The prop trading business is a volatile one, and I’ve had to write a few prop firm obituaries in my time, but I never expected to write one about BluFx. Sadly, issues with the Financial Conduct Authority (FCA) and their liquidity provider led BluFX to close all accounts in March, 2023.

As of early 2024, BluFX has yet to return in any form, and I think it is safe to say that it will not do so.

Table of Contents

BluFX’s demise

For years BluFX’s biggest draws were their simple rules, prompt payouts and their experience — they were celebrating their 10th anniversary when things started to go array. Over the course of about five months, BluFX went from an industry leader with more than 20,000 accounts in 140 countries to its undignified end.

The first sign that something was amiss came in December of 2022, when the UK’s Financial Conduct Authority (FCA) published a warning that BluFX might be “providing financial services or products in the UK without our authorisation.” All prop trading firms operate in an unregulated gray area because they are technically not brokers, but the FCA found an (undisclosed) reason to publish the warning.

Ironically, the FCA’s intervention probably caused the very thing they were trying to avoid — a loss of customer funds. Once the FCA published their warning, BluFX lost their liquidity provider, which meant they could no longer execute their trades. A prop trading company that can’t trade doesn’t stand much of a chance.

In mid-December, BluFX suspended accounts and asked for patience while they found a new provider. Eventually they did, but by this point traders had been stuck on the sidelines for more than a month. During that time, myself and other traders were sounding the alarm, which obviously wasn’t good for BluFX’s ongoing business.

When they finally did get up and running again, BluFX was faced with a number of withdrawal requests, very few if any new traders, and a tarnished reputation. There was also still no resolution with the FCA, which took the additional step of shutting down the blufx.co.uk domain. BluFX tried to limp on with blufx.co, but they were unable to stay in business.

In March 2023, BluFX closed all trading accounts. They pledged to make good on any outstanding obligations to traders and hope to reopen some day with a restructured business model that will presumably not run afoul the FCA.

Is BluFX out of business?

Technically no, but they have closed all trader accounts. Apparently they are holding out hope that they will be able to reorganize and reopen, but in the meantime they have ceased all operations.

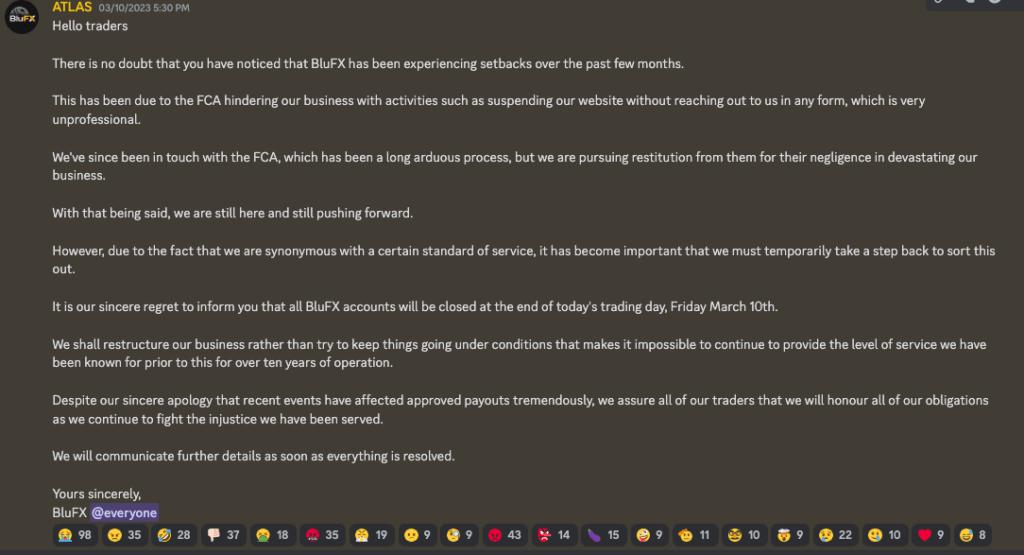

Here’s a screenshot of the announcement they made on Discord:

Was BluFX a scam?

No. They failed, and in the process cost traders time and money, but I don’t think anyone believes it was an intentional scam. BluFX ran into regulatory issues, which led to liquidity provider issues, which ultimately forced them to close against their will.

