Forex Funds work?

TFF is a typical prop trading firm with a two-phase evaluation. Choose your account size, sign up, and pay your sign-up fee. If you pass the evaluations by hitting your profit targets, staying above the loss limits and not violating any trading rules, you’ll become a funded trader and will be reimbursed for your initial fee.

Funded traders receive 80% of their profits and are not responsible for their losses, although they will lose their accounts if they exceed their loss limits.

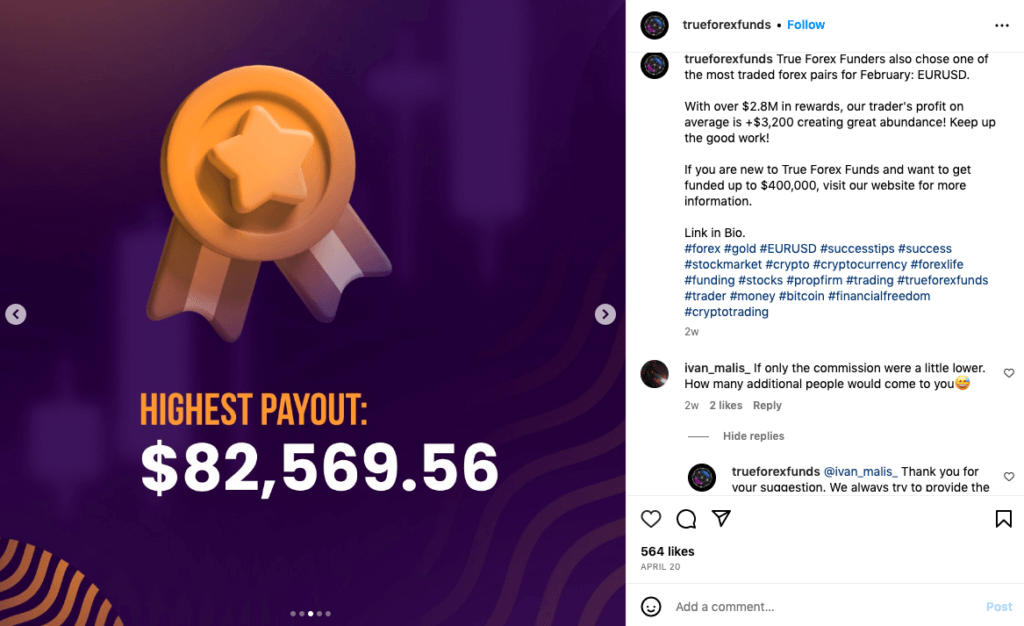

True Forex Funds proofs of payout

TFF is very transparent, and provides both real-time details of payouts they’ve made on their website, as well as monthly recaps on their Instagram.

How much does True Forex Funds cost?

True Forex Funds only charges a one-time sign-up fee, which is fully refunded once you pass. As far as prices go, TFF definitely is among the more affordable prop firms, especially for the smaller account sizes. To see how they compare to their peers, check out my prop firm full comparison.

| Account size | Refundable one-time fee |

| $10,000 | €89 |

| $25,000 | €189 |

| $50,000 | €299 |

| $100,000 | €499 |

| $200,000 | €998 |

Which trading platforms does True Forex Funds use?

Currently, TFF uses only MT4 and MT5, although their website offers you the chance to sign up for a waiting list to join cTrader. Honestly I don’t remember when the waiting list first appeared on their website, but it seems like it’s been up for a while. I’ll update here once cTrader comes on line.

My methodology: How I graded True Forex Funds

Profit splits: 7/10

Yes, TFF falls below a lot of 90% splits that you’ll see advertised by prop firms, but a lot of those come with strings attached. For example, with some prop firms, you have to buy an extra add-on package to be eligible for the 90% split. Others let you scale up to 90% but begin you well short of that. In this context, I think TFF’s solid, across-the-board 80% splits are pretty good.

Scaling opportunities: 9/10

TFF’s scaling plan is very simple and provides a great opportunity for you to earn additional trading capital.

After every three months of trading as a funded trader, you are eligible for a 25% increase in your account size so long as you hit an 8% profit target and don’t violate any of the trading rules or loss limits. There is no maximum account size, so the sky’s the limit should you continue to succeed.

I love the steady scaling approach, but I did dock them one point due to the time frame. Three months seems a bit long.

Trade parameters/profit targets: 10/10

An easy 10 out of 10. I love the lax trading rules, simple, consistent loss limits, and obtainable profit targets. Unlike many funded trader programs, it seems as though True Forex Funds actually wants you to succeed.

Affordability/value: 10/10

TFF is among the more affordable prop firms you’ll find, although you can shop around and do a little better in some cases. I gave them the full 10 out of 10, however, because you may find cheaper prices, but you won’t find better value.

A lot of the really cheap prop firms can afford to offer insane prices because they make the rules so complicated that no one ever actually passes their evaluation. TFF does no such thing. They keep the rules simple and the profit targets obtainable.

Educational resources/Customer service: 8/10

TFF has a really active, informative blog that could teach a lot to new traders. I give them high marks for the blog.

I do wish they’d reactivate the Discord channel, however. I love Discord! You can learn so much from reading through trader’s interactions with both the prop firm and with their fellow traders. Discord is also a great forum for exchanging trade ideas, showing proofs of payout and more. I think Discord is an invaluable forum, and I hope they bring it back. UPDATE: DISCORD IS BACK! TFF actually listened to me (and countless others, no doubt) and now have a Discord channel. They are even offering a 10% discount on new trading accounts to anyone who joins the Discord and verifies their identity.

The customer service department has always been very quick to respond to my queries, and it’s available 24 hours a day during the work week. I’ve only needed them a few times, but so far they’ve been great.

