Table of Contents

Overview

FTMO is arguably the most popular proprietary trading firm in the world. With more than 10,000 traders worldwide, they have the great profit splits, an unblemished record of making payouts on time, and one of the best overall reputations in the industry. They are clearly one of the Best Prop Trading Firms of 2024.

A note to American readers: As of January 10, 2024, FTMO is not accepting clients from the US. This may be temporary, so I’ll keep this review updated.

Pros

- FTMO‘s one-time fee is fully refundable once you’ve passed their evaluation process.

- They are eminently trustworthy and have paid out millions to their funded traders. According to their website, FTMO paid out more than $180 million over the years.

- FTMO has some of the best profit payouts in the business. New traders receive 80% of their profits, with the possibility of graduating to 90% if they meet trading objectives.

- Few other firms offer as many tradable assets. Although a lot of FTMO traders focus on forex trading, you can also trade commodities, indices, bonds, stocks, metals and crypto.

- To help guide your trading strategies, FTMO has made enormous investments in trade-tracking technology. All FTMO traders have access to a series of apps designed to help you with risk management and profit maximization.

- FTMO offers more trading platform options than most. Choose between cTrader, MT4, MT5 and DXtrade.

- FTMO’s scaling plan allows their most skilled traders access to up to $2 million of trading capital.

- So many traders have used FTMO over the years that there is an incredible amount of trader-generated resources available, including lots of great advice on how to pass the FTMO Challenge.

Cons

- A definite con for American traders — FTMO is no longer accepting clients from the US. This may be temporary, perhaps until we get some closure from the My Forex Funds case. I’ll keep this page updated.

- FTMO keeps all traders on demo accounts, even those that have passed the FTMO Challenge and become fully funded. Although your profits will be very real, your trades may or may not be executed in the actual market.

- Even though it’s the industry standard, some traders bristle at the two-step evaluation process. In order to receive a funded account, traders must first pass the FTMO Challenge, followed by a verification stage.

- The 10% profit target for the FTMO Challenge can seem a bit steep. However, if you pass the Challenge, the target drops to just 5% for the verification stage.

FTMO Funded Trader Program Highlights

- Start at 80% profit split, scale up to 90%

- Trade everything from forex to crypto

- Up to $2 million of capital per trader

- FTMO Challenge: 10% profit target, 10% max loss limit, max daily loss 5% limit

- Profit target falls to just 5% for Step 2 of evaluation

- Complete refund of initial fee when you pass the Challenge

- Begin your trading career with FTMO

Who should sign up with FTMO?

If you’re new to prop trading and want to go with the most popular and trusted prop firm in the industry, you should start with FTMO. They offer a very affordable opportunity to try out your trading strategies, and they’ll reward you very handsomely (up to 90%!) if you’re successful.

Even if you have your own capital to trade, FTMO is a great option. They set the industry standard for trader guidance apps. Win or lose the FTMO Challenge, and you’ll come out a much more conscientious, confident trader.

Finally, if you want to trade equities, crypto, metals, or something other than just forex, FTMO offers their traders the largest array of tradable assets.

Who should NOT sign up with FTMO?

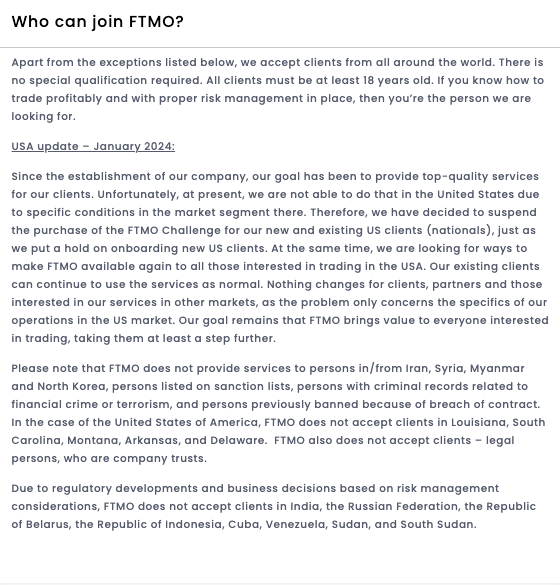

American traders cannot, currently, sign up with FTMO. FTMO is no longer accepting US clients. This is hopefully just a temporary measure, but we shall see.

