Forex trading can be extremely profitable, but you need money to make money. Prop trading firms can give you the capital you need to get started.

Good prop firms will give you up to $1 million in real capital to trade with if you pass their evaluation. You’ll keep up to 90% of your gains, and they will cover all of your losses. That’s an incredible deal — if you pick the right forex prop firm.

You have to be careful because some prop firms just want to keep evaluation fees without helping you become a successful trader.

Give yourself the best chance to become a successful forex trader by sticking with the best.

Table of Contents

Summary of the best prop firms for trading forex:

Here’s a quick summary of my choices for best forex prop firms. Read on below for my more detailed analysis, a side-by-side comparison chart, pros & cons of each firm, promos or coupons, FAQ’s and more.

#1 The 5%ers (9.2/10) — Best Overall

- Outstanding trading conditions

- Great reputation for fair treatment and ontime payments

- Most account options for every skill level of trader

- Extremely quick funding

- Great prices

- Reach up to 100% profit split

- Funded traders trade real capital through private equity fund

- Start your trading career with the 5%ers — 5% discount for my readers

#2 FTMO (8.9/10) — Best Reputation

- The Gold Standard of prop trading firms

- Funding forex traders since 2015

- Accurate and timely payourts

- No longer accepting traders from the US

- The most reliable payouts in the business

- Great trading conditions

- Start your trading career with FTMO

#3 MyFundedFX (8.7/10) — Best Newcomer

- One-step, two-step, or three-step evaluations

- Massive trading community

- No minimum trading days — get funded in as few as 2 days

- Low profit targets — 8% for Phase 1, 5% for Phase 2

- Good trading conditions

- Great price points — around 15% lower than FTMO

- Solid customer support

Forex prop trading firm comparison chart

| Best Newcomer | Best Reputation | Best Overall | |

| Firm | MyFundedFX | FTMO | The 5%ers |

| Initial Balance/Fees | 1-Step & 2-Step $5K — $100 $10K — $100 $25K — $200 $50K — $300 $100K — $500 $200K — $950 $300K — $1399 3-Step Evaluation $10K — $70 $25K — $150 $50K — $225 $100K — $375 $200K — $570 $300K — $900 | $10 K — €155 $25K — €250 $50K — €345 $100K — €1080 | High Stakes $5K – $39 $20K – $165 $60K – $300 $100K – $495 Boot Camp $100K – $95 $250K – $225 Hyper Growth $10K – $260 $20K – $450 $40K – $850 |

| Promo Code | 20% off – 120% refund with code FEB20 | 5% off if you use this link | |

| Trustworthiness/Safety | One of the most transparent firms in the biz — releases monthly pass rates 4.8/5 and “Excellent” rating on TrustPilot Hundreds of verified payouts on Discrd | Most trusted name in the biz Founded 2015 No fear of CFTC — based in Czech republic; no longer available to US traders Has paid out more than $180 million to traders | Out of CFTC’s reach — Not US based Funded traders trade real funds from the 5%ers private equity fund Risk-averse management team Outstanding reputation |

| Highlights | One-phase or two-phase evaluations for the same price; three-phase 30% less Two-phase account: 5% max daily loss 8% max overall loss 8% profit target (phase 1) 5% profit target (phase 2) One-phase account: 4% max daily loss 6% max overall loss 10% profit target 175 tradable assets 1:100 leverage in one-phase & two-phase accounts | Not available to US traders Two-phase evaluation — the famous FTMO Challenge 10% profit target for Step 1, 5% for Step 2 5% maximum daily loss limit; 10% max overall loss limit 80%-90% profit splits Tradable assets: Forex + stocks, crypto, indices, metals | Account size for any skill level or budget Rapid funding with Hyper Growth accounts Obtainable 6-10% profit targets 5-10% max loss, depending on account type Reach up to 100% profit splits No daily loss limits for most accounts Affordable Boot Camp accounts for beginners |

| Swap-Free accounts | Yes | Yes | No |

| Get Started | Start trading with MyFundedFX | Start trading with FTMO | Start trading with the 5%ers |

