Table of Contents

Overview

Lux Trading Firm is a prop trading company that allows trading in a wide array of financial instruments and offers massive amounts of capital (up to $10 million!) to consistent, careful traders.

Thanks to their variety of tradable assets, quick scaling and available capital, Lux Trading ranks amongst my Best Prop Trading Firms for 2024.

Pros

- Massive amounts of capital — Trade up to $10 million!

- Huge capital leaps every time you advance — Funded traders who make 10% profit after meeting their minimum trading day requirement more than double their capital.

- Quick scaling — Open a $200K account and you could be trading $10 million in just six stages

- Real capital — Pass the two-stage evaluation, and you’ll be trading real money. No more demo accounts.

- Lots of tradable assets — With Lux you can trade stocks, crypto, bonds, CFDs, and other instruments in addition to forex.

- Attainable profit targets — During your two-step evaluation process, you only need to hit a 6% profit target to pass Stage 1 and 4% to pass Stage 2

- Great trader support — Industry-leading, fast, reliable customer support team is available 24/7 via chat. I’ve never waited more than a minute or two for a response.

- Excellent reputation — Lux Trading Firm is highly regarded and has funded traders in more than 80 countries.

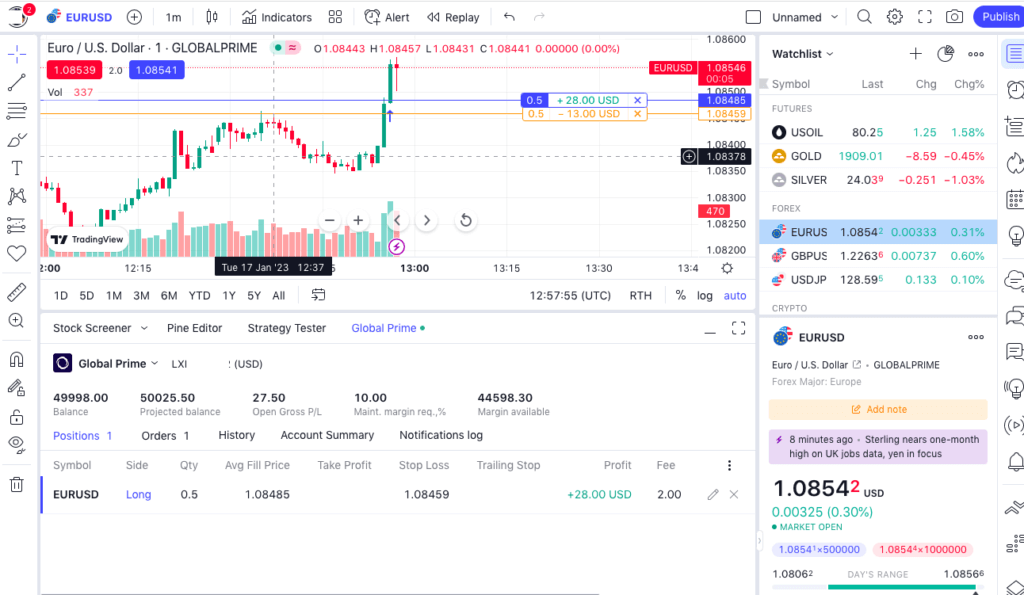

- Trading platform options — Lux is one of the few prop firms to still allow trading through TradingView, in addition to MT4 and TraderEvolution

- No time limits — Take as long as you need to hit your profit targets, you won’t be up against a clock.

- Quick refunds for account fees — Pass Stage 1 of your evaluation, and you’ll get 50% of your fee back, pass Stage 2 and you get the rest.

- New Lux Elite Package — New accounts offer unprecedented instruction, support and one-on-one guidance

Cons

- Refundable fees are pretty high — Lux refunds its fees but you’ll be on the hook for some higher-than-average fees if you don’t pass.

- A lot of required trading days — Lux is looking for patient, consistent traders, so they require someone to meet their profit targets over 29 trading days for Stage 1 of the evaluation and 20 for Stage 2.

- Strict trading parameters — Lux has a 5% maximum relative drawdown, which means you won’t be taking on a lot of risk. Since it’s a relative drawdown, it changes according to your account balance, so you have to be careful. Fortunately, Lux has a great risk management desk to help you keep in line with the parameters.

- 75% profit splits — Firms like FTMO and the Funded Trader offer 80-90% splits, although they don’t give their traders real capital.

- No current promos: Free 7-day trial, but no current discounts

Get started

- Join Lux Trading today to start your journey towards $10 million in capital

Who should sign up with Lux Trading Firm?