If you absolutely must know that your trades are being executed in the real market, FTMO is not for you. Again, they will pay your profits based on the performance of the real market, but you will be trading with a demo account.

If you have uncovered the trading opportunity of the year and just need some capital to maximize your profits, FTMO isn’t a good choice. You’ll have to complete the FTMO Challenge and verification before they give you access to capital. If you absolutely want to start trading right away, firms such as the 5%ers offer immediately funded accounts without evaluation.

All things considered . . .

FTMO always ranks among my top prop trading firms thanks to their trustworthiness, fantastic profit splits, number of tradable assets, and their great price point. It’s no wonder they’re one of the most popular proprietary trading firms in the world. If you are not based in the US, start your Challenge today if you want to begin earning your fully funded account.

FTMO Basics

FTMO origin story

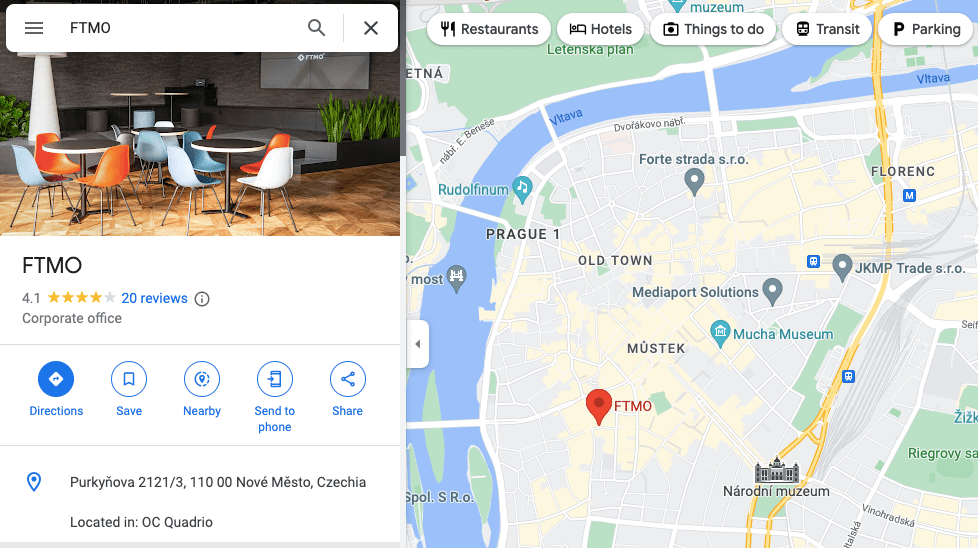

FTMO became a world-renowned prop trading firm after being founded by a group of day traders in Prague in 2014. Originally they met to discuss trading and risk-management strategies, but soon set their sights on creating a company that could distribute capital to deserving traders.

They began FTMO in 2014 and took it global in 2017. FTMO is still based in the Czech Republic, but they’ve grown into an international prop firm that funds traders from all over the world.

How does FTMO work?

FTMO works just like any other prop trading firm that offers funded accounts, with a few exceptions. If you pass the FTMO evaluation stage, they provide the capital for you to trade, up to $200,000 to start. You keep 80–90% of the profits and they cover the losses. It’s a pretty amazing opportunity, but of course you have to earn it.

To get started, you select the account size you want, ranging from $10,000 to $200,000, and pay a one-time fee (€155 for a $10,000 account). After you pay the fee, you have to prove your trading abilities by passing the FTMO Challenge. In order to pass you have to meet profit goals (10% for normal accounts) without violating the trading parameters.

The only trading parameters are two max loss limits—one is the maximum amount you can lose in one day, and the other is the maximum amount you can lose in your account overall. Right now the maximum daily loss is 5% of your starting balance, and overall your account can’t dip to 10% below the starting balance. So with a $10,000 account, if you lose $500 in a day or more than $1,000 over the course of the FTMO Challenge, you’re out.