| Best Overall | |

| Firm | True Forex Funds |

| Initial Balance/Fees | $10 K — €89 $25K — €189 $50K — €299 $100K — €499 $200K — €998 |

| Promo Code | |

| Trustworthiness/Safety | More than 2,000 5-star reviews on TrustPilot Three years in the business Based in Hungary — No fear of CFTC shutdowns More than $60 million in payouts in less than three years |

| Highlights | One-phase or two-phase evaluations for the same price Two-phase account: 5% max daily loss 10% max overall loss 8% profit target (phase 1) 5% profit target (phase 2) One-phase account: 3% max daily loss 6% max overall loss 10% profit target 1:100 leverage Unlimited trading days for 2-phase evaluation |

| Swap-Free accounts | Yes |

| Get Started | Start trading with True Forex Funds |

| Best Reputation | |

| Firm | FTMO |

| Initial Balance/Fees | $10 K — €155 $25K — €250 $50K — €345 $100K — €1080 |

| Promo Code | |

| Trustworthiness/Safety | Most trusted name in the biz Founded 2015 No fear of CFTC — based in Czech republic; no longer available to US traders Has paid out more than $180 million to traders |

| Highlights | Not available to US traders Two-phase evaluation — the famous FTMO Challenge 10% profit target for Step 1, 5% for Step 2 5% maximum daily loss limit; 10% max overall loss limit 80%-90% profit splits Tradable assets: Forex + stocks, crypto, indices, metals |

| Swap-Free accounts | Yes |

| Get Started | Start trading with FTMO |

| Best Trading Conditions | |

| Firm | The 5%ers |

| Initial Balance/Fees | High Stakes $5K – $39 $20K – $165 $60K – $300 $100K – $495 Boot Camp $100K – $95 $250K – $225 Hyper Growth $10K – $260 $20K – $450 $40K – $850 |

| Promo Code | 5% off if you use this link |

| Trustworthiness/Safety | Out of CFTC’s reach — Not US based Funded traders trade real funds from the 5%ers private equity fund Risk-averse management team Outstanding reputation |

| Highlights | Account size for any skill level or budget Rapid funding with Hyper Growth accounts Obtainable 6-10% profit targets 5-10% max loss, depending on account type Reach up to 100% profit splits No daily loss limits for most accounts Affordable Boot Camp accounts for beginners |

| Swap-Free accounts | No |

| Get Started | Start trading with the 5%ers |

#1 The 5%ers

Long after other firms have come and gone, the 5% will be around offering ideal trading conditions and real capital to skilled forex traders. Join the 5%ers if you’re looking for a great prop firm that’s built to last.

Pros

The 5%ers stands out amongst prop firms because they actually offer traders the opportunity to work as contractors with money from their private equity pool. This unique business structure should stand the test of time, and allows traders to participate in the real market.

The 5%ers started out as an instant funding prop firm, but they’ve branched out and now have accounts suitable for any type of trader.

If you’re new to the prop trading game, you can start out with the very affordable boot camp so that you only pay part of your fee upfront. Only if you pass the evaluation do you have to pay the rest of the fee. That’s a great way to get your feet wet, test trading strategies and figure out if trading is really for you.

More seasoned traders can opt for the Hyper Growth account which is a one-step funding program with no minimum trading days or minimum number of trades. Hit your target with one great trade, and you are on to a funded account. That’s as fast as a reputable prop firm can get.

According to the 5%ers, the Hyper Growth account has “the fastest success rate in the industry.” I’m not entirely sure how they could back up that claim considering how most prop firms keep success rate figures pretty close to the vest.

It could be true however because the 5%ers is pretty forgiving when it comes to trading parameters. Instead of a daily loss limit, the 5%ers has a daily “pause” if you lose too much. That just means your account is halted for the rest of that trading day, but your account is not breached like it would be with most prop trading firms.

If we were just looking at trading conditions, I would have the 5%ers at the top of the list. That’s not just my opinion, if you look at any prop trading discord or facebook group, you’ll see someone ask what prop firm has the tightest spreads. Inevitably, other seasoned traders will say the 5%ers.

Cons

The 5%ers is mostly focused on forex and doesn’t offer much in the way of other tradable assets, so if you are looking to branch out, you’ll have to look elsewhere.