Lux Trading Firm has an ideal trader in mind—one who has a proven trading strategy that nets consistent profits without assuming substantial risk. If you fit this mold, Lux will give you a lot of money. A lot. But they expect their traders to be very careful with their capital.

Traders who would like to trade more than the typical forex offered by most prop firms can also find a welcoming home at Lux Trading. Lux allows the trading of any security offered by their broker, Global Prime. That includes stocks, bonds, forex, commodities, and other financial instruments.

Lux is also a great choice for traders who want to be trading with a highly regarded prop firm that offers verified live accounts with real capital. After the first evaluation, there is nothing simulated about your account with Lux. You’re a real trader trading in the real world.

Who should NOT sign up with Lux Trading Firm?

Boom or bust traders should look elsewhere. It will be difficult to survive the minimum trading days requirements with only one or two big trades. You have to hit your profit target over 29 trading days with a consistent, measured approach, while employing the required stop-losses and minding the 5% drawdown parameters.

Lux Trading has said it straight out on TrustPilot: “We do not look for gamblers or high-risk traders.”

All things considered . . .

Lux Trading is about as close to the prop trading firms of old as you’re going to find. They’re old school. They give out real capital. They are eager to reward successful traders who play by the Lux trading rules. Sign up and succeed with Lux, and you’ll be on your way to an extremely rewarding career.

Lux Trading Basics

Lux Trading origin story

Lux Trading was founded by asset managers who were looking to diversify their portfolio and find nontraditional trading and investment opportunities. In the 1990s, they decided to recruit talented retail traders to join the firm, and have been giving traders such opportunities ever since. In January 2021, they extended that opportunity to the general public by opening up a prop firm open to anyone.

They’ve grown in leaps and bounds since then, and they currently have funded traders operating in 80 countries.

The founders are still in the asset management business and if you really excel as a trader, Lux Trading Firm offers a promotion all the way up to Fund Manager, which comes with $10 million to manage.

How does Lux Trading Firm work?

Lux does things a little differently than a typical prop trading firm like FTMO. They have a two-step evaluation process which is done in demo mode, but afterwards you are trading with real money.

When you sign up, you choose between three capital levels, $50,000, $100,000 or $200,000. If you meet a 6% profit target over 29 trading days and stay above the 5% maximum relative drawdown, you move on to Step 2 of the evaluation. Your reward for passing Stage 1 is a refund of half of your initial fee.

The maximum relative drawdown is calculated by taking 5% of the highest value your account has reached and subtracting that from your maximum account value. So if you profit $5,000 on a $100,000 account, your maximum drawdown is 5% of $105,000 or $5,250. So the value of your account cannot dip below $99,750.

For Stage 2 of the evaluation your profit target dips to 4% and the minimum trading days are reduced to 20. The maximum relative drawdown remains at 5%. Pass this stage and you’ll receive a refund for the rest of your signup fee.

Meet your objectives on the second step of evaluation and you are very suddenly in the big time, trading at the Professional Level. At this point Lux will give you $100,000 in real capital.

Accounts at the Professional Level have slightly different rules than those at the evaluation levels. At the Professional Level, you can move up to higher levels of capital by meeting a 10% profit target in 49 trading days and staying above the relative drawdown, which now shrinks to 4%. The drawdown is calculated a little differently, as it resets to the initial balance level at the beginning of each month if you make profit withdrawals. The profit split remains at 75% for all stages of the Professional Level.

Should you meet those objectives, your account size is doubled, or more. With the $100,000 account, you can scale up from $100,000 to $200,000 in one step, and the next level is already $500,000. After that? $1 million. Two more steps and your at $10 million.

During any stage of the process if you violate the maximum drawdown, you can purchase an account reset for £250. The reset will put you back two stages, but you won’t have to start over from the beginning.

How much does Lux Trading Firm cost?

Lux Trading offers three different account sizes. All fees are one-time only and you have as long as you need to hit profit objectives.

Standard accounts

| Account Size | Refundable One-time Fee |

| $50,000 | £299 |

| $100,000 | £449 |

| $200,000 | £599 |

Lux Elite Package

| Account Size | Refundable One-time Fee |

| $50,000 | £1699 |

| $100,000 | £1999 |

| $200,000 | £2399 |

My Assessment

I grade prop trading firms according to my assessment of the following seven factors. You can read how Lux Trading compares to other prop firms in my Best Prop Firms of 2024

Profit splits – 8/10

At a 75% profit split, Lux Trading is about middle of the pack when compared to other prop firms. One popular competitor, FTMO, has an 80% profit split or higher, but FTMO uses demo accounts for its traders. Lux uses real trading capital, which makes 75% seem pretty generous.