Once you pass the FTMO Challenge, you move on to the verification stage. The verification stage is almost the same as the Challenge, but you now have 60 days to meet a lower profit target of 5% within the same trading parameters.

Pass those two stages and you become an FTMO trader to the amount that you signed up for. So if you paid €155 for the $10,000 account, you’ll get $10,000 to trade for profit. Your trading parameters are the same—you still can’t dip below the maximum loss limits, but now you get to keep 80% of your profits.

The more you succeed, the more capital you’ll get, and if you continue to pass profit goals, FTMO will bump you up to a 90% profit split. You can withdraw your profits at any time via a regular bank wire transfer, Skrill, or cryptocurrency.

Profitable traders can continue with FTMO indefinitely, but should you hit one of the maximum loss limits at any time, your account will be terminated, and you’ll have to start over again with the Challenge and work your way back to a funded account.

As I mentioned above, FTMO differs from other prop trading firms in that you never directly trade in the real market, even if you’re a fully funded FTMO trader. FTMO keeps all their traders on a demo trading account and may or may not be duplicating your trades through their real broker. This doesn’t affect your profits, which are obviously very real, and shouldn’t affect your trading strategy either.

How much does FTMO cost?

Unlike many other prop firms, FTMO doesn’t charge any monthly or maintenance fees. You pay once when you sign up for the Challenge, and that’s it. How much you pay depends on the size of account you prefer and whether you want a normal or aggressive account.

Upon passing both stages of the FTMO evaluation, your initial fee is fully refunded.

Normal or Swing Account

| Account Size | Refundable One-time Fee |

| $10,000 | €155 |

| $25,000 | €250 |

| $50,000 | €345 |

| $100,000 | €540 |

| $200,000 | €1,080 |

My Assessment

I assess prop trading firms based on the following seven factors. I give each of the factors equal weight in making my overall judgment, but that doesn’t mean that you should. For example, if you are new to the prop trading game, educational resources will be much more important to you than to someone who has been around. Use this guide to decide what’s most important to you as a trader and make your decision accordingly.

To see how FTMO compares to other top prop firms, read my Best Prop Firms of 2023 post.

Profit splits – 9/10

You won’t find many firms with better profit splits than FTMO. Eighty percent is outstanding. Ninety percent is insane. That’s right, FTMO starts everyone off at an 80% profit split, and if you can prove you’re a profitable trader over an extended period, they will bump you up to 90%.

The only reason I didn’t rate FTMO as a perfect 10 in this category is that there are some firms, like Topstep, who give you 100% of your first $5,000 in profits. Of course, that rate drops after the first $5K, but for new traders, getting your full profits initially can be a huge boost.