With so many account options, it can be easy to get confused as to which rules apply to which account. Most rules are standard across the board, but some differ.

For example, the boot camp account requires stop losses, but Hyper Growth or High Stakes accounts do not. Just make sure you know the specific rules that apply to your account type. The 5%ers has great customer support to clear up any remaining confusion.

Overall

The 5%ers is the best choice for forex traders due to their tight spreads, great trading conditions, amazing prices and seemingly limitless account options. Choose the best, most reliable prop firm to help start your trading career.

#2 FTMO

FTMO more or less invented forex prop trading. They are the standard that everyone else tries to live up to. No one in the industry is more reliable, and more trustworthy. For the moment, they are not allowing new traders from the US. Hopefully that changes soon. I’ll keep you updated.

PROS

FTMO’s reputation has been built on the fact that they’ve never let a trader down. You won’t find any complaints about missed payments, unusual trading conditions, or any of the other shenanigans you find with other prop firms. FTMO runs a tight ship. They do things right.

FTMO started the modern forex funded trading business, but has since branched out and allows its traders to trade all kinds of assets.

FTMO is on the cutting edge of FinTech, and anyone trading with FTMO reaps the benefits of their innovative thinking. They have a number of trading apps and tracking software the lets you analyize and learn from your trades. They also feature the most fully integrated trading platforms. If you’re at all tech savvy, FTMO gives you the best resources to succeed.

They also cover the psychological aspect of trading with a lot of resources designed to help traders manage their emotions.

Whenever I’m introducing FTMO to a new trader, I always say that the trading parameters are “industry standard” but that’s because FTMO makes the standards. FTMO’s evaluation is known as the FTMO Challenge, and most prop firms’ evaluations are just pale imitations. FTMO currently has its profit targets set at 10% for Step 1 of the Challenge and 5% for Step 2.

You have unlimited time to get there, so traders who can manage risk have a great shot at getting funded. Your max loss is also set at 10%, so you have a long leash, although you need to keep in mind that there’s a 5% max daily loss as well.

Once you become funded, the sky’s the limit. FTMO traders who continue to generate 10% returns can see their capital reach $2 million. That’s a lot of capital! As your capital goes up, so too does your ability to profit from it. FTMO starts off paying out 80% of profits, but will scale that up to 90% as you prove your forex trading ability.

Cons

Unfortunately, part of the reason FTMO is such a safe forex prop firm is that they are extremely cautious. For instance, for the time being US traders cannot open a new account with FTMO. This is because FTMO is worried about US regulators in the wake of the case against My Forex Funds.

Rather than deal with any regulatory issues, FTMO would rather be proactive and cut American traders out, at least for the time being.

I’m sure FTMO will be back once there’s a clearer regulatory landscape in the US, but who knows when that will be.

OVERALL

If you’re not based in the US, trade with the original forex prop trading firm. Join the most reliable, most famous prop firm in the world by signing up with FTMO.

#3 MyFundedFX

There’s a bit of an air of mystery surrounding MyFundedFX. They’re only one and a half years old, and their CEO looks like central casting for the spoiled, rich frat guy in any movie about college.

That said, there doesn’t seem to be a hotter firm in the prop firm universe at the moment. I get more inquiries about MyFundedFX than about any other new firm.

The main reason they are so hot right now is probably the buzz generated by their controversial CEO, MattL, who likes to stir things up on Twitter. He disappeared from the platform for the moment, but not before getting in some solid digs against FTMO’s decision to ban US traders.

However, I’m not one to get caught up in attention-seeking CEOs, so what do I actually like about MyFundedFX?

They offer one-step, two-step and three-step evaluations, and have accounts designed for any trading level and any pocketbook. They also come in around 15% cheaper than FTMO and have solid customer support.

Trading parameters are pretty fair when compared to FTMO as well. MyFundedFX has lower profit targets, coming in at 8%, but their max loss is a little lower as well. I also like MyFundedFX’s tradable asset mix, which contains 175 assets including forex, of course, plus indices, commodities, and crypto.

