Table of Contents

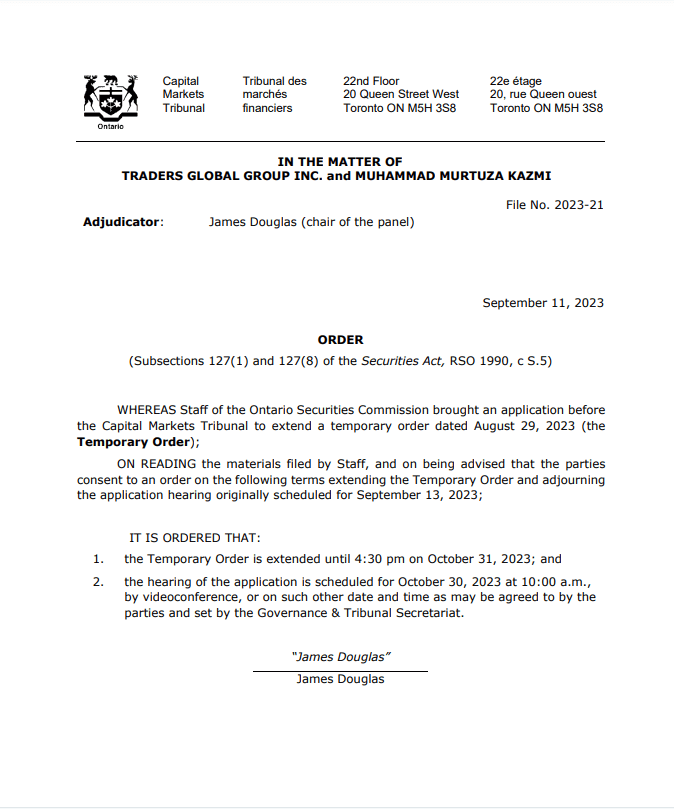

September 11, 2023

I was hoping we’d be talking a little less CFTC this week, but it is clear that the prop trading world is still pretty rattled by what happened to My Forex Funds. So we’ll continue to discuss the complaint against MFF and try to figure out what effects the charges will have on the prop trading industry as a whole, if any.

This week, I’m going to go through the full charges, and highlight how other prop firms have responded to the MFF complaint.

The latest on MFF

MFF’s original response to the freezing of their assets was to offer a glimmer of hope that a hearing on September 11 would resolve things. That didn’t happen, as the hearings were pushed back and the temporary asset freeze was extended until the end of October. That’s right, we’re up for six more weeks of limbo, although it seems increasingly obvious that MFF is not coming back, at least not in its current form.

The full CFTC complaint against MFF

I spent a good deal of time going through the full complaint, which you can also download from the CFTC and read. It’s a little repetitive but probably worth the time, or you can read the article I posted with some of my key takeaways. If even that’s too much effort, here’s a summary of my summary:

- The CFTC has real issues with drawdown limits, calling them a “bad faith pretext” to terminate customer accounts

- MFF was making substantial payouts – more than $137 million in less than two years

- The CFTC threw out the words “Ponzi scheme,” which I don’t think actually applies to MFF

- Murtuza Kazmi likes $1 million Bugattis

- The CFTC seems to have a real problem with some very basic parts of the prop trading business model

- @#$#%! My Fores Funds – according to the CFTC they really wronged traders at every chance they could get, and their actions could have serious consequences for the whole industry.

Read my full article to get more in depth commentary, and join my email list to get weekly prop firm updates:

Lux Trading says “I told you so”

I love the guys at Lux. I mean, look at these guys! What’s not to love?

Lux Trading has always been very straightforward, at times to a fault. I read a review somewhere by a trader complaining about their tight trading parameters. Lux responded, more or less, “we don’t want you either!” They are looking for very particular types of traders, but once they find them, they throw a lot of real capital their way. It is not super easy to get funded with Lux, but can be very rewarding if you do.

For as long as I’ve covered Lux, they’ve offered proof that all transactions for funded traders are made through a real broker in the real market. That never really seemed so important… until now. If you’re looking for the opposite of MFF, Lux is probably it, for better or worse.

And now Lux is taking a little victory lap at MFF’s expense. Lux posted a video responding to the MFF charges and why it could never happen to them. The short of it is this: Lux uses real capital and pays out trader profits from trader profits, not from fees they’ve generated from the fees of failed traders. They are an old school prop firm that is looking for real traders, not the fees from wannabe traders. You can test Lux out for a 7-day free trial if you’re interested.

FTMO responds, sort of

FTMO is the industry stalwart and probably stands to gain quite a bit of business from ex-MFFers and other prop traders who are suddenly putting a lot more value on prop firms that have withstood the test of time. That said, they’ve been pretty quiet about the whole thing, but they did respond to a trader who asked about the similarities between FTMO and MFF

Here’s the quote, from FTMO’s Instagram:

“We are aware of the situation with My Forex Funds. However, as we have no further information on the matter, other than what was published, we are unable to comment on the situation. In light of this matter, we would like to assure you our services remain unaffected and you are welcome to continue trading with us as usual.”