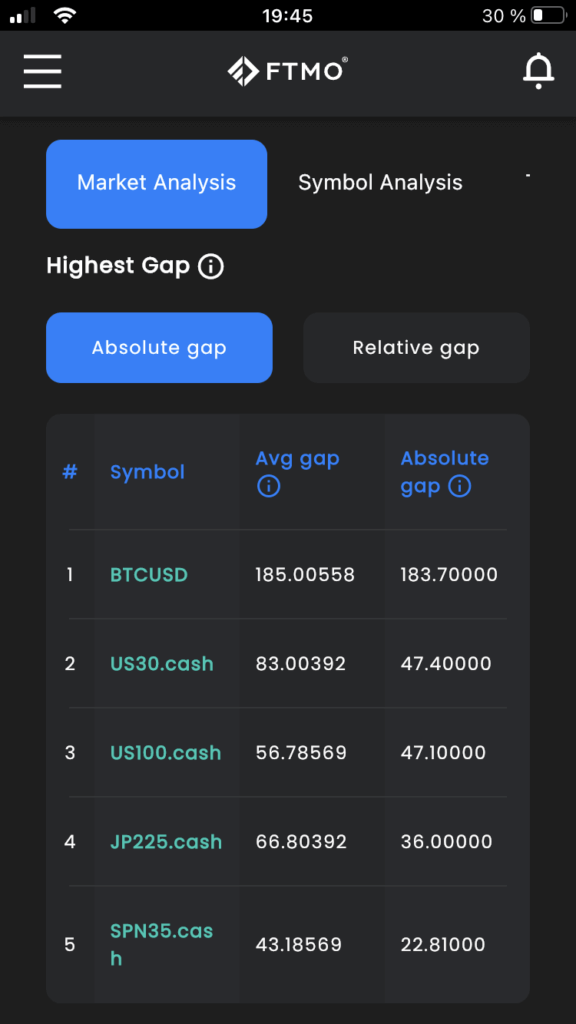

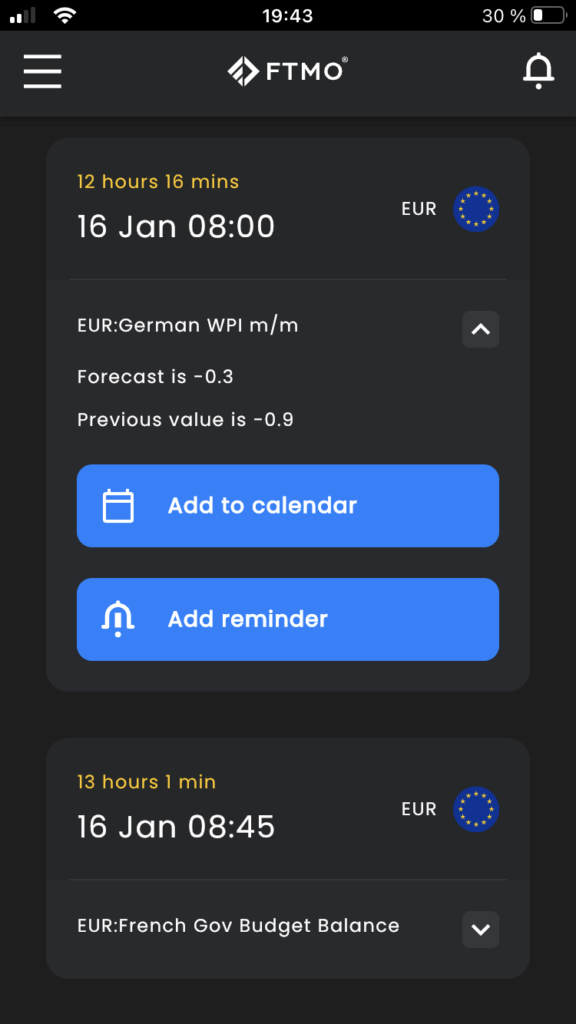

Education & trading resources – 8/10

FTMO offers the best prop trading app in the business. It’s a great resource complete with access to an economic calendar, market analysis, trading platforms, the FTMO community, an equity simulator, and other apps designed to help train the uninitiated and strengthen the skills of the professionals.

I love the trading apps, but it does feel like FTMO expects them to do a lot of the heavy lifting when it comes to account analysis and teaching successful trading. For traders who aren’t particularly tech savvy, if there are any such dinosaurs left, the apps might not be as valuable. If you’re savvy enough to know your way around the latest trading platforms, however, I think the apps are a great asset.

New prop traders love them, but more experienced traders complain that FTMO’s educational resources, such as the webinars found in the “Trading Academy,” are too basic to be of much use. That’s a valid criticism, but all traders start somewhere, and even professional traders can brush up on their knowledge.

FTMO gets extra points for their employment of “performance coaches” who help traders with an often overlooked but crucial part of trading—trader psychology. I’ve never met with one of their coaches, but I’ve heard good things, and the fact that FTMO makes a significant investment by hiring psychologists says a lot about how much they want you to succeed.

Scaling opportunities – 7/10

This is the one area in which FTMO falls behind its competitors a bit. Like many other prop firms, FTMO will increase your capital up to a maximum account size of $2 million, but it will take you a little longer to get there than with other firms.

As an FTMO trader, you will have your account increased by 25% if you meet your profit targets and don’t hit your loss limits over a four-month trading period. That’s pretty good, but there are other prop firms that will scale your account up faster.