Beyond that they have developed a massive community of experienced traders in a very short time period. They have well over 110,000 members of their Discord Channel. If you’ve read my other articles, you know I love Discord – with that many followers, you’re certain to get some good trade ideas and great support. MyFundedFX has also published more than 600 videos on YouTube, and spends a great deal of effort on trader education.

The only complaints I’ve heard about MyFundedFX are regarding their KYC protocols, but I hear that about every prop firm. There is also some concern that they’re based in the US, which means they may have to answer to the CFTC at some point. As long as their day of reckoning is later rather than sooner, they’re a great forex firm for starting your trading career.

#4 Funded Engineer

UPDATE: Funded Engineer is not accepting new clients until they resolve brokerage issues. I’ll update this once Funded Engineer reopens.

My new year’s resolution was to be more open to new things, which is how I came to check out the Funded Engineer. They’ve hardly been around a year, but they are doing some really innovative things, have a number of verified payouts from prop traders, and already rank amongst the best prop trading firms.

Funded Engineer is my favorite amongst the new crop of prop firms that have sprouted out of Dubai. Dubai is much more hospitable to prop firms than the US, and Funded Engineer has no fear of the CFTC.

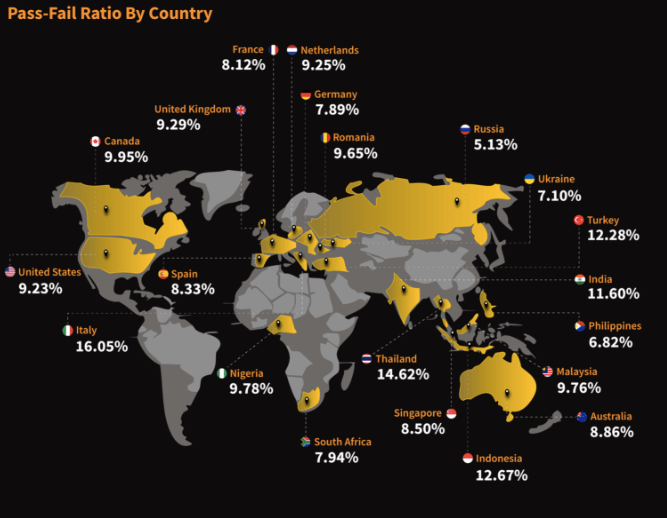

Let’s get to the innovative part. For starters, no one is more transparent than Funded Engineer. They’ll tell you exactly how many traders pass through to funded accounts every month. Check their Instagram for stats. They’re the only prop firm I cover that is this open and honest about your chances to succeed.

I also love their scaling program, which is really unique in the forex prop trading space. A lot of firms bump up your balance after you’ve proven yourself to be a profitable trader. Funded Engineer takes it one step further. They actually bump up your capital by a whopping 40% (all the way up to a max of $2 million) and increase your drawdown limits by one to two points. That’s awesome and it makes a lot of sense.

Unlike some firms that just want to flunk out profitable traders to avoid paying them, Funded Engineer designed its scaling program to give them more leeway and more opportunity to succeed. I love that.

Trading parameters are pretty standard with an 8% profit target for standard accounts, which dorps to 5% for phase 2. The loss limits are in line with other forex prop firms – 5% daily max loss, 10% overall. But I should add that their drawdown is straightforward calculation, not one that’s designed to confuse traders.

Funded Engineer also hosts a pretty interesting podcast and YouTube channel, although they focus more on the mental/emotional aspects of trading than the technical details.

The Funded Engineer is still growing, but they are doing some really exciting things like opening their own brokerage. They are clearly investing in the future and want to invest in the best forex traders. If that’s you, sign up here to join a great new forex prop firm.

#5 True Forex Funds

True Forex Funds is proof of just how quickly news spreads. Within three years, they’ve signed up traders in droves and paid out more than $60 million.

Very recently and quite suddenly their reputation was soured by some technical difficulties they’ve had with MT5 accounts. All accounts using MT5 had to be transferred to MT4 and it has been quite a mess. So what was once a rising star in the prop trading world is facing some great challenges at the moment.

What I initially loved about TFF was the incredibly simple rules. So many prop firms hamper your trading style or try to trip you up with different, hidden rules. Not TFF.