Scaling opportunities – 10/10

I’m going to go ahead and coin a phrase: The Lux Leap. Nobody scales you up in bigger increments than Lux Trading. Funded traders can double their capital in just one step, and get 10x your account size in just four steps.

Every time you meet your profit target, they will double your account or more. Here’s the scaling if you sign up for the $100,000 account:

| Stage | Account size |

| Stage 1 – Evaluation | $100,000 (demo) |

| Stage 2 – Advanced Evaluation | $100,000 (demo) |

| Stage 3 – Professional Level | $100,000 (real capital) |

| Stage 4 – Professional Level | $200,000 |

| Stage 5 – Professional Level | $500,000 |

| Stage 6 – Professional Level | $1,000,000 |

| Stage 7 – Expert Level | $2,500,000 |

| Stage 8 – Fund Manager | $10 million |

You won’t find another proprietary trading firm that scales in such large leaps.

Trade parameters/profit targets – 7/10

Of course one of the reasons Lux has the confidence to give their traders so much money is that they require 49 trading days to pass the first two stages and 49 trading days to advance through the remaining stages. For swing traders, only 15 days are required during your evaluation and 25 days once you’re at the professional level.

The profit target of 6% is very obtainable, especially since Lux gives you unlimited time to get there. Most prop firms that give you unlimited time also charge you by the month, but this isn’t the case with Lux.

Lux wants steady, consistent traders, and they understand that those types of traders need time to reach their profit targets. Lux will give you huge chunks of change, but they want to make sure your trading strategies are legitimate and replicable before they do so.

The trade parameters are also designed to reward the most patient traders. A 4% maximum relative drawdown doesn’t give you a whole lot of room to speculate. I wish they were a little less strict in that regard, but I understand where they’re coming from.

Affordability/value – 8/10

Lux Trading’s one-time fees are on the high end of the spectrum when compared to other prop trading firms. Those fees are, however, fully refundable after you pass your evaluation. Lux also doesn’t charge monthly fees, which is rare for a prop firm that gives you unlimited time to meet your profit target.

Educational resources/trader support – 8/10

Considering the type of trader Lux hopes to attract, it is no surprise that they prioritize risk management in their trader education program. Lux offers every trader access to their risk management desk. The risk management desk helps traders negotiate the maximum relative drawdown, use of leverage, and other trading parameters. They offer individual reviews of your trading style to make sure you can minimize your risk while maximizing profits.

Beyond the risk management desk, most of Lux’s educational resources come from third parties. The phenomenal research and analytics provided by Trading Central is offered free to Lux traders and can be integrated with most trading platforms.

Tradable assets – 10/10

As I’ve mentioned elsewhere, Lux provides an array of tradable assets that is well beyond a select group of forex pairs offered by some prop firms. If forex trading is your forte, you can certainly do that with Lux, but you can also trade stocks, CFDs, commodities, metals, and more.

Trustworthiness – 10/10

The people behind Lux Trading have been in the asset management and trading business forever. Lux is well funded and has a proven track record of making all profit payments.

No firm is as transparent as Lux when it comes to your trading record and whether or not your trades are being executed in the real market. Lux has partnered with KPMG so that funded traders can receive audited, certified trading records. Lux also has ample documentation to prove their affiliation with Global Prime, one of the most trusted forex brokers in the world.

My overall rating – 8.7/10

Lux gets very high marks for its scaling program, trustworthiness, and number of tradable assets. I wish they would loosen their trading parameters a bit, but Lux is very clear that they value consistency over all else. If you’re a steady, patient trader who wants to grow your capital in leaps and bounds, head to Lux Trading.

What Others Are Saying

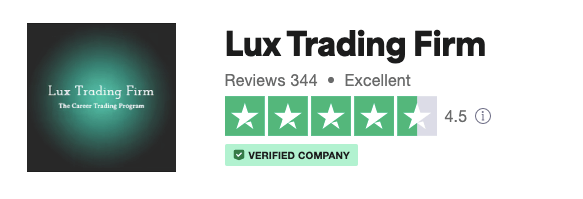

TrustPilot

With nearly 350 reviews, Lux Trading Firm has an “excellent” rating with 4.5/5 stars. That’s a pretty good sample size and 83% of reviewers gave Lux Trading Firm a full five stars.

The few very negative reviews I read mostly took issue with how blunt Lux’s customer service can be. They will not hesitate to tell you to trade elsewhere if you don’t want to abide by their trading parameters. Apparently, there are some traders out there that aren’t used to that level of honesty.

