Table of Contents

October 2, 2023

Unfortunately I’ll be continuing my coverage of prop firm disasters this week, as it looks like another firm, Leveled Up Society, has – at least temporarily – hit the dust.

It’s become very apparent that we’re experiencing some growing pains in the prop trading industry. It’s very hard to say when this phase will end and what the prop trading industry will look like when they do, but I’ve got the feeling we’ll see a few more firm closures and government interventions before the dust settles.

Before we get started, if you’d like this newsletter delivered to your inbox, sign up here:

What happened to Leveled Up Society?

UPDATE: As of January 4, 2023, Leveled Up Society is back. I don’t why anyone would trust them at this point, so they have an uphill battle towards respectability, but they apparently believe that they’ve fixed what needs fixing.

Here’s what I wrote in October, so you can get a sense of what happened:

This is a strange one, as Leveled Up Society apparently pulled the plug on itself as a result of some disagreements amongst the management team. Supposedly this is temporary, but I can’t imagine many traders will go back to a firm that just freezes accounts over management disputes.

I don’t want to speculate, but there must be more than meets the eye here. So far the company line is that they simply need time to transition between management teams, but the timing is very suspicious. Prop firms, especially those that are US-based, are under a lot of scrutiny right now after the CFTC took down My Forex Funds. That’s led to all kinds of payment and liquidity issues for many prop firms, and would be the most logical reason for a prop firm closure.

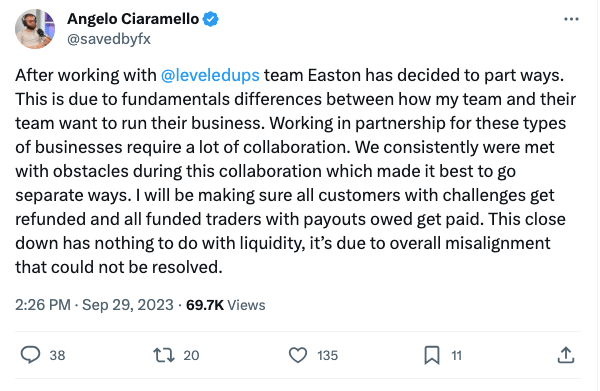

But don’t jump to conclusions dear reader, because Angelo Ciaramello, who owned a part of Leveled Up Society through his company Easton Tech, reassures us that “This close down has nothing to do with liquidity, it’s due to overall misalignment that could not be resolved.”

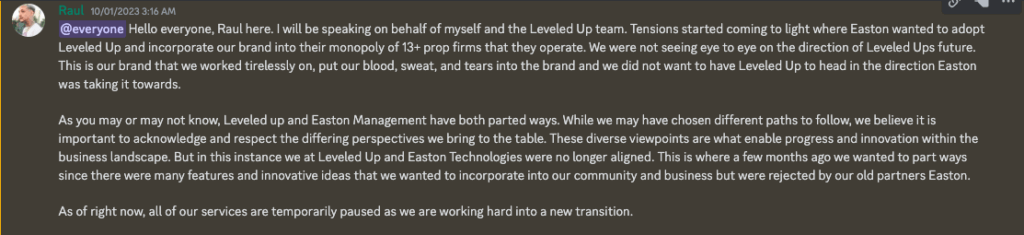

Ciaramello was partnered in Leveled Up Society with Raul Gonzales aka “Lamboraul.” He too blames management misalignment for the shut down, but wasn’t quite as diplomatic as Ciaramello. “This is our brand that we worked tirelessly on, put our blood, sweat, and tears into the brand and we did not want to have Leveled Up to head in the direction Easton was taking it towards.”

Fair enough Lamboraul, but what does an indefinite shutdown do for your brand’s reputation? A look at Lamboraul’s instagram feed would lead me to believe he has plenty of money to buy out Ciaramello, keep his brand’s image intact and save us all this speculation and drama.

Instead, they froze accounts of their 76,000+ (by their own count) members, and did further damage to the reputation of the prop trading industry.

They claim they will issue refunds to traders still in evaluation phases and issue payouts for those traders who had bankable profits. I sincerely hope they follow through, but I know of at least one trader who was on the verge of being funded. He will supposedly get his initial fee back, but what about his last month of work? That’s gone forever.