FTMO definitely makes up some points by scaling your profit split up from 80% to 90% if you continue to meet your profit target and stay within trading guidelines.

Trade parameters/profit targets – 8/10

FTMO’s 10% profit target for a normal account in the FTMO Challenge is a little bit on the high end of the industry standard. A lot of prop firms also have a 10% target, but you can find some with lower objectives. FTMO does lower the target to 5% for the verification stage, which is great, but I understand that this is temporary so sign up now to take advantage.

FTMO’s trading parameters are also pretty close to the industry standard, although I should probably mention that FTMO is so influential in the business that they pretty much set the industry standards. Max loss limits are set at 5% on a daily basis and 10% over the lifetime of the account.

Some prop firms reset max loss limits to correspond with the high water mark of your account, but FTMO doesn’t, which is a big advantage. If, for example, you make some great early trades, with FTMO your max loss limit is still based on your initial account size. That means you can build a nice little cushion for yourself and take on a little more risk with your profits.

FTMO does have time limits, although they expanded them over the past year. Originally traders had just 30 days to pass the Challenge, but FTMO added two extra weeks. For the verification stage, traders now have 60 days to meet profit targets rather than 30.

Affordability/value – 9/10

FTMO is one of the best values in the prop trading game. Other prop firms may beat them on price thanks to eye-popping promos or discounts, but you usually get what you pay for. FTMO is the most respected prop firm in the business, and you should pay a small premium for that fact. The value of knowing that your prop firm won’t sabotage you or deny you payouts is worth the few extra dollars you might pay if you sign up with FTMO.

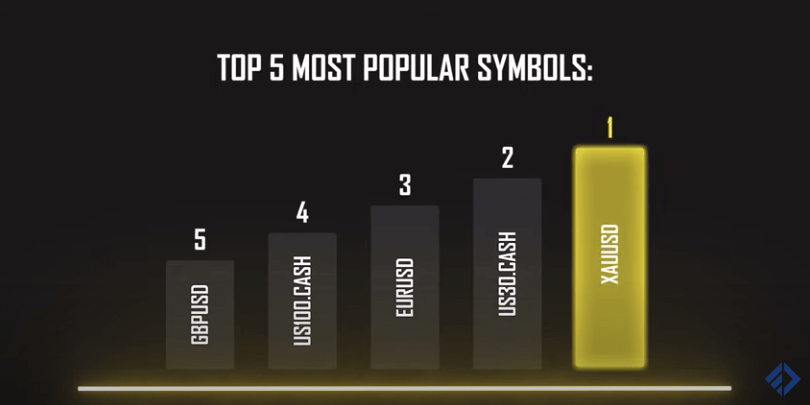

Tradable assets – 10/10

Few prop firms compare to FTMO in terms of trading options. FTMO does not limit trading strategies nor do they only cater to forex traders. You can access almost all financial markets including stocks, bonds, crypto, commodities, and yes, of course, forex.

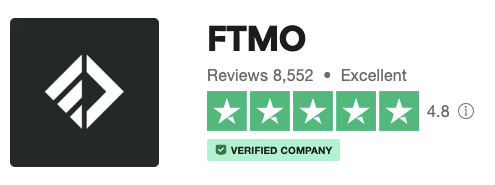

Trustworthiness – 11/10

FTMO is a giant in the industry and one of the main reasons why is that they never miss payments. If you make money with FTMO, that money will unquestionably end up in your bank account. In 2022 alone, they paid out more than $70 million.

That should be the standard with all prop firms, but unfortunately it is not.

Prop firms are like unregulated banks in a lot of ways, and if things go sideways and the word starts circulating that a firm is missing payments, there can be an old-fashioned bank run. This could sink lesser firms, like it did DT4X, but it will never happen at FTMO. They are too popular and too good at what they do.

My overall rating – 8.9/10

It is pretty clear why FTMO is the most popular prop firm in the business. They excel in almost every category and still offer outstanding prices. There’s no such thing as a perfect prop trading firm, but FTMO comes just about as close as you can get. Start your prop trading career off with one of the best in the business.