The good reviews all cited that same customer service department for their attentiveness and prompt replies. Some were pleased with the available trading platforms. Just about everyone loved the scaling plan.

Google Business

Five out of five stars! Unfortunately, only two traders have voiced their opinion with Google Business.

Lux doesn’t offer a rating service on their Facebook page, but they do have over 3,000 likes and followers, if you value such metrics.

Overall

Like with most prop firms, TrustPilot holds the bulk of Lux’s reviews, and those are overwhelmingly positive. Traders love their customer service, scaling opportunities, and available trading platforms.

Frequently Asked Questions

Is Lux Trading Firm legit?

Yes, absolutely. Lux Trading firm is a legitimate prop trading firm with an established track record of paying out many successful traders.

What trading platform does Lux Trading Firm use?

Lux offers its traders the choice between Trading View, Trader Evolution, and MT4.

Does Lux Trading Firm offer discounts or promo codes?

Not often, although they always offer a seven-day free trial, which is quite useful if you’re just getting started in prop trading. You can sign up with Lux by using this link.

Can anyone join Lux Trading Firm? Can Americans join Lux Trading Firm?

Yes, anyone can join Lux Trading, including Americans, so long as you are over the age of 18.

How do you pass the Lux Trading Firm evaluation?

Lux has a two-stage evaluation process with demo accounts. .

To pass Stage 1, you have to hit a 6% profit target without violating the maximum relative drawdown of 5%. There’s also a minimum of 29 trading days, but there’s no time limit — you can take as long as you want to hit your profit target.

The maximum relative drawdown is a moving target, so you have to be careful. It is calculated by taking 5% of your account’s maximum value and subtracting that amount from the maximum account value. To use the same example as before, if you profit $5,000 on a $100,000 account, your maximum drawdown is 5% of $105,000 or $5,250. So the value of your account cannot dip below $99,750.

You also have to have a stop-loss in place for all orders, and the stop-loss must be within the 5% drawdown limit. If you execute a trade without a stop-loss, the position will be automatically closed.

Stage 2 has the less minimum trading days (20), and a smaller profit target (4%), but the same maximum relative drawdown (5%).

What can I trade with Lux Trading Firm?

Lux offers a wide variety of tradable assets, much more than the average prop firm, which is just designed for forex traders. Lux also offers equities, CFDs, commodities, metals, and more. Lux allows you to trade anything that their broker Global Prime trades.

What types of accounts does Lux Trading Firm offer?

Lux offers three different accounts based on initial starting balance. You can choose between $50K, $100K and $150K.

They also offer a new Lux Elite package, which features one-on-one trading, exclusive workshops, risk management tools, and a number of perks to help you succeed. The account sizes are the same: $50K, $100K and $150K.

What is the Lux Elite Trader Club?

In 2022, Lux rolled out a new Elite Traders package that promises an unprecedented level of one-on-one instruction. Traders who join the Lux Elite Trader Club get personalized workshops, access to a live trading room, mentorship by one of Lux’s established traders, access to a risk management desk, exclusive educational videos and more.

It’s expensive, but Lux claims that more than 20% of those who have already joined the Elite Trader Club are now career traders earning a consistent income. Anyone, of any skill or knowledge level is welcome to join the club.

Does Lux Trading offer swap-free accounts?

Yes, Lux Trading offers swap-free accounts through their brokerage, Global Prime. Contact Lux Trading customer support for more details.

Is Lux Trading Firm regulated?

No. Like almost all other prop firms, Lux Trading avoids the distinction of being a broker/dealer and therefore is not regulated like typical financial service companies.

If I violate the trading objectives does Lux give me a second chance?

Yes, Lux offers an account reset option for £250. Depending on where you are in the program, you may have to reset two stages below your previous stage.

How can I contact Lux Trading Firm?

Lux can be reached via chat on their website, via email at info@luxtradingfirm.com, or phone at +44 20 7193 9534, and their office is at 160 City Road in London, just around the corner from the Three Crowns Pub.

My Lux Trading Review Summarized in Exactly Forty Words

For consistent traders, Lux Trading will open up their wallet and provide as much capital as you can manage. You can earn money while you are evaluated and begin your path towards $10 million in capital, if you start today.

Further Reading

More full prop trading firm reviews: FTMO, Fidelcrest, Topstep Futures, Blufx, The 5%ers.

Best of’s: Best Prop Firms of 2024, Best Prop Firms for Stocks, Best Prop Firms for Beginners

Hello, thank you very much for this complete and accurate review. If possible, please also check BluFX. Thank you.

Thank you for the feedback! I just completed a BluFX review as well. Check it out here.

A great and an in-depth review. Thanks buddy