Lamboraul seems to be taking it all in stride, thankfully. As his business shuttered, he went off to Colombia, posting photos from a private jet and pictures of his trading screen showing more than $500K in profits.

Actually, I take back what I said earlier about speculation. I am going to speculate. Both Ciaramello, and particularly Lamboraul are very image conscious. Surely they understood the damage this closure would do to their reputations, the reputation of Leveled Up, and of the prop trading biz in general. So why would they do this? Why now?

Maybe they’re just reckless, young entrepreneurs who really don’t care about their traders or anyone else. Very possible. Or maybe the truth of what happened at Leveled Up was even worse than a clash of egos. Maybe it was a liquidity issue, and the reason they’d cover it up is that it is the first of many more to come.

Ciaramello is also CEO of the Funded Trader and owns at least part of several other prop firms as well. Claiming a management shakeup is cause for a shutdown would potentially do less overall harm to Ciaramello’s other businesses than admitting that a pretty popular prop firm wasn’t able to stand on its own two feet.

Either way, I am tired of prop firms with 20-something CEOs who sell their firms through lavish lifestyle pics. I’m going back to well established firms, with more stable management. I’m talking Topstep for futures, and FTMO and the 5%ers for forex.

Winston Churchill’s connection to prop trading firms

What does Winston Churchill have to do with all this?

I couldn’t help but notice that one of the last tweets made by Leveled Up Society before the great freeze, was from Winston Churchill (unaccredited, of course.) “Success is stumbling from failure to failure with no loss of enthusiasm.”

I have a different idea of success — one that involves less failure – but I get the gist. You have to dust yourself off and keep trying.

You know someone else who liked that quote? Funding Talent’s CEO Jessica Ghaney. She listed it as her favorite quote just a few months before Funding Talent went belly up.

What’s the lesson here? Perhaps Winston Churchill is a bad luck omen for traders. Or perhaps we shouldn’t be trusting our time and money to prop trading firms with prima donna CEOs who think failure is a part of their personal journey towards, I guess, subsequent failures.

My Forex Funds fights back

I’m happy MFF isn’t going down without a fight. It is a little hyperbolic to say that the future of prop trading firms hangs in the balance, but there’s some truth to that. So we’ll be watching upcoming developments in the case very closely.

MFF and its CEO Murtuza Kazmi started their fight against the CFTC with a strongly worded statement sent to Finance Magnates. “To be clear, My Forex Funds has never defrauded its traders, and we look forward to presenting the truth in court. We regret the hardship that this ill-conceived lawsuit has caused our traders and our staff.”

They also hired Quinn Emanuel Urquhart & Sullivan, LLP, a Los Angeles based law firm that is, apparently, the 32nd highest grossing law firm in the world. Good for them. I hope they see that justice is served.

MFF’s new legal team wasted very little time issuing a statement saying that “the CFTC misrepresented that Traders Global transferred $31.55 million CAD to Mr. Kazmi, when in reality Traders Global transferred that money to the Canadian tax authorities.”

If that’s indeed true, it does make it a little harder for the CFTC to justify freezing all of MFF’s assets. The CFTC claimed that Kazmi “used proceeds from the fraud to purchase luxury homes and automobiles, and make tens of millions of dollars in transfers to his personal accounts.” If a lot of that money was actually just going to pay his taxes, that would make the CFTC look pretty bad.

MFF’s defense team also questioned the constitutionality of the CFTC’s action in freezing both MFF’s corporate accounts and Kazmi’s personal accounts.

This trial, should things go that far, will be very interesting. Sign up for my newsletter above and I’ll keep you posted!

Economic calendar

As you may have noticed, I’m a day late getting this out, so we missed Powell’s remarks on Monday as well as some US manufacturing data and a rate decision by the Royal Bank of Australia.

Still to come is the Royal Bank of New Zealand’s rate decision on Tuesday, crude oil inventories on Wednesday along with some PMI data.

US jobless claims come out on Thursday and Friday will see the unemployment rate and nonfarm payrolls announced.

Stay safe and happy trading everyone!