What Others are Saying

TrustPilot

FTMO maintains an “Excellent” rating at TrustPilot thanks to an aggregate rating of 4.8/5 stars. More than 90% of 8,500 reviewers gave FTMO five out of five stars. Many of the reviews compare FTMO favorably to its prop firm competitors, citing the clarity of the Challenge rules, great customer service, and the prompt and generous payouts. One particularly favorable review called FTMO a “life changer.”

Google Business

There are only 27 FTMO reviews on Google, most of which give a full five stars. However, FTMO’s aggregate rating falls to a 4.4 due to some negative reviews. Several of these reviews are clearly written by those not familiar with the prop trading industry, so take them with a grain of salt.

Other complaints do seem to be legitimate, however. For example, one trader writes that after passing the FTMO Challenge and verification it took two week for him to get his funded account. I haven’t heard too many complain about such long delays, but apparently it does happen.

FTMO’s Facebook page has more than 900 reviews and an overall rating of 4.8/5 stars. I’d take these reviews with a grain of salt, however, as it doesn’t seem like FTMO is monitoring them. Almost all the five-star reviews seem to actually be advertisements for account managers with suspicious sounding names such as “Mrs. Amazing Grace.”

Overall

Even discounting the dubious Facebook reviews, FTMO’s reputation online is outstanding and bolstered by hundreds of unbiased traders reviews, blog posts, and videos posted by traders who have successfully passed the Challenge and made significant money trading with FTMO.

If you look hard enough, you’ll find some negative reviews by failed traders, but the overall impression is one of a legitimate prop firm with a great support team that goes a long way toward helping their traders succeed.

Frequently Asked Questions

Is FTMO Legit?

Absolutely. FTMO’s reputation is impeccable. They’ve funded thousands of traders and paid out millions through their 80% profit split. They are the gold standard when it comes to prop trading firms.

This question gets asked about every prop firm for two main reasons. First, there are, indeed, some less-reputable companies operating as prop firms, so it is important to be careful. Second, prop trading seems too good to be true. “You mean there are companies that will give me their money to invest and cover my losses? For real?”

Yes, for real. Prop trading is a legitimate business, and FTMO is one of the top prop firms in the world.

Does FTMO offer discounts or promo codes?

FTMO does offer occasional discounts, usually around the holidays, but they’re pretty rare. When they do offer a discount, you’ll find it on my prop firm promo page, which I update regularly.

What trading platforms does FTMO use?

FTMO offers its traders a choice between MT4, MT5 and cTrader, although US residents and citizens are barred from using cTrader due to US regulations.

FTMO also recently introduced a new platform partner, DXTrade, which I honestly know nothing about. I hope to give it a try in the near future.

Can Americans join FTMO?

No, Americans cannot join FTMO. As of January 2024, FTMO decided not to offer their services to any new traders from the US. They were vague as to the reason, but my best guess is that they want to see what comes out of the CFTC case against My Forex Funds.

The outcome of this case will likely determine what, if any, regulations will be placed on prop trading firms operating in the US market. FTMO, probably the most cautious prop firm in the world (although that’s not saying much), is probably sitting on the sidelines until they know what they might have to do to become compliant.

What is the FTMO Challenge?

The FTMO Challenge is the famous first step of FTMO’s trader evaluation process. It consists of a trading challenge in which you have to hit profit targets while managing your risk and staying above loss limits. You have to complete the Challenge within 44 days, although you can do it within 10 if you hit your profit targets sooner. You must make trades on at least 10 days. Following successful completion of the Challenge, you’ll move on to the verification stage of the evaluation. Pass that, and you’ll be a fully funded trader.

How do you pass the FTMO Challenge?

To pass the FTMO Challenge, you must make a 10% profit on your demo account over 44 days, and you must make trades on at least ten of those days.

FTMO also wants their traders to prove they can mitigate risk. Traders must not fall below the maximum daily loss of 5% (10% for aggressive accounts), which includes both closed and open positions. As an example, if your account is already down 3% at the beginning of the day and your open positions fall more than 2% during that trading day, you will lose the Challenge.