Tradable assets: 9/10

For a prop firm with “forex funds” in its name, you’d think that’s all they offer, but TFF also allows crypto, indices, stocks, metals, and more. If you’re a literal “master of all trades,” you have a lot of different asset types to choose from.

However, I am a little disappointed that they only offer 40 currency pairs. If currency trading is your firm’s main focus, I’d like to see a few more pairs than that.

Trustworthiness: 7/10

True Forex Funds has given me absolutely no reason not to trust them. I haven’t had a single bad experience with them. They are extremely open and transparent about everything, and their trading parameters make it clear they want their traders to succeed. I love what I’ve seen so far.

My only hesitance is simply the fact that they’ve been in the business for less than two years. Even prop firms with the best intentions can fail in the first few years. It’s a tricky business, so I always reserve a bit of judgment. I have very high hopes for TFF, however. For every anniversary TFF remains open, I’ll bump that score up a point.

My overall rating:

I’m very impressed with TFF’s overall program. They make it quite a bit easier to become a funded trader than many of their peers. I love their prices, trading parameters, and scaling opportunities. If they had a little longer track record, they would be far and away one of my favorite prop firms.

What Others are Saying

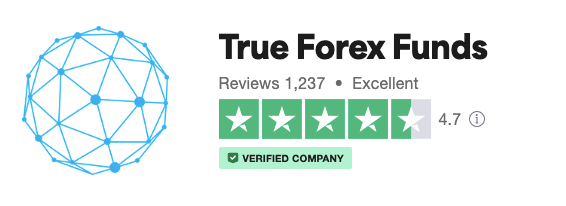

TrustPilot

True Forex Funds has a great rating on TrustPilot: 4.7/5. More than 85% of all reviewers gave TFF a full five out of five stars. Reviewers cited a number of different reasons for giving TFF a perfect score. The most common were the affordable prices, tight spreads, good customer service and fair trading parameters.

The fact that there were so many different reasons is a really good sign that the reviews are legit and that TFF is, overall, a really good prop firm.

The very few negative reviews came from traders who had lost their accounts due to rules infractions and did not agree that they had violated the rules.

Instagram is actually a secretly decent place to find out what traders really think about a prop firm.

Just go to the replies section under the prop firm’s post on a weekend when the firm’s social media team is off posting brunch pics on their private accounts. This is when you’ll see some traders’ unfiltered opinions. Bad prop firms will have a million replies requesting or demanding overdue payouts.

Good prop firms, like TFF, will still have complaints (this is the internet, after all) but they will be about far more mundane things, like “Why did you stop your Discord?!?” Happy to report that TFF’s Instagram replies are a lot of fire emojis, a few complaints about commissions, and very little else.

Let’s agree that Facebook, in general, is a complete mess. TFF has a perfect five-star rating among Facebook reviewers, and that’s with more than 360 reviews. Not bad! Take a good hard look at the reviews, however. I scrolled through about 150 of them and didn’t see a single legit review.

They were all posts trumpeting the investment advisory services of people with names like bella chris (no capitalization necessary) and WhatsApp phone numbers where these “advisors” could be reached. Please don’t give your money to someone who advertises their investment services through comments and reviews on an unrelated Facebook post.

Overall

TFF has earned a great reputation in its brief time as a prop trading firm. Traders love all the same things I love: great prices, tight spreads, simple rules, good customer service, and more.

Frequently Asked Questions

Is True Forex Funds Legit?

Yes, TFF is legit. They are new to the prop trading game, which might give you pause, but they have many verified payouts and a great reputation among prop traders.

Does True Forex Funds offer discounts or promo codes?

TFF doesn’t typically offer promo codes, but when they do, I will certainly post it here.

Can anyone join True Forex Funds? Can Americans join True Forex Funds?

Yes. TFF is open to anyone, including Americans. They currently have traders in 110 different countries.

What trading platforms can you use with True Forex Funds?

TFF currently only uses MT4 and MT5, but they will be adding cTrader in the coming months.

How do you pass the True Forex Funds evaluation?

To earn a funded trading account with True Forex Funds, you have to pass a two-phase evaluation. The first phase requires you to reach an 8% profit in less than 30 days without violating a 5% daily loss limit or a 10% overall loss limit. The second phase gives you 60 days to hit a 5% profit target. The same loss limits apply.

What can I trade with True Forex Funds?

True Forex Funds goes beyond their name and offers 30 stocks, 28 cryptocurrencies, 13 equity indices, metals, energies, and “a variety of CFDs,” in addition to 40 currency pairs.

Is True Forex Funds regulated?

No, True Forex Funds is not regulated. Like all prop trading firms that offer funded accounts, TFF slips through the regulatory net by not being classified as a broker/dealer.

If I violate the trading objectives do I get a second chance?

TFF only offers second chances for profitable traders who don’t hit their profit targets but don’t violate any trading rules or exceed their loss limits.

How do I contact True Forex Funds?

True Forex Funds is based out of Hungary. They can be reached via chat on their website. Live human support is there 24 hours a day, five days a week. They can also be emailed at support@trueforexfunds.com, or snail-mailed at: Bajcsy-Zsilinszky út 27, 3rd floor office. 9021, Győr, Hungary

My True Forex Funds Review Summarized in Exactly Forty Words

TFF is a young prop firm that’s off to a really great start. They want to empower their traders, not confuse them. Simple rules, obtainable goals, few restrictions, and low refundable sign-up fees make for the ideal prop trading firm.

I beg to differ this is one of the worst prop firms

I never had an issue with them, but all of a sudden hearing complaints. Did you personally have a bad experience?