What makes the BluFx situation different from other prop firm failures is that BluFX had a proven track record with more than 10 years in the business and thousands of satisfied traders. I personally put a lot of faith in BluFX and hope that they can make good on their promise to pay off any outstanding trader balances.

Signs of a prop firm in distress

Most prop firms that go under show significant signs of distress before they ultimately close. Watching out for these signs can save you a lot of time and money if you can make your withdrawal before a prop firm fails, rather than standing in line trying to get your money after it fails.

Here’s some typical signs that a prop firm may be in trouble, viewed through the lens of the BluFX case.

Legal troubles

This is often the first indicator that a prop firm may not be long for this world. Prop trading firms operate in an unregulated gray area. They’re not broker/dealers, which helps them avoid a lot of regulatory oversight, but they are obviously very involved in financial markets. Once financial regulators start sniffing around a prop firm’s operations, they often look to color over that gray area if they can.

In the case of BluFX, this led to a published warning by the FCA which was vague, allowed no room for a BluFX rebuttal, and contained no evidence. However, it led to BluFX losing its liquidity provider, its .uk website, and a great deal of credibility. All that culminated in the closing of BluFX’s operations.

The unfortunate reality is that even without any declaration of guilt or even a presentation of evidence, a public investigation by financial regulators can push a prop firm out of existence.

Withdrawal issues

Two things happen once legal troubles or other issues come into play for a prop trading firm. One, traders with current accounts start to cash out. Two, potential new traders opt for other firms. That leaves a prop firm without trading or sign up income, which makes it tough to make payouts.

Once word starts getting around that payouts are being delayed, an old fashioned (or contemporary!) bank run can start. Then everyone cashes out and even the best-funded prop firms can run out of capital.

This definitely happened to BluFX once their liquidity provider bailed. No one wanted their money tied up at a prop firm that had suspended trading, and traders tried to cash out in droves.

Drastic rule changes

Every prop firm tweaks its rules from time to time in response to changing market conditions or new trading techniques, but drastic rule changes can be a sign that something is amiss.

For instance, if a prop firm suddenly changes the trading parameters to make it much more difficult to pass their evaluation or maintain a funded account, they could be running out of capital. Or if they suddenly disallow a certain asset class or trading technique, they’re probably trying to limit losses.

BluFX never did this. They kept their same parameters, which is one of the reasons I’d thought they’d make it. However, they did suddenly announce that they were no longer allowing traders from the US. This was a pretty big red flag. Obviously the decision closed a huge market segment for BluFX and also showed signs that they were under regulatory pressures, possibly from the US as well as the UK.

How to avoid prop firm failures

Good prop trading firms are pretty amazing when you think about it. They give worthy traders who lack capital the chance to turn trading into a really lucrative career. They reward your good trades and cover your bad ones. They take on almost all of your trading risk and give you most of the rewards.

It is important to remember, however, that prop traders still take on risk, even if it isn’t their trading capital on the line.

Prop traders risk losing their sign-up or monthly fee. They risk wasting substantial time if they can’t pass an evaluation. And yes, they risk that their prop firm might go belly up. It doesn’t happen very often, especially to the reputable names that have been around for awhile, but it does happen, as BluFX has proven.

That’s a long way of saying there’s no 100% guarantee that your prop firm will go the distance. Here’s some ways that you can mitigate the risk that your firm fails:

- Only sign up with reputable prop firms

- Look out for the above warning signs that your firm may be experiencing trouble

- Look on a prop firm’s Discord or Facebook group to look for evidence of delayed payments

- Read a reputable trader’s prop firm reviews.

Thanks for the information!

You’re welcome!

Very interesting. I was looking to trade with them this year as I liked there monthly subscription model. Do you know of any similar ones?

They were the only forex prop firm I cover that offers monthly payments. There are a number of futures prop firms that do monthly plans, however. My favorite is Topstep

first time I have seen exactly what happened to BLufx in this detail. They were the first I signed up despite their strict rules and the 50/50 profit share I traded a couple of months before bowing. Sadly MFF got hit also. Now I am sticking with just two firms after very thorough research.