I feel like they could have made a much stronger statement than that, but FTMO rarely rocks the boat. And why should they? They’ve been a successful prop firm for a number of years now and seemed prepared to weather any storm.

The 5%ers responds to the MFF charges and then responds some more and continues to respond

The 5%ers issued by far the longest response to the MFF debacle as founder Gil Ben Her addressed trader concerns for over an hour on Youtube. Gil is a little on the long winded side, but it was definitely good to hear a prop firm really dig into the issues facing the industry. He didn’t hold back.

The 5%ers is another firm that has always given real capital to funded traders, and they make a number of important distinctions between the MFF business model and their own. They were also the first prop firm I’ve heard of to say that they would welcome regulation in order to impose “some standard of ethics.”

That makes sense to me and to a lot of other traders, but it was refreshing to hear it from a prop firm directly. The good prop firms want the bad prop firms out of the business. Amen to that.

There’s a good reason why the 5%ers are quickly becoming one of the most trusted names in prop firms. They have account types that suit just about any prop trader’s needs.

The Funded Trader will make a plan

Of all the prop firms, I was most interested in what the Funded Trader would say in response to MFF’s demise. Like MFF, The Funded Trader is also US-based, has shown the same explosive growth in traders, and aggressively recruits new traders in similar ways.

That would all seemingly put the Funded Trader next on the CFTC’s To Do list, but there are some very important distinctions – the Funded Trader uses outside brokers and, as far as I know, is not the counterparty to any of its traders’ trades.

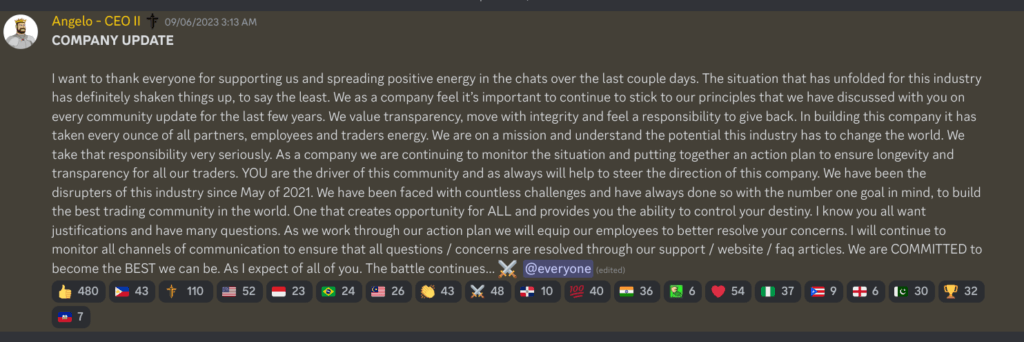

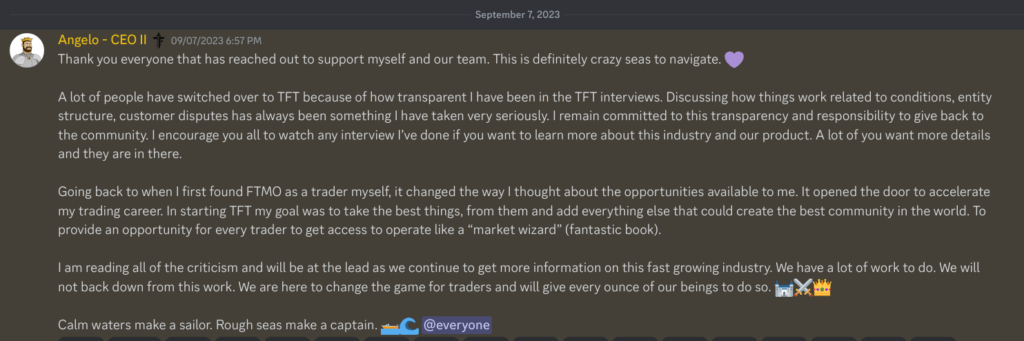

Hopefully that’s enough to keep the CFTC away, but I’d like to hear some reassurances from the Funded Trader’s leadership. They did indeed respond to the charges on their Discord, but it was more a philosophical response than anything definitive.

I’ve made screenshots of the two responses from TFT’s CEO Angelo Ciaramello below, but my takeaway is that they also don’t know what’s next from regulators. I’ve always appreciated TFT’s honesty and transparency, but I would have loved a definitive response that details exactly why they are different from MFF. Until I get that, I’m going to look to other prop firms.

Economic calendar

I’m not sure why, but I always like to minimize the upcoming trading week. I think I’ve used the phrase “quiet week” a lot in this space, even though quiet weeks are exceptionally rare for forex traders. No more. From now on, I’m going to scream out the economic calendar from the rooftops. US CPI DATA!!!!!!

Anyway, it is not a quiet week. On Wednesday we get US inflation data (the aforementioned CPI) plus crude oil inventory. And on Thursday we’ll get the European Central Bank’s interest rate decision and press conference as well as initial jobless claims and PPI data from the US.

Buckle in traders and have a great week!

– Michael