With TFF you can trade news releases, use most EA’s, hold trades over weekends and overnight, and stop losses are not required. Other than strategies that take advantage of the demo environment, almost anything goes.

I also love the drawdown limits at TFF. Other prop firms use complicated drawdowns to confuse traders, but TFF makes a straight calculation. Just stay above 90% of your initial balance, and don’t lose 5% in a day. That’s it. Very simple.

For those of you who like to trade other assets beyond forex, TFF has you covered. They also offer access to 30 shares, 25 cryptocurrencies, metals, and indices in addition to 40 currency pairs.

Bear in mind that you are trading CFDs with True Forex Funds. So you’re not trading forex in the spot market. CFDs have a number of advantages, such as much higher leverage, but make sure you’re familiar with them before you start trading with TFF.

If you want FTMO with less rules, easier trading objectives, a one-step evaluation program and cheaper prices, look no further than True Forex Funds. Personally, I’d like to see how well they come out of this MT5 mess before I give them another try and move them back up my rankings.

#6 The Funded Trader

The Funded Trader offers great promos, a massive trading community, and tons of account options. They used to be much higher on this list, but the risk that they’re the CFTC’s next target has them here.

We’ll talk about the promos first, which I keep up to date on my Prop Firm Promo page. In addition to deep discounts, the Funded Trader often offers rebates beyond what you paid for your evaluation. I love that. They’ll often pay traders 125% of your evaluation fee just for passing. That’s a 25% return before you even traded a dime of your funded account.

Another great advantage of the Funded Trader is the massive online community they’ve built. Check out their Discord. They have well over 100,000 members, many who actively exchange trade ideas, tips for passing the challenges, candid reviews and more. It’s a huge asset, especially for newer traders, although I should note that you don’t actually need a Funded Trader account to join.

With five different challenges, the Funded Trader has options for anyone. One-phase, two phase, or three-phase evaluations, plus a plethora of other choices. If you like eating at diners with 5-page menus, you’ll like the Funded Trader’s range of choices.

All that sounds pretty good, so why are they ranked so low? The CFTC. I can’t shake the feeling that the Funded Trader is next to fall under their scrutiny. The CFTC shut down My Forex Funds, which ran a remarkably similar prop firm to the Funded Trader. Yes, the motif was different, but the nuts and bolts underneath are nearly the same.

The Funded Trader has also suffered from some poor word of mouth as of late with traders complaining about unjustified account closures. I myself had some problems with their accounting, and did not get a satisfactory answer.

Still hundreds of thousands of traders can’t be wrong, and there’s still a lot to like about the Funded Trader, particularly with their current promotion — 15% off + 125% refund of your challenge fee with code TFTJANUARY4.

#7 Fidelcrest

Fidelcrest still barely makes this list for two reasons, but they had a pretty rough 2023 and have fallen out of most traders’ good graces.

UPDATE 4/21: I’m not sure what’s happening at Fidelcrest right now. They don’t seem to be onboarding any new customers and I’ve had no responses from customer service. I’ll update when (if) I hear back from them. For the time being, stay away.

Fidelcrest has always been popular because of their promotions, which are one of the reasons they are still on this list. They’re so good, they seem too good to be true. Fidelcrest still offers a 2×1 promo where you can get two funded accounts after paying for one and passing the evaluation. Go to my prop firm discounts page to see if the offer is currently running.

Before that they offered a generous “bonus” check for passing your evaluation. If you passed, you would get a percentage of the account size you signed up for. For example, a $150,000 account used to cost €649, if you passed, you’d get a $9,000 check. Just passing your challenge yielded a massive return!

As it turns out, deals like that may have indeed been too good to be true. Earlier in 2023, a former Fidelcrest client sued Fidelcrest for not making good on their bonus check. Instead Fidelcrest canceled the account, supposedly under false pretenses.

In August the judge ruled for the client, and “awarded” him $845,000, but not because he believed the client over Fidelcrest. Fidelcrest just never bothered to show up. I doubt very much that the client ever got his money.

Even if they didn’t defend themselves, that was a pretty bad blackeye on the Fidelcrest name, and it caused some other traders to come forward with similar stories.