You also can’t fall below the maximum loss limit of 10% at any point. The maximum loss limit measures your account on an overall basis. Basically, if you are competing for a $100,000 account, your open and closed positions can’t at any point dip below $90,000.

The good news is that FTMO doesn’t use relative drawdowns. With other prop firms such as Fidelcrest that do use relative drawdowns, if you have initial success and raise your equity, your maximum loss limit also raises. So if you were to raise your account to $110,000, your floor also raises and you would lose your evaluation if you fell below 10% of your high, or $108,900. FTMO doesn’t calculate drawdown this way. If you raise your account to $110,000, your floor is still $90,000. That’s obviously much more trader friendly and underscores the importance of making early successful trades to give yourself a greater cushion.

There’s also strength in numbers. So many traders have taken the FTMO Challenge that you can find hundreds of Youtube videos, Facebook posts, and personal blogs from traders sharing their success stories and how they did it. A Facebook group called “FTMO Challenge Support Group” has over 21,000 members and offers a variety of tips and tricks to pass the Challenge.

What can I trade with FTMO?

You can trade just about anything you want. Stocks, bonds, crypto, commodities, indices, forex, and more. Most prop firms are limited to forex, or even just a few forex pairs, but with FTMO you can pretty much trade it all.

To illustrate the diversity of FTMO’s tradable assets, in 2022, FTMO released their most popular symbols traded and the list included two indices, one metal and two currency pairs.

What types of accounts does FTMO offer?

FTMO offers a wide selection of accounts that vary by size and trading style. You can choose a trading account size of either $10K, $25K, $50K, $100K or $200K. You also choose whether you want a normal or swing account.

The swing account offers swing traders the option to turn any of the above trading accounts into a swing account, which allows traders to hold positions overnight and over weekends. You can also request a Swap-Free account (see below.)

Does FTMO offer Swap-Free accounts?

Yes, FTMO offers swap-free accounts. Per the FTMO website, to request a swap-free account you can contact them via email at support@ftmo.com.

Is FTMO regulated?

No, FTMO is not regulated by any US regulatory bodies. Considering what happened to My Forex Funds, one of FTMO’s former rivals, it is probably a good thing that FTMO is based in Prague and not on the CFTC’s radar.

If I violate the trading objectives do I get a second chance?

You can get a free redo with FTMO, but only under certain circumstances. If you make a profit, but no enough to reach your profit target and you didn’t violate any trading rules, you can get a free second chance.

If you failed the FTMO Challenge under any other circumstances, you can’t start over with the same FTMO account, unfortunately. This is why it is so critical to be familiar with the trading objectives before you begin. Even a momentary violation, like if the equity in your account falls 5% below the starting value, means your account is forfeited and you have to open a new account and start the Challenge all over again.

How can I contact FTMO?

FTMO offers customer support in 15 languages. You can reach customer support around the clock via email support@ftmo.com, Whatsapp, or phone: +442033222983.

My FTMO Review Summarized in Exactly Forty Words

FTMO sets the gold standard when it comes to prop trading firms for three reasons: they offer the best profit splits, they’re eminently trustworthy, and they’re affordable. You can maximize your trading profits by opening up an FTMO account today.

Further Reading

More full prop trading firm reviews: Fidelcrest, Lux Trading, Topstep Futures, Blufx, The 5%ers.

Best of’s: Best Prop Firms of 2024, Best Prop Firms for Stocks, Best Prop Firms for Beginners

GREAT WRITE-UP. VERY HELPFUL. THANKS

Thank you for your comment John, I appreciate it.

Thank you for review. I think it’s a bit outdated, because they removed time limit from the evaluation process.

I’ve got just one question: do I get money from two-step evaluation process?

Yes, Robert, you’re right about the time limits. I’m in the process of updating all of my reviews. As far as FTMO goes, you don’t currently get paid for the evaluation. Other prop firms offer a bonus once you pass your evaluation, but FTMO does not.

are my 155 euro are gone if a fail the challenge ? or can i withdraw the remaining amount after the loss?

Hi Sameer. If you fail the challenge, FTMO will keep your entire initial fee. If you pass, however, that fee is refunded.