So what is the second reason that I still have Fidelcrest on this list? Honestly, despite all I’ve heard, my experience with Fidelcrest was always pretty good. Maybe a delayed payment or two, but other than that they were always good to me.

In the end, I still think they might be worth a flier when, and only when, they are offering their 2×1 account promo.

#8 SurgeTrader

SurgeTrader is another one of my former top five proprietary trading firms that had a rough year in 2023. Of course, as a US-based prop firm, they have to worry about the CFTC’s next move, but they also appeared in headlines this past summer for all the wrong reasons.

The husband of SurgeTrader’s CEO, Jenna Seaman, was charged with running a large Ponzi scheme in Florida. The misdeeds of a CEO’s spouse should have no bearing on a prop firm, but VALO Holdings, which is a “partner” of SurgeTrader, as well as Seaman herself, had to pay substantial sums to the SEC to settle the case. Not a good look, plus it brought up liquidity questions for SurgeTrader. It was also yet another black eye for the prop firm industry.

On the other hand, SurgeTrader’s business didn’t seem affected in the least. They are still lightning quick funders, who also added a two-step evaluation for more patient traders. Customer service is still good. Spreads are still decent. Prices are still on the high side, but probably worth it for the better service and fast funding. There’s a lot to like.

Still, at the end of the day, I personally don’t want to trade with a prop firm that has such close ties to the word Ponzi. Not to mention the specter of the CFTC. There’s better prop firm options out there.

FAQs about prop trading firms

Here’s some of the questions about prop trading that I am most frequently asked. Please leave a comment with any further questions you might have.

What is a prop trading firm?

A proprietary trading firm is a company with trading capital that hires traders to trade that capital in order to make profits. Those profits are then split with the successful traders through a bonus or payout.

In most cases, to trade with a prop firm’s money you must first pass an evaluation to test your trading skills. Once you pass the evaluation, you receive trading capital and will get up to 90% of any profits you generate. You must abide by the prop firm’s rules, and if you lose more than a certain amount they will take away your account.

What are the benefits of prop trading?

The chief benefit of prop trading is that prop trading companies give you money to trade, so you can make money as a trader even if you don’t have your own capital. That also means you can’t lose any of your own money, beyond the evaluation fee. You can also test new trading styles with other people’s money, learn from a prop firm’s educational resources, develop risk management skills and diversify your income streams.

What are the negatives of prop trading?

The biggest negative is that you have to trade by someone else’s rules. Forex prop traders must abide by their firm’s rules or they will lose their funded account or fail their evaluation. You also have to consistently hit profit targets to pass your evaluation and earn a payout. There’s also an evaluation fee, which can be expensive for larger account sizes.

Is Prop trading regulated?

This is the million dollar question. It is not, but the Commodity Futures Trading Commission (CFTC) recently filed a complaint against My Forex Funds (MFF), an extremely popular prop trading company. The CFTC froze all of MFF’s assets, and many traders were locked out of their accounts. This case makes it clear that the CFTC has its eyes on prop firms, and it seems like some type of regulation is imminent. For the time being, however, prop firms are not regulated.

How do prop firm evaluations work?

Typical prop firm evaluations are two phases. In the first phase you have to prove that you are a profitable trader by hitting a profit target, usually between 8%-10%. The second phase is to prove that the first phase wasn’t a fluke, but your profit targets are usually lowered to 5%-6%. During both phases you have to abide by all your prop firm’s trading rules.

The main trading rules you have to be aware of are your firm’s loss limits. If you lose a certain amount in one day or overall, you will lose your account. These limits are usually around 5% for the daily loss, and 8%-10% for overall losses. Make sure you understand all trading rules before signing up for a prop firm.

Can I lose my own money prop trading?

Only your evaluation fee, no more. If you can’t demonstrate that you’re a good forex trader, you will fail your trading evaluation and lose your fee. However, proprietary trading companies will cover any losses you may incur. In other words, if you fail, you will fail very cheaply.

Conclusion

Forex prop trading firms offer a great opportunity to obtain trading capital and maximize your trading profits. True Forex Funds offers the best opportunity to do just that. Get your trading career started now with an account from TFF, the best of the best.